Unaffordable housing, extortionate childcare costs, high-tax for substandard public services, an increasingly less competitive private sector, and other ailments, seem to have *at the least* worked against further poverty alleviation in the UK.

It seems that there isn’t one single silver bullet here when it comes to growth. But I’ll try and single out some of the more focussed options from here on out. I’m sorry that this first policy on the list could effectively be hundreds of separate ones. I promise the rest of the list isn’t like this…

2) Take the Poorest out of Tax

The UK’s ‘Personal Allowance’ means you can earn up to £12,570 before you are subject to any tax. But I think this personal allowance amount should be higher. As does the Adam Smith Institute, who thinks the specific amount should be pegged to the National Minimum Wage rate, at least. If this was the case,

‘the personal allowance should now be £17,374.50 a year, the equivalent of 37.5 hours a week on the minimum wage of £8.91. Instead, it has remained frozen for the last 10 years. For the average 18-29 year old, we calculate an annual saving of £250 if both income and NI thresholds were indexed by inflation.’ (2022, pg.15)

This would mean those earning the least would have more money in their pocket. I also err on the side of not wanting taxation falling on the poorest in society.

3) Trillion-Dollar Bills on the Sidewalks

We should liberalise immigration. If I’m right, the gains would create so much value that American Economist, Michael Clemens, imagines that it would be like having trillion dollar bills on the sidewalks… sound appealing?

‘The gains to eliminating migration barriers amount to large fractions of world GDP—one or two orders of magnitude larger than the gains from dropping all remaining restrictions on international flows of goods and capital.’ (2011, pg. 83/84)

But won’t this just mean the poorest in our society will face fiercer competition for lower paying jobs? Clemens thinks not:

‘If [...] human capital externalities are real and large [...] it is possible that the depletion of human capital stock via emigration inflicts negative externalities on nonmigrants. However, these externalities have proven difficult to observe [...] and their use to justify policy remains shaky.’ (2011, pg. 90)

4) Housing Reform

Some useful reforms here:

Implement Flexible Right to Buy à la my last blog.

Let residents in each street vote to allow existing houses to be extended upwards or outwards.

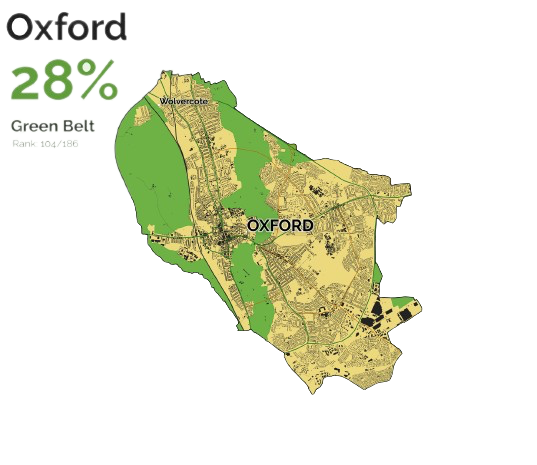

Allow development on small areas of the green belt within walking distance of train stations, whilst preserving areas of exceptional beauty.

Liberalise a range of design regulations.

Legalise subletting for social tenants to make better use of existing social housing stock.

The Housing Crisis might just be the single most damaging and far-reaching ailment the UK is suffering with. But how does this help those in poverty?

First-order effects include: an inability to even *think* about getting on the housing ladder as someone in poverty; means those in poverty who might be more economically productive elsewhere cannot live there due to high housing costs.

Second-order effects include: less affordable housing means social housing is more likely to be at capacity usage, meaning those in poverty will wait longer for better housing arrangements; a stronger housing sector means a stronger economy which in turn could increase the opportunities available to those in poverty.

5) Phase in a Negative Income Tax or Basic Income

There is a sizeable literature which believes that just *giving* money to people in poverty might be the most helpful solution to their situation. Those in poverty are so because they lack cash. Yes, other factors are at play, such as mental health and familial wealth. But the primary issue here is that they don’t have enough cash.

A Basic Income (BI) is a payment sent to every citizen (above a certain age, as usually construed) unconditionally - regardless of their wealth. Usually (except for some tougher cases) people in poverty are there because they lack the cash needed to live comfortably and buy their essentials. A BI would seemingly remedy this. Although of course there are questions of how you give those in extreme poverty the cash when most don’t have their own bank accounts.

A Negative Income Tax is, as per Nikhil Woodruff of the PolicyEngine who wrote for us on the topic last week,

‘[…] a very broadly-defined concept with a simple proposition: income tax should start below zero, representing a transfer from the government to the taxpayer.’

‘'When it comes to work incentives, the negative income tax diverges from a policy often described in the same breath: a universal basic income, which provides an unconditional equal cash payment to every person. While a NIT and UBI might sound like the same thing, a UBI doesn’t include any kind of clawback […]'.’

‘This kind of radical egalitarianism necessitates equal treatment of an entire population [combined with] the values of equality and fairness with its most practical implementation: if we share those values, so should we.’

Final thoughts:

Poverty reduction across the World and in the UK has come far and market reforms have lifted hundreds of millions out of poverty.

There is still more for the UK and other countries in the World to do to lift those last people out of poverty-stricken misery.

Effective policy can prove a potent weapon in this task.