The Observer might have got the wrong end of the stick

Tomorrow’s Observer front page claims that “Rightwing thinktanks call time on austerity era”. The piece says that the Adam Smith Institute, among others, have “endorsed public spending increases to confront the coronavirus outbreak and state-funded investment to boost the recovery”.

On the former point, this is totally unremarkable. There is a role for temporary state spending during the emergency stages of a pandemic. We have repeatedly said that the furlough scheme and business loans are sensible policies to maintain as much productive capacity as possible while swathes of the economy are closed. In a call with the Observer I explained that all this spending is possible today because of the responsible reduction in public deficit spending over the last decade. For some reason this did not make it into the article.

On the latter point about infrastructure spending, this is an absurd misrepresentation of my position and at no point does the story quote me supporting infrastructure spending. In fact, I made the point to the journalist in question that state-spending tends to be directed towards politically favoured projects rather than what is economically beneficial. That’s why my colleague, Matt Kilcoyne, repeated our opposition to the wasteful white elephant HS2 project in April.

The article also quotes me backing the Bank of England’s loose monetary policy and “temporary and short-term” support for Government borrowing. This is sensible during the crisis. But, as I made clear to the Observer, the Government extending their overdraft with the Bank of England, which they intend to repay by the end of the year, is not a long term solution. The Bank cannot, and knows it cannot, fund state spending indefinitely. It would be extremely inflationary if continued. There is still no magic money tree.

This has been an extremely busy time for the ASI. We have been mentioned in the media thousands of times, released four major and timely reports, and written dozens of opinion pieces. We have pointed out the colossal extent of state failure during this crisis, especially when it comes to Public Health England’s catastrophic approach to testing, the excessive focus on ‘protecting the NHS’, and how centralised PPE procurement has been problematic.

We have also been fervent advocates for a plan to reopen the economy when it is safe to do so (even reported in The Guardian). We have also released polling that found three-quarters of respondents (72%) think that the Government should reduce taxes after the lockdown to try to increase economic growth and jobs. We have also been part of debates about privacy and contact tracing, freedom of speech, and much much more.

Over the coming weeks and months we will have a huge challenge on our hands to reboot the economy. The ASI have been and always will be emphatic supporters of entrepreneurialism, reducing taxes and regulatory barriers to businesses large and small. The Observer buries the lead in the final sentence of their article:

The four thinktanks continue to believe the Treasury should examine tax-cutting measures to promote innovation and entrepreneurial activity, saying that over the longer term, Whitehall was poor at allocating funds to the economy in the most effective way.

We will have much more to say on this topic in the coming week. Don't you worry, we'll be setting the record straight.

The furlough scheme has a cost and must come to an end eventually

Like other countries, the UK is subsidising jobs during the virus crisis. Now, the Treasury is finding that it’s much easier to give money away than to stop giving it away. But that needs to happen, and fast.

One reason is cost. The government’s interventions may end up costing a third of the national income. That means higher taxes—which will choke off job-creation and recovery—or cuts in public service spending, or a massive rise in public debt.

Another is that the scheme promotes inactivity. We have fruit and vegetables waiting to be picked but seasonal workers can’t get here to pick them. Yet we have 10m domestic workers being paid to do nothing.

The scheme also prevents businesses adapting to the crisis situation. Sure, we’ve seen restaurants turning into takeaways, and taxi drivers running deliveries. But rather than developing new ways of working, some 900,000 businesses have simply taken the money and sent their workers home at taxpayers’ expense.

After this crisis, our economy will look very different. Jobs in travel, hospitality and retail may be gone forever. It would be far better to let businesses and workers adjust to that reality now, than to keep them idle for six months, only to discover that their jobs have gone anyway.

This all seems slightly pettifogging

It is indeed true that the rule of law is important. And yet quite how that rule should be enforced can be muttered about. Possibly not this way:

The British government has been ordered to pay the European commission’s legal costs after being successfully sued for granting City traders a tax break without EU permission.

The European court of justice ruled that the UK breached an EU directive by failing to notify Brussels of a zero rate of VAT given to commodities traders over the last four decades.

The UK is now expected by Brussels to seek the authorisation of the 27 member states or drop the policy, which it is claimed has unfairly boosted the City of London at the expense of other EU financial centres.

To give a rough background. When the UK joined the EU certain - 11 of them - commodities exchanges were able to trade derivatives without VAT being charged upon the transactions. Over the decades since then new exchanges have opened, new contracts are traded, should they be charged VAT, those transactions upon and in them, or not?

The EU says, well, permission is needed.

The court’s judges, led by a French jurist, Jean-Claude Bonichot, agreed with the commission that the lack of notification did amount to a breach of the EU’s directives. The court added that the judgment held no sway on whether authorisation should be given if it was sought.

Note what this isn’t about, whether VAT should righteously be charged or not. It’s about whether permission was asked.

The English, fueled by the Common Law, approach is, well, commodity futures are unVATed, these are commodities futures, what’s the problem? The EU legal system demands that permission. That is, largely the difference between a legal system that works on basic structures and compares like with like to equalise the law over similars and one that depends upon official documentation from the centre, the bureaucracy, to operate.

We can’t help but think that a legal system trying to cover 450 million people using that second approach is going to end up being overly pettifogging.

Paying for the COVID-19 lockdown

Imagine if you were handed a bill amounting to a quarter or even a third of your annual income. You’d think: ‘How on earth can I pay that?’

Well, that’s the bill the government faces for the cost of its crisis measures, such as the Job Protection Scheme. And they are asking the same question.

The first possibility is to raise taxes. That’s popular with the Left , who imagine that ‘the rich’ will pay most. But tax is paid by ordinary people when they earn or spend. ‘The rich’ simply aren’t numerous enough to make much difference. Meanwhile, the higher taxes will discourage people from creating the new jobs we will need after this is all over.

The second possibility is public spending cuts. Well, I’d love to see bureaucracies and prestige projects being cut back. But again, the biggest spending items by far are healthcare, pensions, welfare and education. That’s what would suffer most.

No, it needs to be borrowing that takes the strain. I usually oppose government borrowing because politicians use it to promise us goodies and pass the bill to future generations. But in World War II we borrowed heavily to defeat Hitler, and it makes sense in this crisis to borrow—much less—to defeat this hidden killer.

Is Behavioural Science a science at all?

Clearly the understanding of how we react to stimuli presented by governments, marketers and others trying to change our behaviour, is important.

Prime Ministers like to make out that they govern objectively and according to balanced assessment of evidence, or rather as is now common parlance: “guided by the science”. Advertising agencies likewise use research to sell campaigns to their clients but they recognise advertising is a craft, not a science. Some techniques work better than others and experience shows how modest ideas can be crafted into great campaigns. Governing and advertising may borrow terms from science but that is just part of their persuasion, sugar-coating the pill.

In both cases “behavioural ‘science’” is a favourite. But just what is behavioural science? The Encyclopaedia Britannica says:

“Behavioural science [is] any of various disciplines dealing with the subject of human actions, usually including the fields of sociology, social and cultural anthropology, psychology, and behavioral aspects of biology, economics, geography, law, psychiatry, and political science.”

And that excludes business studies, notably marketing and advertising. BS, as it is otherwise known, is offered in courses at some 22 English universities. Not a single Russell Group university offers it though. Almost all universities offer social science degrees of some kind, such as PPE at Oxford, and those taking them have been alleged to have better job prospects: “Some 84.2% of social science graduates were employed three years after graduating, compared with 79% of arts and humanities graduates and 78% of graduates with science degrees.”

“Science” is a collective noun for a large number of academic disciplines which share a standard methodology:

Conjecture/theory -> experiment -> proof/rejection -> fresh conjecture/theory cycling on.

Different people correctly conducting the same experiments should, if it is a true science, get the same results. One essay considering whether sociology should be considered a science concluded that “controlled scientific experiments cannot be carried out on society and although many of the areas that are studied in sociology, such as human behaviour, are useful when trying to understand society, there are many different view points on each subject and therefore no one conclusion is drawn from every experiment carried out.”

In August 2013, the perhaps biased, but certainly well-informed Barry Ritholtz published ten reasons why economics is an art not a science. Experiments are hard, if not impossible, to conduct, behaviour is inconsistent, and announcing the predictions can affect what actually happens, to name but three. For all the maths and equations, my own view is that, like advertising, economics is neither an art nor a science but a craft – a valuable craft for sure but a craft just the same. Observing what happens is helpful if only to avoid making the same mistakes again. The potter at his wheel does the same. But if you cannot explain why the phenomenon happens, predict what therefore will happen, and conduct an experiment to prove it happened as predicted, it is not science.

Even the most far out and extreme thinking in theoretical physics today, including the likes of 11 dimensional M theory which is untestable right now, is set up so that as technology progresses it can tested and either varified or falsified. That is not true for the components of behavioural science listed above. It is not “a science” or even a collection of many sciences.

The uncomfortable truth is that practitioners add the word “science” to their chosen way of thinking to posh it up — “domestic science” sounds far more prestigious than its previous title, “household skills”, for example. So it is that when government claims it is guided by “the science”, it is merely poshing up whatever course of action it intends to take. Dig deeper and you will find claims that behavioural science is being employed and proves the rightness of the policies being deployed.

Be not fooled: it is not science but it is propaganda for the government’s chosen course. It is an appeal to authority. Like any form of advertising, the propaganda may have been tested to see what changes our behaviour more effectively and that may well be good for us and the country as a whole but it is a rhetorical device just the same.

The potter spins his wheel and the politician spins his message but they are craftspeople, not scientists.

Yes, this is what a fall in GDP means

There’s a distressing lack of knowledge concerning reality on display here:

Councils in England fear they will have to make budget cuts of 20% and face a social care funding shortfall of £3.5bn due to the coronavirus pandemic.

Labour claims local authorities are facing a £10bn black hole as they encounter spiralling costs while revenue streams such as parking charges dry up amid the lockdown.

Cuts of up to 21% could be needed to balance the books, according to the analysis by Labour, seen by the Guardian.

This is just what a fall in GDP means. Forget money for the moment, that’s just vouchers showing who gets what. The important thing is the underlying what there is for people to get. That’s what GDP is, the value added, the value produced, within an economy. That has fallen by 5 or 6% just in March and the likelihood is that our April figures, when they arrive, will show a fall of 20 to 30%.

There is, at that rough guess, some 20% less of everything to be had. Therefore everything gets cut by 20%. This is as true of social care as it is of haircuts, beer and motor cars. There are simply less of all those things around - everyone can therefore have fewer of them. This is just what it means to have a fall in GDP.

Of course, there is an answer, open up the economy again, spiced with lot more of that capitalist free marketry red in tooth and claw, and watch GDP bounce back. At which point, and only at that point, will we have the resources to have the level of social care that we used to have. Or the number of haircuts, beer and motor cars. For it is by definition true that richer places can have more of all those things and we are currently poorer, therefore we can have fewer.

Once again we find ourselves agreeing with George Monbiot

It really is appalling the level of education these days. People just don’t seem to get the most basic - and most important - things about the world we live in. Of course, we do slightly differ over what it is that people are ignorant about:

The issues about which most people live in ignorance are, by contrast, matters of life and death.

I don’t blame anyone for not knowing. This is a collective failure: a crashing lapse in education, that is designed for a world in which we no longer live. The way we are taught misleads us about who we are and where we stand.

We agree so far. Monbiot then goes on to tell us that economics is wrong and ecology is where it’s at. Something that would carry more weight as a critique if his knowledge of economics included a little more finesse. Or even knowledge:

In mainstream economics, for example, humankind is at the centre of the universe, and the constraints of the natural world are either invisible or marginal to the models.

The entire subject starts with the observation that human beings want lots of things but we happen to be in a universe of scarce resources with which to sate them. That concept of scarcity is central to the entire intellectual edifice. In fact, items for which there is no scarcity are non-economic goods. Quite how the very subject that studies the allocation of scarce goods is not cognisant of resource constraints is difficult to understand.

In an age in which we urgently need to cooperate, we are educated for individual success in competition with others.

We are only solely in competition with others for things which are in fixed supply. Where we cooperate we manage to increase supply. This is one of the arguments in favour of economic growth - we cooperate, increase supply and so are not trapped in a zero sum competition.

Large numbers of people now reject this approach to learning – and to life. A survey reported this week suggests that six out of 10 people in the UK want the government to prioritise health and wellbeing ahead of growth when we emerge from the pandemic. This is one of the most hopeful results I have seen in years.

If only those basic concepts of economics were understood. The assumption is that humans desire to, strive to, maximise their utility. This includes such concepts as health and the limited meaning of wellbeing used by Monbiot. It is also that larger sense of wellbeing - whatever it is that the individual concerned thinks maximises their wellbeing in this world of constrained and scarce resources to apply to that wellbeing.

This is the time for a Great Reset.

Which is where we come back to agreeing with Monbiot. Yes, let us have that great reset. We could start by in insisting those advocating a change in the economy, in the teaching of economics, gain a clue concerning the subject under discussion. Wouldn’t that be a nice change, a nice place to start the conversation - dealing only with these who already grasped the basics?

Just one of those damned things about people

We have to admit that we thought this amusing:

For the French capital and the rest of the country, it was a case of “back to abnormal” as thousands of shops, businesses and schools re-opened after two months of lockdown; but things were not quite as they once were.

Paris transport authorities had insisted social distancing would be respected but outages overnight leading to a 40-minute delay made a mockery of stickers on the floor supposed to keep passengers safely apart.

“It’s a catastrophe,” said one commuter. “The trains are totally packed without respecting the measures our leaders decreed. I should have known it.”

How nicely that plays to every English prejudice about the French, excitable Latins who won’t do what they’re told etc.

Except, of course, it’s not actually about the French at all, nor even Latins, excitable or not. It’s about people. For one of those great truths about us human beings is that we’ll do what seems best to us at the time and in the circumstances. What we’ve been told to do comes rather a distant second to this self-calculation of our own interests.

This always coming as a surprise to those who would plan society, people just don’t do as they’re told. Or, more accurately, the telling will only succeed when what is forced upon people is what they already agree is concordant with that self-calculation of own interest.

The implication of this should be obvious. It’s not possible to produce that planned society in any detail. It is possible to set fairly broad outlines - don’t murder and if we do we’ll get you - but anything at the level of don’t put paper in with the plastics recycling is doomed to failure. Therefore, if we want a set of rules that work - in the sense of their being obeyed and thus reaching the desired outcome - we can only have rules that everyone largely agrees with already.

Sure we can have the planned society, the rigid rules for the economy. Only not very many of them and only reinforcing what everyone does already.

Central purchasing and PPE in the time of coronavirus

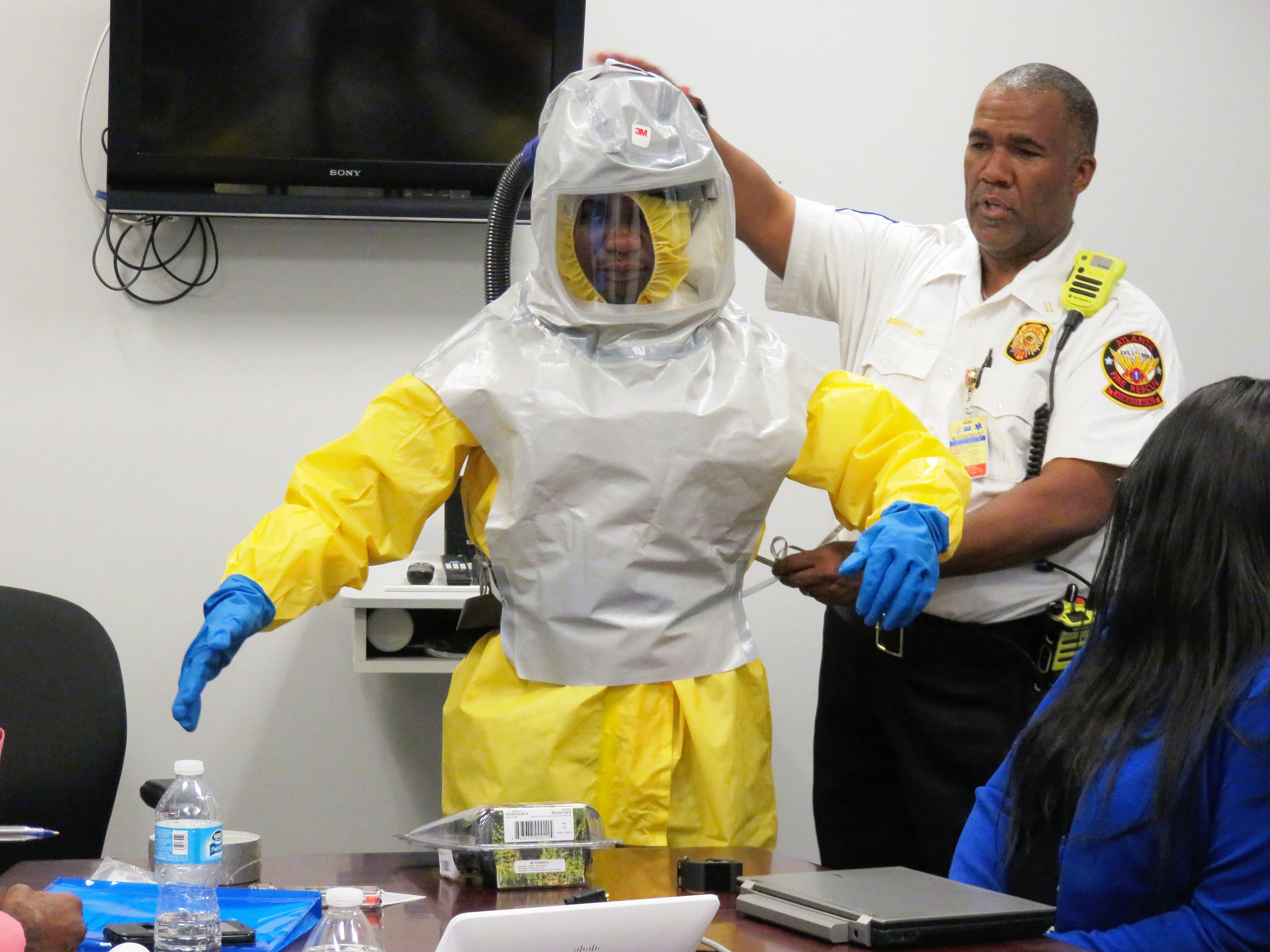

We’re in The Times talking about the purchasing of PPE in these troubled days:

Given official intransigence, it is Edmund Burke’s little platoons who save the day. The website PPE Exchange has been cobbled together by the publicly minded, as distinct from the publicly employed, and does just what it says on the tin: it is an exchange for these necessaries, and one that claims to have two billion pieces of equipment available at time of writing.

The correct governmental solution to many problems is less of it, not more. Who knows, trusting the people might even catch on as an idea.

An argument against our preferred decentralised preference turns up in the comments. Not to particularly pick on this individual for it’s an idea we’ve seen in many another place:

In the USA states and federal government are getting played against each other in bidding wars instead of negotiating at scale.

Well, yes, but that’s rather the point. We not just want but should actively insist that the various people desirous of the thing be played against each other. This is what a market means.

At any one moment in time of course there is only some - unknown but fixed - amount of PPE in the world. If that moment were to last forever then the monopsonist buyer argument might have a point. But that moment is as long as it takes to retask a seamstress. Or, if you prefer, a plastic cutting machine, repurpose the output of an ethylene plant, pick your own example.

We have a rise in the demand for these varied things that we call personal protective equipment. None of them are hugely difficult to produce, an increase in production does not require the building of a new factory. The necessity is the repurposing of already extant trained labour, fairly low tech machinery, commonplace enough raw materials and a certain gumption and energy to make it all happen.

We’d also like people to be pondering whether they do truly need it. Perhaps the supermarket checkout can manage with a plastic visor to show willing, while a nurse on a ward requires full facial covering, possibly even a clean air supply. Who knows, who among us out here knows that is? This is something those directly involved will know better than anyone else.

So, how do we call into existence these two desirable behaviours? A consideration of what is to be used by whom and a scramble to produce more to be used by all?

We change the price. At which point it all happens as if by magic - any sufficiently advanced technology is indistinguishable from magic and the price system combined with markets is a technology, most advanced and thus indistinguishable from magic. We most certainly, from the above example, get all too many people asking “Well, how does that work then?”

The point being that it does. Further, it’s the only technology we’ve got that does.

We wish to increase the supply of PPE in this time of coronavirus. Would be purchasers of PPE being played against each other in bidding wars is not a problem, not something to be avoided, it’s the point, for it is the solution. Both supply and demand being elastic with respect to price, d’ye see?

If you’d prefer the “Shazzam!” explanation, the idea that there really is a wizard, then don’t look behind the curtain, it works all the same.

Business angels to the rescue

HM government has introduced substantial loan schemes to reinvigorate the private sector post-lockdown: the big banks lend the money and the government, to some extent, guarantees repayment. One of the lessons of the last crash is that banks tend to demand repayment when it suits them, not the borrowers. The days of the friendly, open-door, local bank manager are long gone. Today we have centralised, tick-box systems looking for reasons to say “no”. The Chancellor had to coerce the banks to make the loans he was guaranteeing.

In any case, such loans are intrinsically short term. It can be much better for well heeled-companies and individuals to take equity interests in reviving businesses. Cash is only part of the medicine; general support, experience and encouragement can be even more important. Most of all: long-term shared interest. Venture capitalists, to some extent, meet these needs but most businesses find the City’s ramparts too steep to climb.

The government offers four venture capital support schemes:

The Enterprise Investment Scheme (EIS), maximum investment £12M;

The Seed Enterprise Investment Scheme (SEIS), maximum investment £150K;

Social Investment Tax Relief (SITR), maximum investment £1.5M;

Venture capital trust (VCT), maximum investment £12M.

The EIS was set up in 1994 and George Osborne, then Chancellor, added the SEIS for small start-ups in 2012. SITR was created in 2014; four years later, just 63 deals had been done. VCTs are a form of investment trust for City merchants with two levels of tax incentive: initial investments and subsequent share trading. The amounts raised by VCTs have grown slowly to £743M in 2018/19 and, though a helpful device, it is not relevant here. All four schemes offer financial support to small and medium sized companies and social enterprises significant tax advantages to the investor: e.g.

Income tax relief of 30% of investment;

No capital gains tax on profits (if held for defined period);

Investment losses can be offset against income tax;

No inheritance tax on shares.

But like anything administered by HMRC, the schemes are complex and bureaucratic. Many trades are excluded presumably because they are deemed unworthy of public support – residential care homes being a topical example. And having HMRC marriage-broking in the private sector is odd: their skills lie in taking our money, not providing it. True to form their “guidance” on using the schemes boils down to a list of reasons why they should refuse the tax benefits. And HMRC have set up plenty of traps for the unwary.

I am not decrying these schemes, far from it, but tax incentives can only be the jam on the bread. Fundamentally, government needs to lead us out of this Covid economic crisis by bringing together business angels and wealth creators. Only the private sector can do that, not tax inspectors.

Unlike lenders, equity investors are willing to take risk and a flexible time-line. Life will not return to what it was in the past. More will work from home. Meetings will be on Zoom or other web tools. Many will have to retool their business models and each company may need several iterations. Investors can be sympathetic to these needs and, using their own experience, valuably supportive.

In essence, the issue is how to bring private money to bear on rescuing the post-Covid economy. The two main ways are taxation and private investment. Socialists believe in the former but experience shows that government’s wastefulness in collecting money is only rivalled by its wastefulness in spending it. Leadership and tax incentives apart, the less government has to do with the rescue the better.

Leadership is needed in two areas: the array of networks for business angels and businesses seeking funding is bewildering. It is (or was) a free country and those who wish to create networks should be allowed to do so but rising above all the confusion we need just one country-wide marriage broking (so to speak) website which should be sponsored by the government and/or the British Chambers of Commerce as the go-to web source for an angel or an investee seeking a partner. Informal local business hubs should also be encouraged, linked with their local Chambers of Commerce.

Secondly, the EIS, SEIS and SITR incentive schemes should be simplified, broadened and merged. Just one site should explain what each pair of partners in a small business needs to know. Of course, each business may end up with multiple investors but, for simplicity here, I am assuming one will take the leadership role. HMRC has the knowledge and skills to manage the incentive schemes website but they also bring two handicaps: their tendency to bureaucratise, complicate and not answer telephones on the one hand and their reluctance to publicise perfectly legal tax avoidance schemes on the other. A great deal of private money lies fallow waiting to be hit by inheritance taxes when their times come. Reviving the economy demands that these funds are not left mouldering in minimal interest bank accounts but are invested in recovering businesses, using the inheritance tax relief to the benefit of all (except the banks).

Broadening the merged tax incentive scheme means that the permitted trades should be extended to just about anything that is good for the economy or national well-being, care homes for example. Currently preference shares, now banned for no obvious reasons, should be permitted. The partners should be able to agree to any share structure that suits them, though limiting the angel to the current 30% seems sensible. At present the tax schemes focus on start-ups, but post-Covid, reviving long-standing businesses will need as much, perhaps more, support. Maybe adjusting the tax reliefs would be the price but that should be for consultation.

The central facilitator envisaged here is the marriage-broking website. A prototype exists but is limited to SEIS and it lists only the businesses looking for investors. It is part of a group of companies founded by Kate Jackson in 2012; the extent of the site’s usage is unclear. There are three levels of annual fees depending on the extent of the listing.

The publicly- or BCC-owned future website would require some level of funding by users and/or the owner, not so much for operating the website itself (not expensive) as for the publicity needed to kick-start the post-Covid economy. Some levels of anonymity and verification, as for any other dating agency, would be needed. Since dating agencies already have the skills and the technology, why not invite them to tender for the website business leaving the size of the publicity budget for later consultation?

Back in 1993, Michael Heseltine, then President of the Board of Trade, sought to import the German model of bringing investors and businesses together to create wealth. In the event, the civil servants took it over and “Business Link” failed. HMRC was then put in charge with a “national helpline”. No prizes for guessing what happened then. The network of local advisers was disbanded in 2011 leaving some benighted business development officer in each larger local authority to do his or her best. That said, the local development officer can often be the most valuable point of contact for the smallest companies. They know how the system works. Furthermore, local crowd-funding may well be the best solution.

If we are to rescue the post-Covid economy along the lines proposed here, we need a strong leader with no other mission but this.