I'm not sure the Russians have got the hang of this sanctions thing yet

I've been continually amused by the Russian reaction to the sanctions that have been imposed upon the country over Crimea and the Ukraine. First they ban imports of fruit and veg from the EU and US. That's clearly and obviously something that damages Russian citizens more than it does anyone else. Then there was the delightful idea that they would have price controls on the supplies they could get: exactly what not to do to encourage domestic production and imports from new suppliers. And now we've got them closing down McDonald's branches in Moscow over "food safety violations". Russia has shut down four McDonald's restaurants in Moscow for alleged sanitary violations in a move critics said was the latest blow in its tit-for-tat sanctions tussle with the west.

The federal monitoring service for consumer rights and wellbeing announced on Wednesday that the offending outlets included the famous restaurant on Pushkin Square that opened just before the fall of the Soviet Union. The body said the eateries were being shut down for "sanitary violations" discovered during inspections this week.

No, no one at all believes that it's for any reason other than those sanctions. Quite apart from anything else the floor in a Maccy D's will be cleaner than the average food preparation table elsewhere in Russia.

But of course there's more to it than that: obviously, those who would eat at McDonald's, ie the Russian citizenry, are discomfited by this. McDonald's Canada, which owns (last I heard at least) 50% of the stores will lose money. But here's where it gets really fun. The other 50% owner is Moscow City Council (again, last I checked).

So, err, Russian sanctions against the US reduces the cash income of the local council in Moscow.

I'm unconvinced that they've quite got the point of sanctions just yet: you're trying to hurt the other guy, not yourself or your own citizenry.

An independent Scotland should use the pound without permission from rUK, says new ASI report

Today the Adam Smith Institute has released a new paper: "Quids In: How sterlingization and free banking could help Scotland flourish", written by Research Director of the Adam Smith Institute, Sam Bowman. Below is a condensed version of the press release; a full version of the press release can be found here. An independent Scotland could flourish by using the pound without permission from the rest of the UK, a new report released today by the Adam Smith Institute argues.

The report, “Quids In: How sterlingization and free banking could help Scotland flourish”, draws on Scottish history and contemporary international examples to argue for the adoption of what it calls ‘adaptive sterlingization,' which combines unilateral use of the pound sterling with financial reforms that remove protections for established banks while allowing competitive banks to issue their own promissory notes without restriction. This, the report argues, would give Scotland a more stable financial system and economy than the rest of the UK.

According to the report, adaptive sterlingization would allow competitive, private banks to issue their own promissory notes backed by reserves of GBP (or anything else – including USD, gold, index fund shares or even cryptocurrencies like Bitcoin). With each bank given powers to expand and contract its balance sheet relative to demand, this system would be highly adaptive to changes in money demand, preventing demand-side recessions in modern economies such as the ones that led to the 2008 Great Recession.

The report’s author, Sam Bowman, details Scotland’s successful history of 'free banking' in the 18th and 19th centuries and the period of remarkable financial and economic stability which accompanied it. Historical ‘hangovers’ from this period, like Scotland's continued practice of individual bank issuance of banknotes, are still in place today, making Scotland uniquely placed for a simple transition to the system outlined in the report.

The report highlights evidence from 'dollarized' economies in Latin America, such as Panama, Ecuador and El Salvador, which demonstrate that the informal use of another country’s currency can foster a healthy financial system and economy.

Under sterlingization, Scotland would lack the ability to print money and establish a central bank to act as a lender of last resort. Evidence from dollarized Latin American countries suggests that far from being problematic, this constraint reduces moral hazard within the financial system and forces banks to be prudent, significantly improving the overall quality of the country’s financial institutions. Panama, for example, has the seventh soundest banks in the world.

The report concludes that Britain's obstinacy could be Scotland's opportunity to return to a freer, more stable banking system. Sterilization, combined with reform of Scottish financial regulation that:

-

removed government liquidity provisions to illiquid banks,

-

established mechanisms to ‘bail-in’ insolvent banks by extending liability to shareholders, and

- shifted deposit insurance costs onto banks and depositors rather than taxpayers,

would improve standards and competitiveness in banking, while significantly reducing the prospect of large-scale bank panics and financial crises.

Commenting on his report, the Research Director of the Adam Smith Institute, Sam Bowman, said:

The Scottish independence debate has repeatedly foundered on the question of currency, but if Scots look to their own history they will find that their country is a shining example of how competition in currency and banking can ensure a stable and effective banking system. Scotland’s free banking era was an economic and intellectual Golden Age, and its system of competitive note-issuance was recognised by such thinkers as Adam Smith as one of the root causes of the country’s prosperity during this time.

The examples of Panama and other dollarized Latin American economies are proof that countries can thrive when they unilaterally adopt another country’s currency. Combined with a flexible, adaptive banking system, the unilateral use of another country’s currency can instill a discipline in a country’s financial sector that neither a national currency nor a currency union can provide. Scotland’s banking system is almost uniquely primed for such a system of ‘adaptive sterlingization’. The path outlined in this paper would go almost unnoticed by the average Scot – until the next big economic shock, when they might just wonder why their system was so much more stable than that of the country they’d left behind.

This train fare question isn't difficult you know

The Guardian rather jumps the shark here:

The Guardian view on rail fares: unfair Travelling by train produces benefits for everyone – less air pollution, lower greenhouse gas emissions, fewer traffic jams. Passengers should not have to pay two-thirds of the cost

Actually, a small engined car with four people in it has lower emissions, lower pollution, than four people traveling by train. So it simply isn't true that everyone benefits from more train travel.

There are indeed some truths there though. It simply would not be possible to fill and empty London each day purely by private transport: some amount of commuting public transport is going to be necessary. And there's no reason why those who benefit from that should not pay for it: as they largely do through the subsidy of London Transport paid for by Londoners.

But on the larger question of who should pay for the railways of course it should be those who use the railways that pay for it. Some City fund manager who commutes in from 50 miles outside London should not have his lifestyle choice subsidised by the rest of us. We should not be taxing the man who cycles to work at minimum wage in order to pay for wealthier people top travel longer distances.

The Guardian is, once again, forgetting that there is no magic money tree. If rail users do not pay for the railways then there is no unowned cash that can be diverted to doing so. Either the rest of us put our hands in our pockets or we don't. And why should the poor pay taxes so the middles classes can live in the greenbelt?

Looking at the world through neo-liberal eyes

I spoke at Brighton University as part of their seminar series on neo-liberalism. The term 'neo-liberal' is usually used in a derogatory sense, though I chose not to use it that way. I was the only speaker in the series to speak in favour of neo-liberal ideas, and my title was "Looking At the World Through Neo-Liberal Eyes." I began by quoting an old Chinese proverb: "Never criticize a man until you have walked a mile in his shoes. That way you are a mile away when you voice your criticism; and you have his shoes." I invited the audience to see the world briefly as it looks through neo-liberal eyes. These were the points I made.

1. Value is in the mind, not within objects.

Value is not a property of objects or a quality they possess. Although we talk of objects "having value," we mean that we value them. Value is in the mind of the person contemplating the object, not in the object itself. If value resided in things, it could theoretically be measured objectively and we would all agree on what it was. There would then be no trade, for exchange takes place when each person values what the other person has more than they value what they are offering in exchange. A trade gives each of them something they value more, and thus wealth is created by the exchange. When people make the mistake of supposing that value resides in objects, they ask how it arrived there, and come up with fallacious ideas such as Marx's labour theory of value. An object can take masses of labour to produce, but if no-one values it, it will be worthless.

2. Time must be factored into activities.

Time must be factored into economic transactions. I could read a book today or read it tomorrow. If I choose to read it tomorrow, I forego the pleasure of a day spent contemplating its wisdom and being stimulated by its insights. I value the activity less if it is in the future. If I postpone gratification I should be compensated for doing so. There is a risk element, too, in that if I postpone a pleasure, circumstances may make it unavailable in future and I will have lost out by delaying my enjoyment. From this notion that present pleasures are valued more than future ones comes the idea of interest, or being compensated for doing without present enjoyment in return for receiving more enjoyment later. And from this arises the notion of investment, of setting aside funds that could bring gratification now, and using them instead to bring more gratification later. This is the essence of capitalism, of using funds as capital, not to bring gratification now, but to increase future rewards.

3. Imperfection abounds.

The world of human activity is not characterized by neatness and perfection. It is not represented by simple, pure principles in action. On the contrary, it is messy, and it changes from moment to moment. In the real world there is no perfect competition and no perfect information. People act rationally sometimes, and not at others. They sometimes change their minds and behave differently. Society is not perfectible, and nor is human nature. People are motivated sometimes by worthy aims, and at other times they show less admirable traits. This imperfection should be recognized and admitted so that it can be coped with, and so that ways might be found to minimize any baleful effects it might generate.

4. Compare the present with the past rather than with an imagined and hypothetical future.

Free market economists tend to think the present is better than the past. People live longer. Life expectancy, which was about 30 years for millennia of human existence, is now at 68, and greater still in advanced countries. Death of mothers in childbirth is a tiny fraction of what it was just over a century ago, and child mortality in infancy is minimal compared to what it was. Major diseases have been conquered, and fewer die of malnutrition than ever did. Fewer live lives at or below subsistence, and more have access to healthcare and education than did in previous ages. By many measures the present is better than the past. Instead of comparing it with a hypothetic future of an imagined world, neo-liberals compare it with the past, inspect what has made it better, and try to do more of what has worked in order to make the future better still.

5. The outcome of spontaneous interaction is better than a preconceived goal.

When people make choices, including economic ones, the outcome produced by those millions of interactions will contain more information and allow more different goals to be met than any brought about by planners thinking one up. The planners are few and they dream up a future that satisfies their own aims. Those freely interacting are many, and they act to produce a future that allows more of their own goals to be achieved. The spontaneous society not only results from more minds and more information, it also reacts faster and is quicker to cope with crises.

6. Poorer peoples become richer by creating wealth, not by redistributing it.

The world's wealth is not a fixed supply to be shared out according to some idea of what is just. Wealth is created by exchange. When people trade what they value less for what they value more, wealth is increased. Development aid redistributes a little wealth, whereas trade creates a great deal of it. No poor country has become rich through aid, and none has done it without trade. To help poorer countries on that upward path, richer countries should open their markets and buy what they produce.

7. Life before the industrial revolution was far from idyllic.

Although some conservatives and environmentalists have a rosy view of Britain's pre-industrial past, and praise what they call "the measured rhythm of rural life," the reality was of abject subsistence for most, accompanied by squalor, disease and early death. Most people worked on the land from dawn till dusk, doing back-breaking work and living in primitive and filthy conditions. Most had no margin, so bad harvests or severe winters could bring starvation. The industrial revolution brought a step up in living standards. What we now regard as poor and unsanitary housing was an improvement from their rural squalor, and wages gradually enabled them to afford decent clothes, china dishes and household items. The industrial revolution brought mass production and affordable items, and created the wealth that raised living standards.

8. Economic growth is a good thing and there are no limits to it.

Economic growth brings the opportunities to satisfy our wants. It enables us to pay for medical care and sanitation, and for education. It funds art galleries, libraries and concert halls as well as meeting our material needs. Although some critics say we will run out of resources, our ability to access new sources of them as technology advances is increasing faster than our use of them. The same is also true of our development of substitutes. Technology is becoming smarter, too, using fewer resources for its outputs. Growth can continue to bring more opportunities and greater security to more and more people.

9. Globalization has brought huge benefits to large numbers across the world.

Globalization has brought millions of people who previously lived fairly isolated, subsistence lives onto world markets. They have been able to sell their labour and their produce to distant buyers and to join in the wealth-creation process that lifts people above the struggle for survival and into a world of greater opportunities. Although some praise buying locally, it is buying globally that uses resources efficiently and enriches more people. As Adam Smith said, we could make wine in Scotland very expensively, but if we buy cheaper French wines it leaves us money left over to spend on other things. Globalization has enriched, and is still enriching, the world.

10. The world is not reducible.

The real world is immensely complex, ever moving, ever changing. It cannot be reduced to a few simple equations. When people attempt to do this, they have to simplify, and in doing so leave out essential information that makes it work as it does. It is not only complex, but inherently unpredictable. We do the best we can with limited information, and always with the knowledge that unforeseen events might alter our plans and thwart our intentions with unintended consequences. The world is not like a clean-lined machine whose mechanism can be studied, but more like a messy mass of interactions whose outcomes are uncertain. Fortunately, the world is fairly resilient and usually manages to cope eventually with the follies people put upon it.

A simple point on railway nationalisation

One point people bring up when they advocate renationalising railways (or renationalising stuff in general) is that when private companies run something they take a chunk of the total surplus in profit, but if the government were in control, that could go to them. But there's a very basic reason why this isn't the case: opportunity cost. A firm, in doing business, puts capital to use. It uses a mix of physical and human capital and devotes it toward achieving tasks in order, usually, to turn a profit.

The best way to measure the amount of capital tied up in a project is the market's assessment thereof—the firm's market capitalisation—although of course we know that market prices are never perfectly accurate, since they are only on their way to an ever-changing equilibrium, and they may not have got there yet. And what's more, not all the relevant information will always be in the public domain.

For rail franchises—or TOCs (Train Operating Companies), as they seem to call themselves—it is relatively hard to pinpoint the exact amount of capital they are using, as they are usually subdivisions of a larger structure. But suffice to say, running trains involves tying up money on the order of billions, whoever does it (i.e. it includes Directly Operated Railways, the state body that is currently running the East Coast Mainline pretty well). You have to rent the rolling stock (trains), pay the staff, buy the fuel, pay to use the track and so on.

From this capital you get a return. TOC margins average about 4% over the last ten years. The average company got more like 10%. FTSE100 companies seem to enjoy higher returns. Of course, operating profits are not share returns, but they tell more or less the same story. The extra couple dozen billion the government would need to spend on trains could equally be spent on equities or anywhere else for more or less the same risk-adjusted return. The return they got here could be put into trains.

But even doing this makes no sense. If the government returns that couple dozen billion to the population at large, the government can tax the income that the private citizens make on the wealth, at a glance dealing with the problems of governments holding wealth—principally: they are not very good at picking winners. Or they could pay off debt and reduce their repayment costs—since the risk-adjusted return of gilts is priced in just the same way as other assets.

Either way, and whether or not rail re-nationalisation makes sense from any other perspective, it is simply not the case that government, by nationalising rail, could get a bit of extra cash to put into our network.

Looking at the world through neo-liberal eyes

Adam Smith Institute President, Dr. Madsen Pirie, explains why he is willing to own the usually-derogatory term neo-liberal, and explains why the world actually shows us the success of the much-maligned perspective.

I spoke at Brighton University as part of their seminar series on neo-liberalism. The term ‘neo-liberal’ is usually used in a derogatory sense, though I chose not to use it that way. I was the only speaker in the series to speak in favour of neo-liberal ideas, and my title was “Looking At the World Through Neo-Liberal Eyes.” I began by quoting an old Chinese proverb: “Never criticize a man until you have walked a mile in his shoes. That way you are a mile away when you voice your criticism; and you have his shoes.” I invited the audience to see the world briefly as it looks through neo-liberal eyes. These were the points I made.1. Value is in the mind, not within objects.

Value is not a property of objects or a quality they possess. Although we talk of objects “having value,” we mean that we value them. Value is in the mind of the person contemplating the object, not in the object itself. If value resided in things, it could theoretically be measured objectively and we would all agree on what it was. There would then be no trade, for exchange takes place when each person values what the other person has more than they value what they are offering in exchange. A trade gives each of them something they value more, and thus wealth is created by the exchange. When people make the mistake of supposing that value resides in objects, they ask how it arrived there, and come up with fallacious ideas such as Marx’s labour theory of value. An object can take masses of labour to produce, but if no-one values it, it will be worthless.

What glories this capitalist free market thing hath wrought

There's nothing worse than being exploited by some running lackey pig dog of a capitalist, as Deirdre McCloskey reminds us:

The aim of the true Liberal should not be equality but “lifting up those below him.” It is to be achieved not by redistribution but by free trade and compulsory education and women’s rights.And it came to pass. In the UK since 1800, or Italy since 1900, or Hong Kong since 1950, real income per head has increased by a factor of anywhere from 15 to 100, depending on how one allows for the improved quality of steel girders and plate glass, medicine and economics.

In relative terms, the poorest people in the developed economies and billions in the poor countries have been the biggest beneficiaries. The rich became richer, true. But the poor have gas heating, cars, smallpox vaccinations, indoor plumbing, cheap travel, rights for women, low child mortality, adequate nutrition, taller bodies, doubled life expectancy, schooling for their kids, newspapers, a vote, a shot at university and respect.

Never had anything similar happened, not in the glory of Greece or the grandeur of Rome, not in ancient Egypt or medieval China. What I call The Great Enrichment is the main fact and finding of economic history.

It's that penultimate sentence which is so important. There have most certainly been many attempts at designing economic systems: there have been even more that just sorta happened out of voluntary interactions. But there's only one of them that has actually managed what we are all the lucky, lucky, beneficiaries of. That is, one economic method of organisation that has led to a substantial, sustained, increase in the standard of living of the average woman on the Clapham Omnibus.

Nothing else, nothing planned nor nothing unplanned, has managed this. And that really is the main fact and finding of economic history. It's the one unique even in it too. McCloskey, you and I, we might differ on the details of how it all happened but we shouldn't allow minor disagreements over precedence between the flea and the louse to obscure the manner in which we're all feeding off that larger truth. That nothing else does work as well as those largely bourgeois virtues plus economic and social liberty.

Currency reform in Ancient Rome

In the Western world, modern civilizations are often thought of in comparison to those of the ancient world. The Roman Empire is typically the first considered, and arguably the most natural reference point owing to its many achievements, complexity and durability. It stands in history, widely considered the high water mark of the ancient world; one against which contemporary political, economic and social questions can be posed. Much of the world is still living with the consequences of Roman policy choices in a very real sense, in matters ranging from the location of cities to commercial and legal practices to customs.

The global economic downturn of 2008, in particular its monetary facet, readily invites comparison between the troubles of the modern world and those of the Roman Empire; just as Western currencies have declined precipitously in value since their commodity backing was removed in stages starting roughly a century ago, Roman currencies were also troubled, and present a cautionary tale.

The Roman coin in use through most of the empire was the denarius, which demonstrated a persistent decline in value, starting from the time of transition from Republic to Empire, and continuing until its decimation during the Crisis of the Third Century AD. Although efforts by Diocletian taken after the monetary collapse are commonly associated with Roman economic reform, there were other efforts by earlier, lesser known emperors that suddenly and unexpectedly improved the silver content and value of the denarius. Firsthand accounts and archeological findings provide sufficient detail to allow examination of these short, if noteworthy, periods of voluntary restorative policies – and their architects.

While popular interest typically fixes on such well known emperors as Julius Caesar, Nero, and Augustus, I seek to direct attention toward four lesser known emperors who undertook the improvement of the denarius. These initiatives essentially constitute rare, temporary episodes of qualitative tightening, in contrast to the more common – and, in recent history, ubiquitous - policy of quantitative easing. The reformers were Domitian, Pertinax, Macrinus, and Severus Alexander. A necessarily concise summary of each one’s initiatives follows, with a brief review of the circumstances surrounding their administration and decisions.

Domitian (September 81 AD – September 96 AD)

The first noteworthy Roman currency reformer was Domitian, son of Vespasian and brother of Titus. He ascended in 81 AD, inheriting the problems associated with his forbear’s costly projects. Vespasian had undertaken large scale construction projects he thought necessary to repair the damage to many structures during the civil wars that raged throughout the late Republic. In addition, he paid lofty financial incentives to regime-supporting historical writers and awarded pensions of up to 1,000 gold coins annually to a coterie of court intellectuals. Titus, his son and successor, was known for the initiation of lavish and elaborate games as well as for recompensing individuals struck by unexpected natural disasters, including the eruption of the volcano Vesuvius, the Great Fire of Rome, and those affected by the outbreak of war in Britannia. Together, Titus and Vespasian committed vast resources to the construction of the Coliseum; and, consequently, during the 12 years of their emperorship, the silver content of the denarius was reduced from roughly 94% to 90% purity.

Despite that precedent, “Domitian was apparently very sensitive to the importance of capital and the benefits of stability derived from a credible and dependable money supply.”[1] Thus early in his reign, in a “dramatic and entirely unexpected” move that coincided with the end of hostilities in Britain and Chatti (Germany), he fired the Empire’s financial secretary. Historians speculate that this was either because the secretary considered Domitian’s plans to improve the currency quality “unwise” or because he’d allowed such “slackness to permeate the mint” in the first place.[2] Shortly thereafter, “in 82 – 84 AD Domitian improved the silver standard, and older coins averaging 88 to 92 percent silver were reminted into purer denarii (98 percent fine)”.[3]

However, Domitian’s currency improvement effort was short-lived due to renewed foreign warfare. Between 85 and 89, fighting in Africa, Dacia (Eastern Europe), and Chatti again broke out, such that the “purer coins had scarcely entered the marketplace when [he], in mid-85, pressed for money to pay war bills, again changed the standard, reducing it to 93 percent fine”.[4]

Domitian’s reign eventually devolved into tyranny and massive building projects echoing those of his brother and father, and culminated in a wealth confiscation edict so brutal that “it [became] fatal at th[e] time … to own a spacious house or an attractive property”.[5] In 96 AD, he was assassinated.

Pertinax (January 193 AD – March 193 AD)

For nearly a century after Domitian’s fall, the debasement of the denarius continued apace, and by 148 AD devaluations became ritually associated not only with the start of wars and public projects but with inaugural events and holidays as well.[6]

At the beginning of Domitian’s reign, money supply was 60% of what it had been in 40 [AD], and about 70% of this level at the end of his reign, a range maintained throughout the reigns of the Antonines, until, under Commodus, money supply reached 700-800% above [that] initial level.[7]

Commodus, whose twelve year regime saw among other things the re-introduction of Plebian Games – a pricey, nearly month-long festival of religion, art and sports - and an incredible expenditure of state funds in a massive, megalomaniacal campaign of self-indulgent iconography, was succeeded by Pertinax – a man of “propriety [and] economy” – whose 86-day rule starkly depicts the considerable risk that currency reformers undertook - and perhaps still do.

[O]n the day of his accession, he resigned over to his wife and son his whole private fortune, that they might have no pretense to solicit favors at the expense of the state. He refused to flatter the former with the title of Augusta, or to corrupt the inexperienced youth … by the rank of Caesar … g[iving] him no assured prospect of the throne[.][8]

In addition,

[h]e forbad his name to be inscribed on any part of the imperial domains, insisting that they belonged not to him, but to the public. He melted the silver statues which had been raised to Commodus … s[elling] all his concubines, horses, arms, and other instruments of pleasure. With the money thus raised, he abolished all the taxes which Commodus had imposed.[9]

On the heels of that, Pertinax “carried out an extraordinary … coinage reform that returned the denarius to the standard of Vespasian.”[10] It revalued the denarius from 74 to 87% silver by weight on new coins, several mintings of which were emblazoned with the motto “MENTI LAVDANDAE” (“noteworthy good sense”), and most significantly featured not his or another emperor’s visage but Ops, the Roman personification of wealth. In addition to this, Pertinax simultaneously embarked upon a fiscal rehabilitation program, the centerpiece of which were large budget cuts targeting the Roman military; he began by cancelling the customary bonus paid to soldiers by newly-seated emperors.

In a remarkably short of time, Pertinax gained “the love and esteem of his people.”[11] But his cuts to the military were deep and far reaching, and his urge to settle disputes with enemies rather than fight them out enraged the soldiery. “A hasty zeal to reform the corrupted state … proved fatal” for him. [12]. On the 86th day of his rule, his personal guard betrayed him and mutinied, gathering at the imperial domicile. Though other guards urged him to safety, “instead of flying, he boldly addressed them” – and fell beneath their swords.[13] Rome’s “Age of Inflation” had thus begun.

Macrinus (April 217AD – June 218AD)

Gibbons describes Caracalla, who ruled for 19 years, as “the common enemy of mankind” for the incredible number of massacres and persecutions, as well as economic destruction, which occurred during his tenure.[14] He devalued the denarii from 1.81 grams of silver to 1.66 and introduced a new coin, the antoninianus: ostensibly a “double denarius” but actually weighing 2.6 grams of silver instead of the implied 3.3 grams. Additionally, he increased tax revenue by making all freemen in the Empire citizens and commissioned the construction of a number of massive, exorbitant bathhouses. And, most unsurprisingly, he raised the pay of the military, granted them new and expanded benefits, and launched a war against the Parthian Empire.

Macrinus, a member of Caracalla’s staff, became emperor after his assassination – to which, by some accounts, he was a co-conspirator. From the start, he made clear his concern with “prioritiz[ing] public faith over the generation of a sufficient amount of cash” for the Roman state.[15] During his short reign, he made the conscious choice to raise the purity rate of silver from Caracalla’s debased 1.66 grams of silver to above the level extant when Caracalla was installed - 1.82 grams - and demonstrated an inclination toward diplomacy versus combat. When the Persians challenged the Roman army, Macrinus “tried to make peace with the Persian king” and “s[ent] back [their] prisoners of war voluntarily.”[16] Consequently, he incurred the resentment of soldiers and further enraged them by introducing a pay system which paid them according to their rank and time-in-service.

In summary,

[t]he increased silver content was clearly beneficial for the state, as it would instill more confidence among its recipients and presumably still inflation … [but] the major problem, of course, was Macrinus’ attempt at military reform … [T]he army would not stand for a curtailment of privileges, even among new recruits. So while Macrinus’ plan was … fiscal responsibility in the state, the strength of the army was too great to allow for it … [and] paved the way for Macrinus’ downfall.[17]

Dissent soon erupted within the ranks and military forces, in a coup, elevated 15-year-old Elagabalus as the new emperor; a battle ensued between Elagabalus supporters and Macrinus loyalists. Macrinus’ forces were routed, and he was captured and executed.

Severus Alexander (March 222AD – March 235AD)

The new Emperor Elagabalus presided until his 18th birthday, profoundly debasing the denarius and squandering monstrous sums from the public treasury. “No fouler…monster” wrote the poet Ausonius, “ever filled the imperial throne of Rome”.[18] After his assassination, his cousin Severus Alexander rose to power. And

[b]y the time that Alexander ascended the throne the question of the coinage, long acute, had become critical. Looking backwards one may see two centuries of fraud that the debasement of money had gradually but surely proceeded; in the future something little short of national bankruptcy awaited the Roman world unless measures were forthwith adopted to ward off [that] evil day.[19]

Yet in a different strategy from Domitian’s, Alexander initially reduced the silver content of the denarius from 1.41 grams to 1.30 grams, and some years later not only raised it back to the old standard, but far beyond that to 1.50 grams; a quality it had not seen in decades. He

restored the tarnished reputation of imperial money by improving the denarius and striking the first substantial numbers of brass sestertii and copper assees in a generation … they were well-engraved, struck on flans of traditional size and weight, and, as money, the equal of their more elegant ancestors.[20]

He reduced taxes and attempted through various means to end the “singular system of annihilating capital and ruining agriculture and industry [which] was so deeply rooted in the Roman administration”.[21] At the same time, though, he subsidized literature, art and science and socialized education.

When invaders from Gaul threatened the Empire, Severus Alexander attempted to buy them off rather than engage in a pitched, costly battle. This, once again, angered the legionnaires, who elevated General Maximinus as the new emperor. The military rebelled and, like Pertinax and Macrinus before him, Alexander Severus was executed.

Over the next three years, Maximinus doubled soldiers’ pay and waged nearly continual warfare. Taxes were raised, with tax-collectors empowered to commit acts of violence against delinquent or reluctant payers, as well as to summarily confiscate property for citizens in arrears.

Over the next five decades,

[e]mperors … debased the silver currency and raised taxes during what they perceived to be a temporary crisis, expecting windfalls of specie from victory, but war had changed from profitable conquest to a grim defense … The Roman world was treated to the spectacle of imperial mints annually churning out hundreds of millions of silver-clad antoninaniani by recycling coins but a few years old [which] removed older coins from circulation and destroyed public confidence in imperial moneys.[22]

Characteristic of all monetary collapses, as the denarius rapidly withered into a billon trinket Roman citizens developed odd, if essential, skills – the most noteworthy of which were extracting the thin silver coating from otherwise worthless coins and fluency in the social language of monetary failure: barter.

Epilogue

Comparing modern challenges and policy responses to those of remote times is an attractive but precarious enterprise: every generation, let alone culture and era, breathes a unique psychological oxygen. Nevertheless, in this case the exercise yields several potentially valuable insights.

First, what can we say about the reformers? Why did select figures, in an era admitting no formal economic theories and within which the interaction of supply and demand was attributed to superstitious causes or conspiracies, occasionally shore up their currency?

It is notable that all of the reform-minded emperors possessed germane backgrounds and experience: where the majority of Roman emperors had pre-ascension careers in politics or the military, Domitian grew up in a family known for banking; and despite the inglorious end of his incumbency (when maintaining power came to trump sense and experience) his initial

concern with finance, with a stable currency, and an awareness of reciprocity in business and trade dealings as demonstrated in instruments such as his Vine Edict, reflect his continuation of a tradition of financial sensibility, more in keeping with a business house, than with the traditions of [elites] valued by Senators and expected of Emperors.[23]

Most fascinatingly,

[w]hile still a Caesar, Domitian had published a work on coinage … which Pliny the Elder … had cited as a source.[24]

Macrinus was the first non-senatorial emperor, and had years of both financial training and experience; he served as the administrator of the massive Flaminian Road project. Later in his pre-political career, he was personally selected to manage the personal wealth of the imperial family under the emperors Caracalla and Geta. Pertinax had spent years in business as well as teaching, and his time as a merchant led him to the belief that “[e]conomy and industry … [were] the pure and genuine sources of wealth”[25]

Alexander Severus became emperor at 13. It is difficult to hypothesize as to what may have led him to enhance the denarii – and so strongly – but one may speculate that his closest advisors, his mother and grandmother, drew from years of experience in Roman booms and busts.

One also notes that each of the reformers came after particularly egregious debasers: Domitian after Vespasian and Titus; Pertinax after Commodus; Macrinus after Caracalla; and Severus Alexander after Elagabalus. It seems as if each deduced the connection between his predecessor’s profligate monetary (and, indeed, fiscal) policies and the consequent economic crisis, choosing to reverse the afflux.

Summarizing Macrinus’ efforts, but no doubt broadly applicable, is this synopsis:

The exact motivation … for coinage reform [efforts in the Roman Empire] is in general a little hazy … attempts at reforming the coinage standards could reflect the distrust that the … population had for the imperial currency … [a]nother possibility is that [the reformers] wanted to fit into a monetary tradition that was considered responsible … [or] felt a desire to distance themsel[ves] from the policies of [their] predecessor[s] … [as many] were a simple overturning of [prior emperors] destructive economic measures.[26]

In consummation, were these episodes in qualitative tightening successful? Obviously, brief respites in the systematic debasement of the denarius delayed the eventual, yet perhaps inevitable, monetary emergency. More analytically, though, one hint lies in the architectural analysis of lost, donated, and hoarded coins, in that

coins lost casually on sites are equivalent to small change lost today [in that] more were lost as their numbers mounted and purchasing value plunged due to debasements … [C]asual losses and hoards, then, can document shifts in patterns of circulation both within and beyond imperial frontiers.[27]

The number and constitution of coin hoards reveal the public propensity to forestall consumption (“saving”, in familiar parlance) or represent financial reserves hidden out of fear of future devaluations; in any event, they imply which coins were highly valued. Patterns of similar coins lost or donated, oppositely, suggest which in circulation were valued appreciably less. While both Pertinax and Macrinus ruled briefly, and their programs were quickly reversed by their successors, under both Domitian and Severus Alexander (who ruled for 15 and 13 years, respectively) the number of discovered, archeologically-dated coin hoards skyrocketed over those dated to their immediate predecessors: from 3 to 10 and 7 to 18; again, respectively. Similarly, coins of reduced quality are found with higher frequency at ritual offering sites (e.g., temples) and where losses were common (e.g., river crossing sites) than those of contemporary circulating issues with higher purity.[28]

But the most forbidding commonality is the thread of continuity running through the fates of the monetary reformers:

Emperors who improved the purity of the denarius, [notably] Pertinax in 193 [and] Macrinus in 217 … found themselves outbid for the loyalties of the army, and … went down in ignominious defeat.[29]

And so we return to the present day. Owing to the deep entrenchment of government in daily life and, consequently, the politically incendiary nature of entitlements, attempts to underpin the value of any currency with a commodity is likely to be met with considerable resistance from the diffuse and deep-seated institutions and social groups benefitting from fiat currency systems. And yet, for the first time in well over a century, the issue of what actually backs state-issued money has resurfaced as a political issue. Precious metals are seeing their greatest popular resurgence in decades, as, in tandem, interest in and usage of Bitcoin and other cryptocurrencies - precisely because of their irreproducibility and the consequent quantitative limitations - expands rapidly. This, perhaps, hints at a burgeoning shift in public awareness and sentiment, which may eventually translate to political pressure for a return to sound money, but real progress will likely be an uphill battle - with bouts of ‘sticker shock’ along the way. As historian William Warren Carlise wrote,

[a]ll through history we find that it is the reform, the return to sound money rather than the depreciation itself that first rouses popular discontent. It is only when the mass of the people learns that depreciations must be followed sooner or later by such remedies that they begin to entertain a salutary dread with regard to them.[30]

Perhaps the best conclusion that can be drawn from examining these instances is that in response to the familiar rhetorical query – “Are we going the way of the Romans?” – one can reply, truthfully: “No; they occasionally reformed their currency.”

Endnotes

[1] http://domitian-economicemperor.blogspot.com/2011/01/domitian-emperor-in-broader-economic.html

[2] Brian W. Jones, The Emperor Domitian (London: Routledge, 1992), 76.

[3] Kenneth W. Harl, Coinage in the Roman Economy, 300 B.C. to A.D. 700 (Baltimore: The John Hopkins Press, 1996), 14.

[4] Ibid.

[5] Jones, 77.

[6] Susan P. Mattern, Rome and the Enemy: Imperial Strategy in the Principate (Los Angeles: University of California Press), 141.

[7] http://domitian-economicemperor.blogspot.com/2011/01/domitian-emperor-in-broader-economic.html

[8] Edward Gibbon, Esq. The History of the Decline and Fall of the Roman Empire, Vol. I (London: W. Strahan, 1776), 101

[9] John Platts, A New Universal Biography … of Eminent Persons (London: Sherwood, Gilbert and Piper, 1826), 122.

[10] Mattern, 140 – 141.

[11] Gibbon, 102.

[12] Gibbon, 103.

[13] Platts, 122.

[14] Gibbon, 139.

[15] Andrew Scott, “Change and Discontinuity within the Severus Dynasty: The Case of Macrinus”, a dissertation submitted to the Graduate School-New Brunswick, Rutgers, The State University of New Jersey, in partial fulfillment of the requirements for the degree of Doctor of Philosophy, Graduate Program in Classics, May 2008, 133.

[16] Henry Jewell Bassett, Macrinus and Diadumenian (Menasha: George Banta Publishing Co., 1920), 33.

[17] Scott, 135.

[18] Martijn Icks, The Crimes of Elagabalus: The Life and Legacy of Rome’s Decadent Boy Emperor (London: I. B. Taurus & Co, 2011), 115.

[19] R. V. Nind Hopkins, The Life of Alexander Severus (Cambridge: University Press, 1907), 182.

[20] Harl, 128.

[21] Hopkins, 154.

[22] Harl, 132.

[23] http://domitian-economicemperor.blogspot.com/2011/01/domitian-emperor-in-broader-economic.html

[24] Ibid.

[25] Gibbon, 102 – 103.

[26] Scott, 129 -133.

[27] Harl, 17 – 20.

[28] Richard Duncan-Jones, Money and Government in the Roman Empire (Cambridge: Cambridge University Press, 1994), 107.

[29] Harl, 126 – 127.

[30] William Warrand Carlile, The Evolution of Modern Money (London: Macmillan and Co.), 100.

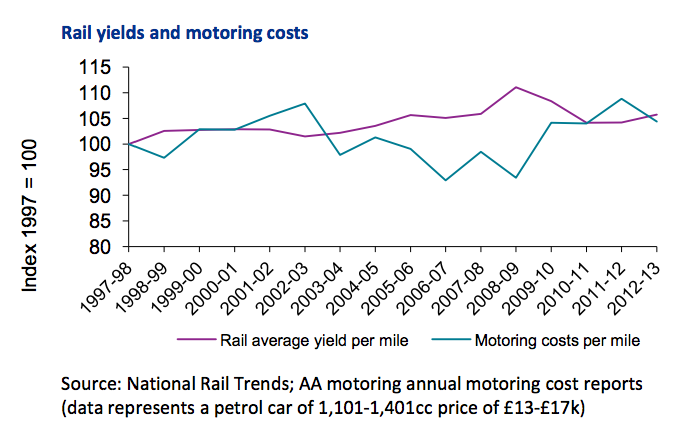

What would we consider a successful railway system?

Under many measures, the railways have performed remarkably since privatisation. It is not surprising that the British public would nevertheless like to renationalise them, given how ignorant we know they are, but it's at least slightly surprising that large sections of the intelligentsia seem to agree.

Last year I wrote a very short piece on the issue, pointing out the basic facts: the UK has had two eras of private railways, both extremely successful, and a long period of extremely unsuccessful state control. Franchising probably isn't the ideal way of running the rail system privately, but it seems like even a relatively bad private system outperforms the state.

Short history: approximately free market in rail until 1913, built mainly with private capital. Government control/direction during the war. Government decides the railways aren't making enough profit in 1923 and reorganises them into bigger regional monopolies. These aren't very successful (in a very difficult macro environment) so it nationalises them—along with everything else—in the late 1940s.

By the 1960s the government runs railways into the ground to the point it essentially needs to destroy or mothball half the network. Government re-privatises the railways in 1995—at this point passenger journeys have reached half the level they were at in 1913. Within 15 years they've made back the ground lost in the previous eighty.

But maybe it's not privatisation that led to this growth. Let's consider some alternative hypotheses:

Was it a big rise in the cost of driving?

Was it the big rise in GDP over the period that did it?

Was it just something that was happening around the developed world?

Was it purely down to extra cash injections from the state?

Has it come at the expense of safety?

Has it come at the expense of customer satisfaction?

Has it come at the expense of freight?

Is it all driven by London?

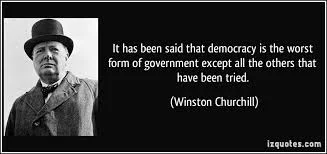

Democracy's not all it's cracked up to be you know

As Churchill pointed out democracy does have something going for it, that it's better than all other methods anyone's ever tried. But that doesn't mean that it's perfect, not by a long shot. And interestingly we've that nice Owen Jones making the point for us:

The Aids crisis was building; more than half the population believed homosexuality was “always wrong”, peaking at 64% in 1987 when just 11% opted for “not wrong at all”; and later that decade the homophobic legislation, section 28, was introduced.

Meaning that under the pure rules of democracy that Section 28 legislation was entirely justified. Indeed, it should have been introduced as it was obviously the majority view of the people. All of which is a problem with democracy: for there are quite obviously times when that will of the majority conflicts with the civil liberties of various minorities. Meaning that we have to decide which we are going to regard as more important, those civil liberties or that will of the majority.

Those times that we have to decide coming in a variety of flavours. We could most certainly gain a majority for the idea that we should string the paedos up without much of a trial. There's actually a substantial campaign to insist that legal protections for accused rapists should be weakened, even to the point (not in the UK thankfully, not yet, but in the Antipodes) that the presumption of innocence should be dropped. Here at home we have a campaign to insist that prostitution among consenting adults must be made illegal: quite clearly a violation of that right to ownership of ones' own body and the income therefrom. And there's been campaigns against the rights of property ownership for most of the past century. A subset of which today is the idea that the shareholders in a company may not decide how much they wish to pay the managers in their own employ (in the name of "equaliteeee" of course).

And the campaign against the arbitration part of the Transatlantic Trade and Investment Partnership is exactly a complaint that that treaty would insist that governments must obey the law of the land over and above whatever democracy demands as changes.

Jones has provided us there with a useful example of when those civil liberties are more important than whatever it is that the mob thinks. We should remind him of this point when he next, or his ilk, suggests taking away our economic liberties. Just because the Demos can be whipped into howling for it does not make a policy one we should enact.