How does increasing trade barriers reduce food prices?

A landmark deal clinched between the UK and EU to remove checks on food exports will add £9bn to the UK economy and lower food prices, No 10 has said, as the last-minute agreement was secured early on Monday morning.

How to denannify the state

An incoming UK government that aims to reduce the nanny state of excessive government intervention in personal choices might pursue reforms in several key areas to roll it back.

How very dare trade make us better off!

China is set to flood Britain with cheap vapes, researchers have said, as manufacturers seek to capitalise on the world’s second biggest market after Donald Trump’s tariffs.

The Treasury mindset

There are strong arguments to suggest that the UK Treasury is too focused on maximizing tax revenues at the expense of broader goals such as economic growth, living standards, and fairness.

Bureaucracy gone mad we tell ‘ee

An underlying and fundamental part of our analysis of what has gone wrong with this sceptered isle is that we simply have too much bureaucracy.

So, where’s the beef here?

Waitrose has ruled out buying American beef and chicken as it insisted it would stand “shoulder-to-shoulder with our farmers” after Sir Keir Starmer’s US trade deal.

Regulation has its own Laffer Curve

That is, it’s possible to regulate something so much that the protections aimed at disappear.

After the Rose Garden 6 - Foreign policy

This week’s post takes foreign policy as first serving the people of the UK, then our friends, then the rest of the world. Once this was known as “realism”.

The latest environmental demand - don’t trade with poor people

We do - no really, we do - wonder what goes through minds like these: UK urged not to exploit poor countries in rush for critical minerals

Why tax the poorest?

There is a strong case for proposing that those living on the basic UK State Pension or the National Minimum Wage should be exempt from income tax and National Insurance contributions (NICs).

It’s not obvious that nationalisation would solve water shortages

We await the usual insistences as a result of this story: Thames Water refuses to rule out a hosepipe ban as drought looms.

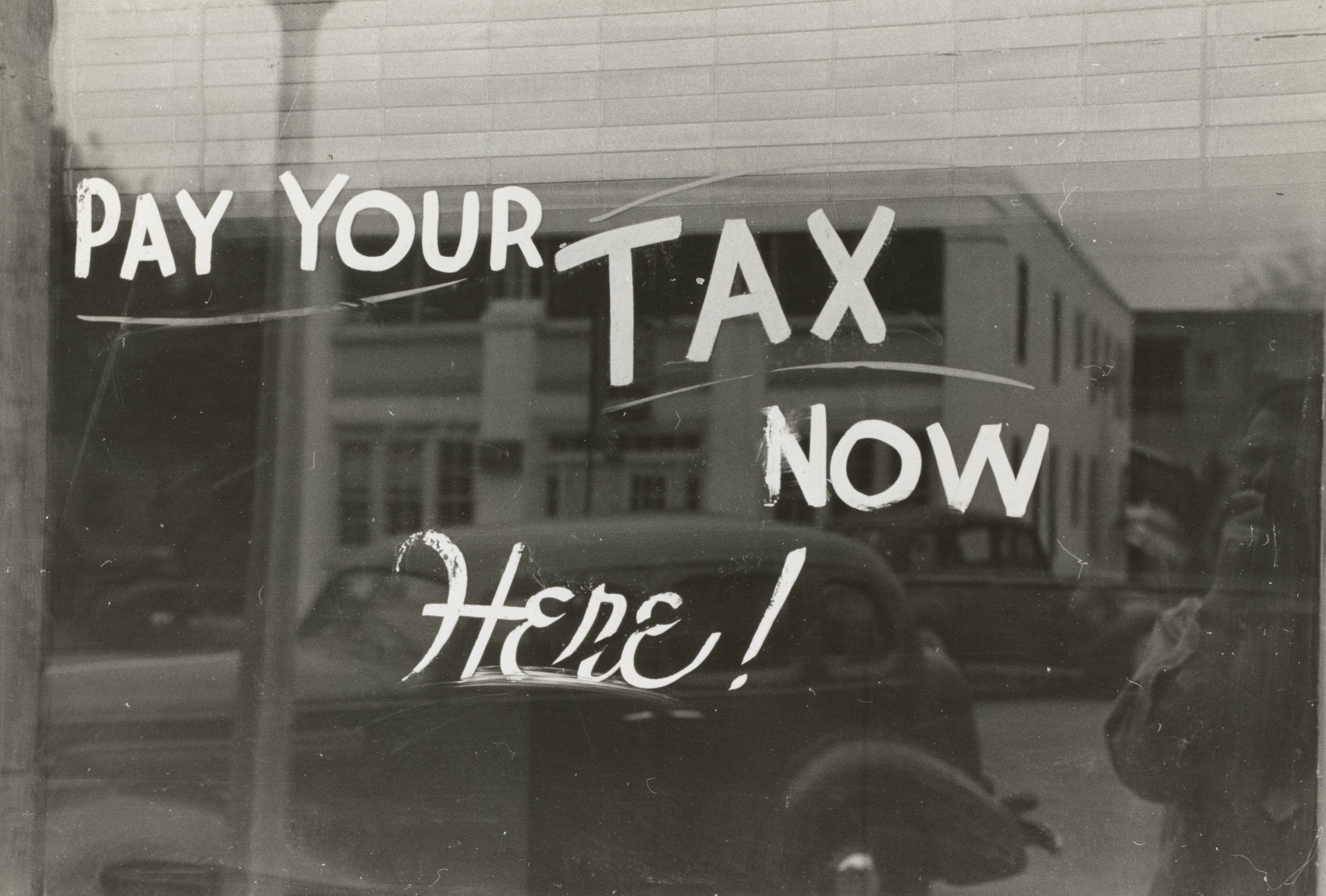

Taxation is theft, of course

Taxation is collected under the threat of punishment such as fines, asset seizure, or imprisonment, making it non-consensual.