An interesting proof of the efficient markets hypothesis

A proof as in to test rather than a proof as in, my word this is absolutely and everywhere correct, of the efficient markets hypothesis that is. And the EMH, just for those who don't know, does not say that markets are always and everywhere the efficient way of doing things. We ourselves are quite keen that we don't have a free market in private armies. The history books are quite plain that the Wars of the Roses weren't a fun time for us run of the mill people even if the people wielding the broadswords enjoyed themselves immensely.

All the EMH does state is that markets are efficient at processing the information about what prices should be in a market. Just about all economists sign on to this idea at some level - it's how strong the effect is which is muttered about. And a useful proof, in that sense of test, is to go and look at minor, very minor perhaps, issues which should affect prices and then see, well, have they affected prices?

Which brings us to this paper here:

As of this writing in June 2016, the markets are predicting Venezuela to be on the brink of default. On June 1, 2015, the 6 month CDS contract traded at about 7000bps which translates into a likelihood of default of over 90%. Our interest in the Venezuelan crisis is that its outstanding sovereign bonds have a unique set of contractual features that, in combination with its near-default status, have created a natural experiment. This experiment has the potential to shed light on one of the long standing questions that sits at the intersection of the fields of law and finance, the question of the degree to which financial markets price contract terms. We find evidence to suggest that at least within the confines of a near-default scenario, the markets are highly sensitive to even small differences in contract language.

This is all about those collective action clauses. Argentine debt did not contain any and thus those holdouts, after default, were able to campaign and sue and then get paid fully. A CAC being a clause which states that if 75%, or 85% or whatever %, of all bond holders agree to change the terms of the bond, accept a haircut, then the others, those potential holdouts, can be forced to accept. This sort of thing is entirely normal in takeover law for example, if 90% of shareholders agree to accept an offer then the other 10% can be forced to sell at that offer price.

Argentina had no CAC clause. Thus the holdouts won. In Greece, Greek law bonds were changed by the Greek Parliament to have a CAC. Greek English law bonds were not - thus the differential payouts to the two classes of Greek bonds. Here, the point is that Venezuela has a series of bonds outstanding, some with no CAC, some with one of 85%, others with ones of 75%.

So, if there's truth to the EMH then even these minor changes in contractual language should lead to differences in current prices. For the lower the percentage in a CAC the more likely it is that a bondholder will be forced into a cramdown in the event of a default. And the finding is that yes, the bonds are trading at different prices. Same maturities (as far as is possible to measure of course), same coupon, different CACs and different prices.

We have not here proved that the EMH is correct - that's not the way this sciencey stuff works. Rather, science works by having a hypothesis, testing that against reality, and as long as the evidence doesn't disprove the idea we can proceed with it as a working description of the universe until some aspect of that reality does disprove it. Scientific theories are thus true only in the sense that no one or no thing has yet disproved them.

So it is with our efficient markets hypothesis. We know of times when it is not true or at least less than wholly so, like when markets are not complete (Shiller's part of the Nobel is largely for this). But in complete markets like sovereign bond ones we at least haven't any evidence against the idea that the EMH is true. And thus our working assumption has to be that the EMH is true in such complete markets.

Let's be mature about pensions

Many years ago I promised myself I would jump off a bridge if I ever got interested in pensions. Then I did briefly get interested in them. This was during the 1980s where Britain’s company pension funds were larger than the rest of Europe’s put together. It seemed like an amazing, far-sighted arrangement. But to save myself from jumping, I quickly lost interest in pensions again – partly due to Nigel Lawson’s tax raid on their surpluses (which should have been left to grow in order to pay the pensions of future retirees) and Gordon Brown’s 1997 stealth-tax raid (which has since taken about £120 bn out of people’s pension funds. Those raids, I figured, were the death knell.

Which they were. Of Britain’s 6,000 company pension schemes, which promise final-salary-linked pensions to 11 million people, around 5,000 are in deficit.

And it’s not just unscrupulous asset strippers milking companies and leaving pensioners’ retirements underfunded. That, mercifully, is the tiny minority. As well as the tax raids (which continue, with another one from George Osborne just this year), and the onerous and expensive governance rules that Gordon Brown also imposed, but the impossibility of predicting things thirty or forty years into the future.

When these funds made their extravagant promises, which induced people to invest up to 20% of their wages in them, times were great. But then we had (Gordon Brown again) a massive fake boom followed by the inevitable massive real bust, with investment rates forced down to near zero. Meanwhile, Quantitative Easing has seen the Bank of England buying government bonds and keeping their prices high, which means their returns are low too. And pension funds have a lot invested in government bonds, because they are relatively safe. Add to that greater longevity (with life expectancy now ten years longer than when some of these pension schemes began), people expecting to retire earlier, more people moving jobs (which raises administrative costs) and the regulatory fees, and defined-benefit pension funds have had it.

What is the answer? In most cases, the funds were quite properly managed, with good investment and actuarial advice. But the world changed in major ways, and their promises became undeliverable. You could ask companies to make up the shortfall, but money doesn’t grow on trees, and that means lower wages and pensions for current employees, higher prices for customers, or lower dividends for shareholders (who are - you guessed it - often pension funds).

No, I think we have to have a serious conversation with pension scheme members. The promises were over-optimistic, sunk by a large measure of government greed and ineptitude, but even more by changes in lifestyle, healthcare, and investment returns. Will our politicians initiate such a conversation? Unlikely: they dread doing anything that will annoy pensioners, who are more likely to vote than any other group, and who jealously guard their entitlements.

But actually, the political turmoil we have seen in the UK, the EU and the US tell me that in fact, people no longer want politicians telling them that the world is rosy. They would much rather see politicians telling them the truth. In company pensions, bygones are bygones, the damage has been done, and we need to grit our teeth and work out what future benefits can be afforded. Not a pleasant conversation, but I think we are grown up enough to have it.

Proof perfect that supermarket food waste is not a problem

One of the more difficult things, as Douglas Adams pointed out, is to keep a sense of proportion about the world. It is easy, of course it is, to point to something or other and shout "That's a massive problem!" It's rather more difficult to look at something and ponder on whether it's actually an important problem. It is once we do the latter that we can actually work out whether this is something that we should devote efforts to sorting out or not.

And so it is with food waste from supermarkets. We're told that this is one of those massive problems. There are even those who insist that supermarkets themselves are the problem as a result of this waste. Consideration is necessary here:

Tesco has revealed that the amount of food waste generated by the supermarket giant increased to 59,400 tonnes last year – the equivalent of nearly 119 million meals.

119 million meals! That's a massive problem!

Well, no, not really. It's two meals a year, a little under that in fact, for each inhabitant of these isles. Interesting, certainly, but not exactly massive. And then there's this:

The amount wasted was the equivalent of one in every 100 food products sold by Tesco during the last financial year.

Or as we might put it, 1% of throughput. At which point it's worth going and looking at parts of the world that do not have the supermarket logistics chain. And that is the correct way to think of supermarkets. Not as simply shops that we go to, they're just the retail outlets of the logistics and production chain that stretches right back to the planting of the fields.

The FAO and others have pointed out that in countries reliant upon more traditional practices some 50% of food gets wasted between farm and fork. It is this which explains the reason why the world grows enough calories for all yet not all can eat enough calories. The supermarkets reduce that waste considerably at that cost of the trivial losses at the supermarkets themselves. No, it's not quite true that the net gain from having supermarkets is 49% of the harvested crop but it's getting on for that number.

Sure, distributing that 1% to the needy is a worthwhile thing to do, why not? But we do need to understand that it's not an important point. What is important is bringing that industrial logistics chain to those places which do not have it in order to save that 50% of the harvest.

Supermarkets, properly considered, are the cure for food shortages and waste, not the cause of them.

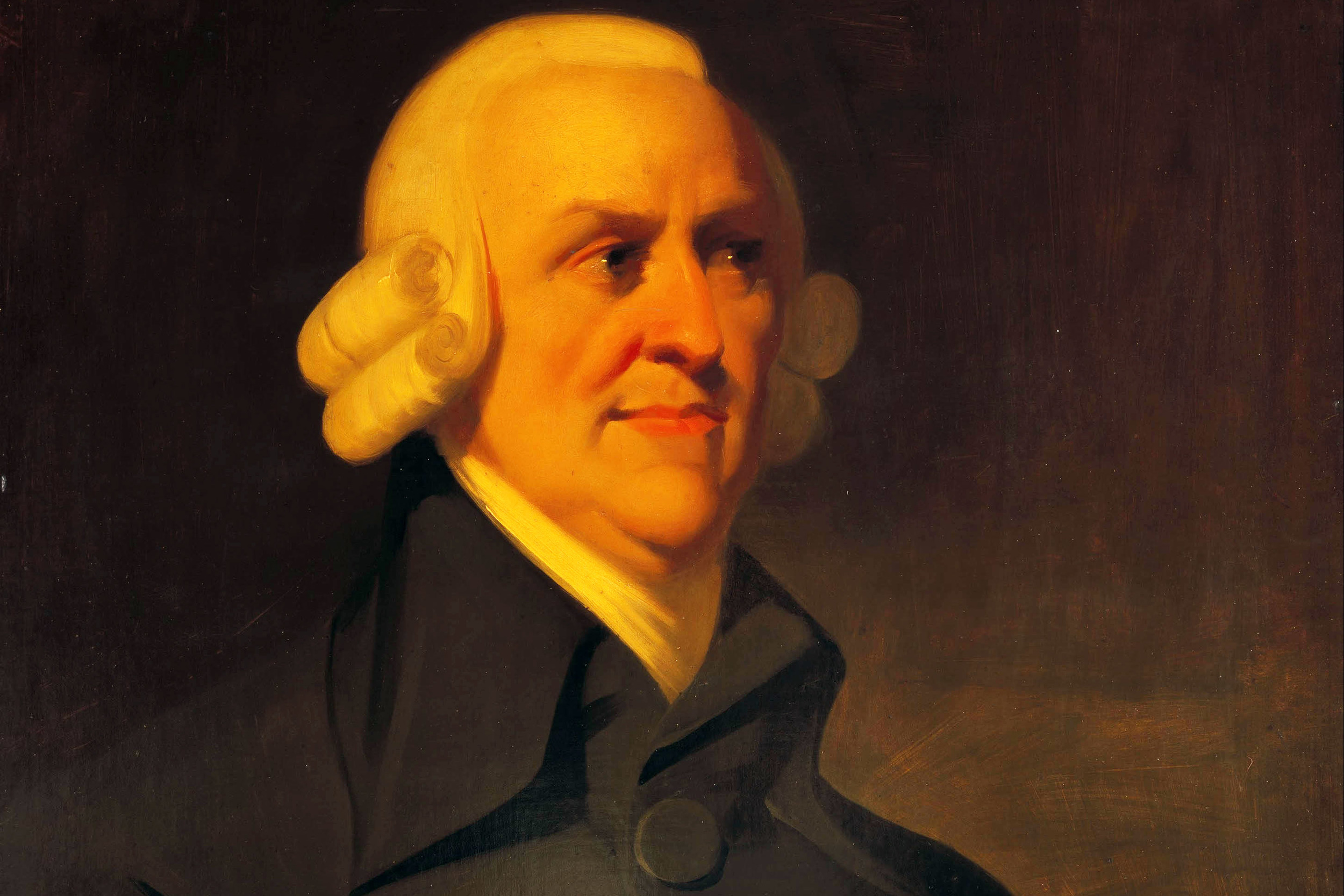

Happy 293rd birthday Adam Smith

It’s Adam Smith’s 293rd birthday. What would the pioneering Scottish economist, who in 1776 published The Wealth of Nations as a staunch defence of free trade, make of the world and its economic relations today?

At one level, he would be delighted. His free-trade message certainly got through to most of his fellow economists today. They share his view that trade benefits both sides – both buyers and sellers. After all, neither side would voluntarily strike a bargain unless they each thought it would make them better off. That is why Smith argued for ending Britain’s ‘beggar my neighbour’ policy, dropping trade barriers – a source of particular contention in the American colonies – and welcoming open trade with anyone who would reciprocate.

It’s Adam Smith’s 293rd birthday. What would the pioneering Scottish economist, who in 1776 published The Wealth of Nations as a staunch defence of free trade, make of the world and its economic relations today?

At one level, he would be delighted. His free-trade message certainly got through to most of his fellow economists today. They share his view that trade benefits both sides – both buyers and sellers. After all, neither side would voluntarily strike a bargain unless they each thought it would make them better off. That is why Smith argued for ending Britain’s ‘beggar my neighbour’ policy, dropping trade barriers – a source of particular contention in the American colonies – and welcoming open trade with anyone who would reciprocate.

And over the years, politicians too have heeded this economic message. So with a lot of pushing from the World Trade Organization (WTO) and the General Agreement on Tariffs and Trade (GATT) talks that preceded it, import tariffs – the taxes that countries impose on imports from others – have fallen all over the world. Smith would be delighted. And he would be particularly delighted by how the globalization created through such free trade has helped the poorest countries of the world more than anyone – taking perhaps two billion of the world’s population out of the most abject dollar-a-day poverty.

But Smith might cast his eye over the EU and the US – which account for 60% of world GDP, 33% of trade in goods and 42% of trade in services – and wonder whether the message has really sunk home. Tariffs may have fallen, but all kinds of non-tariff barriers – technical, regulatory, paperwork and administrative hurdles – remain, all designed specifically to protect domestic producers and keep out other people’s goods and services. Even in places where a ‘single market’ is supposed to exist – like the EU – it does not. Though the EU accepted the principle of a common market in services ten years ago, it is only very partially applied. Just try selling insurance or banking products in France and Germany. And this, of course, is a particular problem for the UK, which is home to the EU’s leading international financial services sector.

And again, while EU tariffs against other countries average just 3%, some discriminate massively against other, non-EU countries, including many of the world’s poorest. The UK’s once-prosperous sugar processing industry for example, is now a pale shadow of its former sense. The tariffs on non-EU sugar imports are just too high. And that has a particularly damaging impact on poorer countries where sugar can be just about the only cash crop.

Africa produces $2.4 billion worth of coffee each year – rather less than the Germans make from processing and re-selling it – but EU tariffs of 30% on processed cocoa products like chocolate or coco powder (and tariffs of 60% on some other cocoa products) are blatant discrimination. Not only does it mean that Africa sells less cocoa. It also means that there is less investment, innovation and technology going into the crop. So it keeps African cocoa farmers poor.

Added to which, Africa imports over 80% of its food; and the EU, with its highly protectionist agricultural policies and large clout in world markets, actually raises the price of food. Trade economist Professor Patrick Minford thinks the effect could easily be 10% or more. So not only does the EU keep out African agricultural products, it also forces Africans to pay higher prices for their food on world markets.

And Smith would also be worried about the mood that is developing in the US. Despite being relatively open to trade for half a century or more, the US has always been quick to protect certain industries – like steelmaking and auto manufacturing, for example. The result is that US steel- and car-makers have had too easy a time, have not innovated fast enough, and have been eclipsed by lower-cost providers in other countries.

President Obama has been lukewarm on trade freedom, opposing the Keystone pipeline and showing no support for dropping the prohibition on US crude oil exports. In the Presidential election campaign, meanwhile, the protectionist rhetoric has been ramping up. Republican front runner Donald Trump has advocated forcing US companies to ‘bring manufacturing home’ – that is, to stop outsourcing to other countries – and generally to tear up US trade agreements. His arguments have not faced much opposition: indeed, the Democrat hopeful Bernie Sanders agreed wholeheartedly with them. Democrat front runner Hillary Clinton, meanwhile has no clear stand on trade agreements, though she likes to pepper her speeches with digs about ‘hedge fund managers’ and ‘billionaire CEOs’ who are more interested in a buck than the health of the US workforce. And recent voting in Congress show that her party is becoming more protectionist.

Many of the other candidates, too, have opposed ‘fast track’ negotiation of the TPP trade agreement with Asian countries, which looks certain to be kicked into the longish grass of the next Administration. The Transatlantic Trade and Investment Partnership (TTIP) talks, meanwhile, are hitting the sand of protectionist demands from various of the EU’s 28 member states. (As is the EU’s proposed trade deal with China – bogged down by demands from Italian tomato growers and suchlike.)

As a big winner from globalization – think silicon valley, aircraft makers, pharma companies, the music and movie industries – the US has much to gain from focusing on the global market, and not just its domestic market. But will it keep its doors open to others, or is it going the way of Nigeria and Venezuela?

Smith was a quiet and modest man. But he would give both the US and the UK – not to mention Russia, China, India, Indonesia and all the other countries who have been raising trade barriers – a very stern talking to.

Eamonn Butler is Director of the Adam Smith Institute

Obviously, drugs drive you mad: for there must be regulation of them

We are half a step forward here on the subject of the legalisation of drugs. Part of the Millian thesis seems to be getting through, we should not ban behaviour which harms only the person undertaking that behaviour. Similarly, the pragmatic point that illegality doesn't in fact work has been understood. Sadly, the logical loop hasn't been completed for there's still a misunderstanding about regulation. The point being that there must be regulation, there must be regulation about everything.

Who does the regulating being the important thing:

All drugs should be decriminalised, Britain’s leading public health experts say ina landmark intervention today.

The law is failing to protect drug users or society and police involvement in drug-taking must end, according to the Royal Society for Public Health and the Faculty of Public Health.

The two bodies, which represent public health experts working for the NHS and councils, are the first leading medical organisations to come out in favour of radical drugs reform.

In their blueprint for an overhaul of Britain’s attitude to substances — ranging from class A drugs such as heroin and cocaine to cannabis and so-called legal highs — they argue that addiction must be regarded as a health problem rather than a crime.

Possessing drugs for personal use would no longer be punishable under the reforms but the health chiefs stop short of proposing that the state should regulate sales. Anyone making or dealing drugs would still face prosecution.

It's that last sentence which is the problem. There has to be some regulation of purity, concentration, strength and so on. And it's fine that the State doesn't do that. But we do still need to have regulation of those things - and that should be being done by the consumers.

By analogy with the past the great clean up of the food supply was in the latter half of the 19th century. And that clean up came not as a result of regulation by government - most of the egregious middle Victorian (or, if you prefer, early industrial age) abuses had already been dealt with by the market itself. Brands appeared, promising quality, and those that did so prospered, pushing out of the market the more adulterated offerings. An inverse Gresham's Law, good food pushes out bad. As an example, canning was in its early days and it was all too easy for those not very good at it to poison large numbers of people (badly canned fish has killed people through botulism poisoning in our own lifetimes). The brands that started and then survived to our own day, the Heinz, Campbell's sort of stuff, were rather more adept at not poisoning their customers than others.

And so it will be with legal drugs. As we say, it's just fine that the State won't be regulating purity or sourcing. But someone has to, somewhere, for there must be regulation and pressure upon suppliers,. And that can only be done if supply is legal so that consumers can indeed regulate through their behaviour - and, of course, the usual exigencies of tort and consumer law.

Legalising drug consumption is something we've been arguing for for decades. But along with that must come legalisation of supply. Only then can brands, reputations and a holding to account become possible.

That the regulation comes from "Which Drug?" with monthly publication of which brand is cutting with rat poison, which with brick dust and which is offering the actual drug in a reasonable state of purity is what will drive the dust and the poison out of the market. And that's why drug supply must be legal: because there must be regulation and that consumer choice is the most effective form there is.

Legalisation of drug consumption is a good idea but we'll only really have solved the problem when we can hold Bayer to account for the purity of its heroin by buying it or not buying it according to our perception of its quality. Which means that we must be able to identify the vendor and that means legality of supply.

One tax cut free marketeers shouldn't support

Milton Friedman once said “I am in favor of cutting taxes under any circumstance and for any excuse, for any reason, whenever it’s possible."

Now I try not to make it habit of disagreeing with Milton, but, following Sam Bowman's post on good and bad ways to do redistribution, I want to explain why I think free marketeers should oppose Vote Leave's recent proposal to scrap the 5% VAT on Household Gas and Electricity.

Currently the EU restricts the ability of member states to vary rates of VAT on different products like tampons or fuel. This is done to promote trade across the EU. Without this power, there's a risk that nations will exempt products that can be made cheaply at home and raise VAT on products that tend to be imported, creating tariffs by proxy.

But, even putting free trade to one side, there are good reasons to oppose exempting certain goods and services from VAT. Free marketeers know that flatter, simpler taxes are vital to encouraging growth and reducing unemployment, but tinkering around the edges with VAT exemptions takes us even further away from that goal.

There are better ways to help the poorest. Vote Leave argue that the 5% tax on household energy bills is regressive because the poorest spend three times as big of a proportion of their income on energy costs compared to the well-off. But if you're aim is to help those on low incomes, VAT exemptions are a staggeringly inefficient way of doing it.

Sticking with fuel. Let's look at who'd benefits. Someone living in a small flat will typically pay about £26 a year in VAT on fuel, but someone on a larger income living in a large house will pay £76. So while that extra £26 will certainly mean a lot to the someone living hand to mouth, you have to spend an extra £74 in handouts to relatively wealthy people to that £26.

In fact, the IFS ran the numbers and found that if you scrapped every single VAT exemption and replaced them with tax cuts for low paid workers (e.g. raising the personal tax free allowance) and increased means-tested benefits (e.g. Working Tax Credits), you could preserve the existing progressivity of the system and still raise an extra £3bn to fund further tax cuts or pay down the deficit. (Note: This was calculated when VAT was 17.5% rather than the current 20%, so this change would probably raise more revenue now, even more once you factor in growth and inflation.)

Exemptions distort consumer choices. By taxing some goods less than others, the state nudges consumers to spend more on certain goods and less on others. In the case of fuel, it might encourage people to leave their heating on, when otherwise they would have instead put an extra layer of clothing on. While such a case might seem small or trivial, if you add up every single VAT exemption and add it up across the economy, you end up with very large distortions and inefficiencies.

These distortions can also discourage innovation. Take the case of E-Cigarettes. They're taxed at the full whack of VAT while other highly regulated anti-smoking products like Nicotine patches and gum are taxed at 5%. At the margin, this gives less of an incentive for businesses to invest in e-cigs and more of an incentive for them to invest in nicotine gum.

They create unnecessary complexity, which encourages wasteful avoidance. Is a Jaffa Cake a biscuit or a cake? (Likewise is a burrito a sandwich?) A question that should have been left to philosophers, instead is brought into the courtroom. McVities fought a hard battle (and baked a massive Jaffa Cake) to prove that Jaffa Cakes are cakes and not biscuits, thus qualifying them for a lower rate of VAT. Again, the money wasted here might seem silly or trivial, but it adds up.

This is bad for two reasons. First, it's a misallocation of resources. Every pound McVities spend on tax lawyers is a pound they're not spending on investing in new products (although in the case of Jaffa Cakes maybe that's a good thing.)

Second, it can actually lead to worse products. Take the case of Cornish Pasties. In theory, hot prepared food should be taxed at the standard rate of VAT. Straightforward enough, but according to tax law, products that are incidentally hot (e.g. freshly baked bread) are not taxed at the standard rate and instead taxed at the same rate as cold groceries (if this weren't the case, bakers would have to wait till their bread had cooled down to avoid tax). So whether or not you end up paying a Pasty Tax depends on whether it's incidentally hot (i.e. it's just come out of the oven) or deliberately hot (it's been kept in a heated cabinet). At the margin, this encourages bakers to sell cold pasties when they could be selling hot ones.

Indeed the deeper you get, the more maddening it becomes.

I'll leave you with a puzzle.

Do I have to pay VAT on these Heart Shaped Marshmallows?

According to VAT Notice 701/14, edible cake decorations are zero-rated but marshmallows aren't. So what is it?

We told you so, you fools

Back when the National Living Wage was announced we were just about the only people warning that it might hurt workers, saying that:

There is also evidence to suggest that higher minimum wages slow down the creation of new jobs, particularly in sectors that employ large numbers of low-skilled workers.

Well, lo and behold, this week the Guardian reports:

the national living wage, which pays £7.20 an hour to 25-year-olds and over, has prompted retailers to register the biggest fall in optimism about their hiring intentions since 2011. …

About a third of employers in the retail sector intend to restrict the number of new jobs as higher pay packets for the lowest-paid staff eat into profit levels and cut dividend payouts.

Interesting.

We also warned that:

Firms may also respond to this by cutting back on non-monetary worker compensation like break times and sick leave, to offset their increased labour costs.

And what do you know? Yesterday the Guardian reported that left-wing pressure groups Citizens UK and ShareAction are protesting B&Q’s planned cut-backs in employee breaks and overtime pay:

B&Q announced in February it would be cutting Sunday pay and reducing bank holiday pay and bonuses for some staff. The DIY retailer raised basic pay to a minimum rate of £7.66 an hour from 1 April – 46p more than the new national living wage. Some staff had been on the previous statutory minimum wage of £6.70.

Today at PMQs Siobhan McDonagh questioned the Prime Minister about Marks and Spencer, which has:

announced changes to so-called premium payments for Sundays and unsociable hours, which will see it axe extra pay for Sunday shifts and introduce a flat rate for bank holidays.

It is of course far too early to tell what the full effects of the National Living Wage will be, and many other factors may be at play even if retailers blame the NLW. It may be quietly forgotten by whoever succeeds George Osborne as Chancellor later this month. But the early signs don't look good.

Linguistic redefinition happening in 3...2...1

Milton Friedman warned us that there's nothing so permanent as a temporary government program. Or we might cast it as old bureaucracies never die they just change the language. And we are privileged, privileged, to see this happening before our very eyes. It's entirely true that the correct meaning of malnutrition is badly nourished. But it's been used for decades to talk about people starving or being damaged by simple lack of food and nutrients.

So, we went and did something about that: we globalised, started buying things made by poor people in poor countries and global poverty, along with the malnourishment associated with it, is plummeting. Excellent news of course but perhaps not if you are a bureaucrats whose income depends upon there being malnourishment for you to monitor and berate people about. This this:

Malnutrition is sweeping the world, fuelled by obesity as well as starvation, new research has suggested.

The 2016 Global Nutrition Report said 44% of countries were now experiencing "very serious levels" of both under-nutrition and obesity.

It means one in three people suffers from malnutrition in some form, according to the study of 129 countries.

Being malnourished is "the new normal", the report's authors said.

Malnutrition has traditionally been associated with children who are starving, have stunted growth and are prone to infection.

These are still major problems, but progress has been made in this area.

The report's authors instead highlighted the "staggering global challenge" posed by rising obesity.

The increase is happening in every region of the world and in nearly every country, they said.

Hundreds of millions of people are malnourished because they are overweight, as well as having too much sugar, salt or cholesterol in their blood, the report said.

Professor Corinna Hawkes, who co-chaired the research, said the study was "redefining what the world thinks of as being malnourished".

"Malnutrition literally means bad nutrition - that's anyone who isn't adequately nourished.

"You have outcomes like you are too thin, you're not growing fast enough… or it could mean that you're overweight or you have high blood sugar, which leads to diabetes," she said.

Why, it's almost as if the purpose of it all is to provide a platform to berate us from rather than a call to arms to end the despicable existence of starving African babies.

Really, who would have thought that the people who spend our money might do such a thing? Change the language so as to make sure they still get to spend our money?

The end of the climate change scare

News just in which should stop people worrying so much about climate change. Of course, it's not going to but it should. That news being that the worst estimates of emissions and thus temperature changes just are never going to take place:

The way we get electricity is about to change dramatically, as the era of ever-expanding demand for fossil fuels comes to an end—in less than a decade. That's according to a new forecast by Bloomberg New Energy Finance that plots out global power markets for the next 25 years.

Call it peak fossil fuels, a turnabout that's happening not because we're running out of coal and gas, but because we're finding cheaper alternatives. Demand is peaking ahead of schedule because electric cars and affordable battery storage for renewable power are arriving faster than expected, as are changes in China's energy mix.

The most hair raising of estimates of future temperature rises come from a model of the future called RCP 8.5. No, don't worry about the details but this model assumes an ever rising use of fossil fuels off into the future. Not just that, it assumes that we use ever more coal, not just in total, but as a proportion of fossil fuel use.

The is also what almost everyone wrongly describes as "business as usual" or BAU. The truth is that all of the models created are BAUs. Even the ones which show that climate change will be trivial are BAUs. Simply because that's how the model making m process was done: what could possibly happen in the future without direct action to change behaviour? What possible interactions of population, technology and fuel use could lead to what emissions?

In the earlier set of models there was even one called A1T which just assumed proper business as usual. Population changes as we've been seeing them, technological advance as we've seen it and economic growth as we've seen it: climate change was not a major problem. So too with B1 from that same set of models.

The one that had all panicking was A1FI. And that's roughly the same as RCP 8.5 in this newer set of models. And if what Bloomberg is reporting there is true then neither of those models will ever come true.

Assume that the entire problem over climate change has been properly identified for a moment. No, leave aside the idea that it's all lies. By the very things that the research tells us will cause problems in the future we've already largely done the things needed to avert that danger. Anything beyond a mild warming is predicated upon the idea of ever more fossil fuel use. If that's not true because of what we've already done then anything beyond a mild warming is not true either.

Redistribution: Not if, but how

Many people assume that classical liberals are ardently opposed to redistribution of income in principle, and that this usually overrides other concerns. It is certainly true that we are sceptical of it, but many of us are actually very relaxed about it in principle, and reserve most of our scepticism for the way it’s done.

Consider three different education systems.

In system one, the government spends £6,500 per year per child through a centrally-managed school system where many aspects of the curriculum are decided by the Secretary of State for Education. In system two, the government gives parents a voucher for £6,500 per child to pay for their education in any school they like. In system three, parents are legally required to send their children to school but they do not receive any money from the state to help them do so.

Or three different healthcare systems.

In one, we have an government-run and -provided National Health Service. In two, the government pays for health insurance for people too poor to afford it, but the private sector provides the care. In three, you’re on your own.

In both examples, system one is what we’ve got at the moment. System two is what I would characterise as a moderate classical liberal stance. System three is what I would characterise as a hardcore libertarian stance.

People like Milton Friedman and FA Hayek spent most of their lives advocating system two-like policies, and these are generally the sorts of policies that the Adam Smith Institute and Institute of Economic Affairs advocate for too.

If the state ended up spending less money under these policies, this is incidental to changing the way money is spent. The real goal is decentralising decision making to the level of the individual, and allowing firms to profit by satisfying people’s individual needs efficiently, and fail when they do not do so.

I think a similar approach makes sense for welfare. The system we have at the moment is highly complex and relies on the people who run the system being near-omniscient about what’s best for people on benefits. That’s why I’m in favour of radical simplification of the welfare system along the lines of straightforward cash payments to the poor. Even if that means not cutting the welfare bill.

Redistribution isn’t costless, especially when it’s done badly. Taxes on the incomes and savings of the rich depress investment, and hence economic growth – making the pie smaller overall. On the other hand, taxes on consumption seem much less economically harmful. Again, the focus for me is on making the state cause less harm in the redistribution it does.

Does this mean I don’t want a ‘small state’? I’d say no.

The scope of the state is much more important than the simple amount it redistributes by. A government could raise very little tax, but still prohibit alcohol, tobacco, cannabis and any sex outside of the missionary position. This would be a much bigger state than a very liberal one that nevertheless had a £10k basic income – at least in the sense that it matters.

Thatcher’s reforms revolutionised Britain not because they cut state spending as a percentage of GDP, but because they got the state out of key industries and opened them up to competition. It was rolling back the scope of the state that mattered.

So I don’t think it’s incoherent to say that you’re a pro-redistribution classical liberal. In principle, I don’t mind redistribution. The problem is how bad the state is at it.