Boris is right. Tinkering with the presumption of innocence is, unfortunately, a minor change in the law

Boris Johnson has called for a change in the law. He wants to shift the burden of proof on those accused of travelling to Iraq and Syria to join ISIS. No longer will the prosecution be required to prove that they intended to join ISIS. Rather the accused will have to prove that they travelled there for innocent purposes. There has been near universal condemnation of Boris's proposals. The Prime Minister called it a knee-jerk reaction. Nick Clegg was not a big fan either. In addition to rejecting his proposals commentators on both the left and the right have taken issue with Boris's statement that this was a “minor change” in the law. They argued that instead it was an attack on this hallowed principle that is the presumption of innocence. The fact Boris did not realise that was further proof that he is unfit to become Prime Minister.

However, Boris is completely right. Not about the substantive proposal but about the fact it represents a minor change in the law. The fact of the matter is that the presumption of innocence has in the past few decades been severely eroded. In 1935 we were told by the Lord Chancellor Viscount Sankey that “throughout the web of English criminal law one golden thread is always to be seen, that it is the duty of the prosecution to prove the prisoner's guilt” [1]. There were only two exceptions: (i) the defence of insanity and (ii) statutory exceptions.

How often did Parliament by statute make exceptions to this golden thread? Andrew Ashworth and Meredith Blake attempted to find out in 1996 [2]. They look at how many of the offences triable in Crown Courts derogated from the presumption of innocence. It was not 5%, 10% or 20%. Out of 540 offences, 219 involved some form of departure from the presumption of innocence. That's just over 40%! In the Magistrates' Courts the position was hardly better. There, the defendant bears the burden of proving “any exception, exemption, proviso, excuse or qualification” [3]. At this point one can ask whether the exception has swallowed the rule. So Boris was not wrong when he described it as a minor change in the law.

The situation has not really gotten better since 1996. Parliament continues to reverse the burden of proof on a number of offences. In one respect, however, the situation has gotten better. Previously, if Parliament imposed a reverse burden of proof the courts would just have to apply it. However, following the coming into force of the Human Rights Act, the courts have been able to de facto nullify some of those reverse burdens.

For example in R v Lambert [2001] UKHL 37, the House of Lords was considering a provision of the Misuse of Drugs Act which required a defendant found in possession of a package containing drugs to prove that he did not know that it contained drugs. If the defendant failed to discharge that burden he would be found guilty of possession of drugs. The House of Lords held that this was an unjustfied infringement of the presumption of innocence. So, this provision was read as merely requiring the defendant to adduce evidence that he did not know the package contained drugs. The burden would then be on the prosecution to prove beyond reasonable doubt that this evidence was untrue.

Those wanting to repeal the Human Rights Act (and withdrawn from the European Convention on Human Rights), whilst still adhering to the presumption of innocence, should think carefully about that.

In the meantime the outrage sparked by Boris's comments should be directed to adopting the proposal the Criminal Law Revision Committee made in 1972: that there should not be reverse burdens in English criminal law [4].

1 Woolmington v DPP [1935] AC 462 at 481

2 “The Presumption of Innocence in English Criminal Law” [1996] Criminal Law Review 306-317

3 Section 101 Magistrates' Courts Act 1981

4 Criminal Law Revision Committee, Eleventh Report, Evidence (General), Command Paper 4991 of 1972, para 140

Rajiv Shah is a PhD student in Law at the University of Cambridge.

Maybe Karl and Friedrich were right about this Produktionsverhältnisse?

Karl Marx and Friedrich Engels introduced us to the idea of Produktionsverhältnisse, the thought that social relations are determined (or, in a weaker form, influenced by) the methods of production. They did mean it to cover all parts of life too, the way we work, the way we marry, the way we trade and so on. All of which leads to an interest in this:

Women who have several sexual partners before getting married have less happy marriages - but men do no harm by playing the field,a study has found.According to new research by the National Marriage Project, more than half of married women who had only ever slept with their future husband felt highly satisfied in their marriage.

But that percentage dropped to 42 per cent once the woman had had pre-marital sex with at least two partners. It dropped to 22 per cent for those with ten or more partners.

But, for men, the number of partners a man they appeared to have no bearing on how satisfied they felt within a marriage.

Researchers said the study showed that sex with many different partners 'may be risky' if the woman is in search of a high-quality marriage.

It concluded: 'Remember that what you do before you say 'I do' seems to have a notable impact on your marital future. So decide wisely.'

The findings were published in 'Before 'I Do': What Do Premarital Experiences Have to Do with Marital Quality Among Today’s Young Adults?', published at the University of Virginia.

Well, yes, there's more than a modicum of special pleading going on in that. One explanation for it all is that the more experience of men a woman has the more she realises that most aren't very good at this sex thing, leading to possible unhappiness with the Chosen One.

Being less cynical (and possibly less amusing) about it though it is true that one of the great societal changes of the last couple of generations has been the change in attitude towards virginity, pre-marital sex and so on. And that's where Mark and Engels might well have been right: for the technology surrounding reproduction has changed in that time period too.

Time was when the only reliable method of knowing that a man was bringing up his own children was if his wife had been a virgin at marriage and chaste since then (no, not celibate, obviously). These days that's simply not true: and the reference is not to DNA testing. Effective and reliable contraception has meant that, by and large, pregnancies are the result of an active decision. Thus that value of virginity and or chastity has fallen.

This is all allied with Gary Becker's work on why the wages of prostitution are so high: it's not, at root, a highly skilled job after all. But it does involve a high expenditure of social capital: thus the wages to compensate for that.

In a world where highly desirable men would insist upon having virgin wives then virginity had a high value. In a world where this is not so, for virginity is no longer the only valid assurance of not being pregnant by another, the value of that virginity has fallen.

And we can most certainly see this as being true in the society around us. Outside certain highly religious groups there simply is no value placed upon the virginity of a woman of marriageable age (something that has risen by about a decade as well).

So we might well say that the change in the technology of reproduction has led to those changes in social relations. Which would be interesting, to find something that the Bearded Ones were actually correct about.

This is not certain though, not certain that we've identified the correct technology. For the rise in pre-marital sex didn't actually start with the pill, in the sixties. Rather, in the fifties, with the ability of penicillin to cure the clap. Which might make slightly more sense: human beings, young human beings especially, are known to be subject to hyperbolic discounting. Knowing that a horrible disease can be cured near immediately might well have more effect on behaviour than a longer term concern of the quality of a future marriage partner.

No, Boris - we are never guilty until proven innocent

The proximity of the 800th anniversary of Magna Carta next year makes Boris Johnson's Telegraph column from Sunday even more shocking. His plan to arrest anyone who travels to Syria or Iraq without 'good reason' utterly abandons the presumption of innocence. Instead, all travelers would be presumed guilty – and guilty of the extremely serious charge of terrorism – unless they could somehow convince 'the authorities' otherwise:

We also need to be far more effective in preventing British and other foreigners from getting out there…We need to make it crystal clear that you will be arrested if you go out to Syria or Iraq without a good reason. At present the police are finding it very difficult to stop people from simply flying out via Germany, crossing the border, doing their ghastly jihadi tourism, and coming back. The police can and do interview the returnees, but it is hard to press charges without evidence. The law needs a swift and minor change so that there is a “rebuttable presumption” that all those visiting war areas without notifying the authorities have done so for a terrorist purpose.

Boris of course has the laudable aim of curbing the jihadists. But that is just the sort of ambition that has excused too many careless erosions of our ancient freedoms. Already he calls for the return of control orders and laments how hard it is to press charges against British citizens without evidence; as if the assumption of innocence until proven otherwise has not acted as the ultimate safe-guard of citizens against radicals throughout modern history.

According to the Mayor, such controls and assumptions need merely a 'swift and minor' change in the law. Are our Magna Carta liberties to be so swiftly and so triflingly abandoned?

As Herb Stein said, if something cannot go on forever then it won't

It's the Daily Mail that brings us the news that property prices have been rising by 8.6% a year for many decades now. This is of course a nominal number, not a post-inflation one, but projecting it outwards we see that there's going to be something of a problem in the future:

Children born today looking to buy their first home in 2048 will be required to pay a staggering £3.4million, according to new research.The remarkable figure was revealed in a study showing how decades of property value rises will affect a baby born today should the price increases continue on their currently trajectory.

The study was based on average annual increases of 8.6 per cent a year since 1954 and then uses this to pinpoint a cost for those buying their first home at the average age of 35.

Obviously, unless there's rather more inflation than we currently think is going to happen, that's not going to happen. Herb Stein will be right, something will happen to make this not happen.

But what will happen is the interesting bit. We hope that the solution will be a change in the way we plan housing in this country. For it's worth noting that this house price inflation really only started as the effects of the 1947 Town and Country Planning Act started to bite. In effect the government said that no one should build houses where people would like to go and live.

No, really, the 1930s were a time of an almost laissez faire attitude to who could build what where. And where people wanted to be able to buy should not be a surprise, they wanted to live in the countryside surrounding the towns and cities. That's how towns and cities had grown in England for centuries. We ended up with those ribbon developments across the South East, suburban semis along the major roads, little estates added to villages and towns within reasonable distance of London.

That's what people actually wanted, something we can see from the way people flocked to purchase these speculatively built homes. So what did the government do? Banned building what people actually wanted to live in. For of course we can't let the ghastly proles actually enjoy their lives, can we?

The solution to housing becoming too expensive is of course to reverse course on what it is that makes housing so expensive. Allow people to build houses where people actually want to live: in short abolish the Town and Country Planning Acts.

We'll get there, of course we will, for Stein was and is right. The only question is how long will the Nimby's be able to frustrate the desires of their fellow citizens?

So, just what is this economics stuff good for?

Mark Wadsworth asks us an interesting question:

Reading this and this got me thinking.If we think that we know all this stuff, the temptation - on the part of prodnoses - is to use it to interfere.

Alternatively we could think of economics as a discipline that tells us why we need to tell those prodnoses to bugger off.? That is its best purpose. Telling people why they should NOT do stuff.

Is economics best use as a negative or positive thing?

Discuss and inform me.

The answer comes from Ben Bernanke:

Economics is a highly sophisticated field of thought that is superb at explaining to policymakers precisely why the choices they made in the past were wrong. About the future, not so much. However, careful economic analysis does have one important benefit, which is that it can help kill ideas that are completely logically inconsistent or wildly at variance with the data. This insight covers at least 90 percent of proposed economic policies.

Yes, sometimes we can propose sensible things as a result of having consulted the economic runes. But the real value is that 90% of the time we can tell damn fools that their damn fool plans are damned foolish.

Nationalisation, rent controls, price controls of all kinds, trade barriers, infant industry protection....there's a long list of things that people propose again and again, even if vanquished they'll pop up a generation later. The value of economics is that not only can we point out that they're damned foolish but even why they're damned foolish.

Economists are morally superior beings, scientifically proven that is

A lovely paper discovered by Paul Walker over in the land where Kiwis live standing on their heads:

Does an economics education affect an individual's behavior? It is unclear whether differences in behavior are due to the education or whether those who choose to study economics are different. This issue is addressed using experimental evidence from the Trust Game where trusting and reciprocating behaviors can be measured. First, it is shown that economics students provide greater trusting investments and reciprocate more. Accounting for the selection effect, these effects are explained by those who choose to study economics and not directly from the education being provided. Thus, economists play well with others and these social preferences are not taught in the classroom.

We who have studied economics are thus morally superior because we do play nicely with others: the reasons being that playing nicely with others is the reason we went to study economics.

Well, Hurrah! for that.

However, this does pose a problem for us as we try to explain it to others. For we're, in some manner, captivated by those very examples of playing nicely together than the market offers us. We can see how competition is the method by which we decide who to cooperate with and that the vast majority of economic activity isn't in fact competition at all, it's cooperation. The seemingly vast and impersonal market itself is simply a description of how we all, the many billions of us, choose to cooperate to our mutual advantage.

Great, excellent and it's all true. But note what the paper is telling us. We're, because we chose to study economics, inclined to believe all of that anyway as that's the way our own personalities work. But our task is to get across the points about such cooperation to those who simply do not have those same basic beliefs about human behaviour that we do. No wonder it sometimes comes out as a dialogue of the deaf: we don't get what they don't believe at root, that humans are naturally cooperative beings and markets are the way that we do this.

Thus, we might posit, the existence of this idea that trade, the economy itself, is a zero sum game. We have one view of human nature, they another and the fact that ours is correct doesn't matter so much as the fact that they don't believe us or the main point itself.

Companies are the cells of the economy

An interesting point being made by Ronald Coase here:

Wang: Microeconomics is about demand and supply. Compared with classical economics, marginal analysis clearly offers a deeper understanding of consumer choice. But I don’t think it is equally powerful in explicating production, the supply side of the economy.Coase: To understand production, we have to go back to Adam Smith’s division of labor. It serves well as a starting point, even though the modern economy today has become far more complicated.

Wang: This must be Smith’s most undeserving failure. Modern economics is built on Smith’s framework of the “invisible hand”. But it leaves no room for the division of labor.

Coase: Modern economics shows little interest in production. I am not sure production function tells us anything about production in the economy.

Wang: Adam Smith used the pin factory as an example to develop his analysis of the division of labor. Today, to investigate the division of labor, we can no longer afford to confine our focus to a single firm. Instead, we have to study the organizational structure of production.

Coase: That’s right. The firm remains the cell of the economy, but the intricate relations and constant interactions among the cells determine economic dynamism.

It's that last line that so particularly interests me. For it's often pointed out that companies are little sections of a command economy and thus, some leap to say, obviously it's possible to have a command economy because we actually do.

It's possible however to run Coase's analogy in two ways. One is to make that distinction between the cell itself and the entire organism, which do run to different rules. Another might be to compare it to physics: we know very well that there are entirely different rules at the quantum level and at the macro.

Any such analogy can be pushed too far of course but with the economy that cell might well be subject to central planning: but it's the interaction of all of those limited plans which leads to the vibrancy of the economy as a whole. We as entire human beings cannot and do not work by the same rules that apply at the cellular level: nor do economies work well subject to the same rules that might apply at the company or organisational level.

I'm not sure the Russians have got the hang of this sanctions thing yet

I've been continually amused by the Russian reaction to the sanctions that have been imposed upon the country over Crimea and the Ukraine. First they ban imports of fruit and veg from the EU and US. That's clearly and obviously something that damages Russian citizens more than it does anyone else. Then there was the delightful idea that they would have price controls on the supplies they could get: exactly what not to do to encourage domestic production and imports from new suppliers. And now we've got them closing down McDonald's branches in Moscow over "food safety violations". Russia has shut down four McDonald's restaurants in Moscow for alleged sanitary violations in a move critics said was the latest blow in its tit-for-tat sanctions tussle with the west.

The federal monitoring service for consumer rights and wellbeing announced on Wednesday that the offending outlets included the famous restaurant on Pushkin Square that opened just before the fall of the Soviet Union. The body said the eateries were being shut down for "sanitary violations" discovered during inspections this week.

No, no one at all believes that it's for any reason other than those sanctions. Quite apart from anything else the floor in a Maccy D's will be cleaner than the average food preparation table elsewhere in Russia.

But of course there's more to it than that: obviously, those who would eat at McDonald's, ie the Russian citizenry, are discomfited by this. McDonald's Canada, which owns (last I heard at least) 50% of the stores will lose money. But here's where it gets really fun. The other 50% owner is Moscow City Council (again, last I checked).

So, err, Russian sanctions against the US reduces the cash income of the local council in Moscow.

I'm unconvinced that they've quite got the point of sanctions just yet: you're trying to hurt the other guy, not yourself or your own citizenry.

An independent Scotland should use the pound without permission from rUK, says new ASI report

Today the Adam Smith Institute has released a new paper: "Quids In: How sterlingization and free banking could help Scotland flourish", written by Research Director of the Adam Smith Institute, Sam Bowman. Below is a condensed version of the press release; a full version of the press release can be found here. An independent Scotland could flourish by using the pound without permission from the rest of the UK, a new report released today by the Adam Smith Institute argues.

The report, “Quids In: How sterlingization and free banking could help Scotland flourish”, draws on Scottish history and contemporary international examples to argue for the adoption of what it calls ‘adaptive sterlingization,' which combines unilateral use of the pound sterling with financial reforms that remove protections for established banks while allowing competitive banks to issue their own promissory notes without restriction. This, the report argues, would give Scotland a more stable financial system and economy than the rest of the UK.

According to the report, adaptive sterlingization would allow competitive, private banks to issue their own promissory notes backed by reserves of GBP (or anything else – including USD, gold, index fund shares or even cryptocurrencies like Bitcoin). With each bank given powers to expand and contract its balance sheet relative to demand, this system would be highly adaptive to changes in money demand, preventing demand-side recessions in modern economies such as the ones that led to the 2008 Great Recession.

The report’s author, Sam Bowman, details Scotland’s successful history of 'free banking' in the 18th and 19th centuries and the period of remarkable financial and economic stability which accompanied it. Historical ‘hangovers’ from this period, like Scotland's continued practice of individual bank issuance of banknotes, are still in place today, making Scotland uniquely placed for a simple transition to the system outlined in the report.

The report highlights evidence from 'dollarized' economies in Latin America, such as Panama, Ecuador and El Salvador, which demonstrate that the informal use of another country’s currency can foster a healthy financial system and economy.

Under sterlingization, Scotland would lack the ability to print money and establish a central bank to act as a lender of last resort. Evidence from dollarized Latin American countries suggests that far from being problematic, this constraint reduces moral hazard within the financial system and forces banks to be prudent, significantly improving the overall quality of the country’s financial institutions. Panama, for example, has the seventh soundest banks in the world.

The report concludes that Britain's obstinacy could be Scotland's opportunity to return to a freer, more stable banking system. Sterilization, combined with reform of Scottish financial regulation that:

-

removed government liquidity provisions to illiquid banks,

-

established mechanisms to ‘bail-in’ insolvent banks by extending liability to shareholders, and

- shifted deposit insurance costs onto banks and depositors rather than taxpayers,

would improve standards and competitiveness in banking, while significantly reducing the prospect of large-scale bank panics and financial crises.

Commenting on his report, the Research Director of the Adam Smith Institute, Sam Bowman, said:

The Scottish independence debate has repeatedly foundered on the question of currency, but if Scots look to their own history they will find that their country is a shining example of how competition in currency and banking can ensure a stable and effective banking system. Scotland’s free banking era was an economic and intellectual Golden Age, and its system of competitive note-issuance was recognised by such thinkers as Adam Smith as one of the root causes of the country’s prosperity during this time.

The examples of Panama and other dollarized Latin American economies are proof that countries can thrive when they unilaterally adopt another country’s currency. Combined with a flexible, adaptive banking system, the unilateral use of another country’s currency can instill a discipline in a country’s financial sector that neither a national currency nor a currency union can provide. Scotland’s banking system is almost uniquely primed for such a system of ‘adaptive sterlingization’. The path outlined in this paper would go almost unnoticed by the average Scot – until the next big economic shock, when they might just wonder why their system was so much more stable than that of the country they’d left behind.

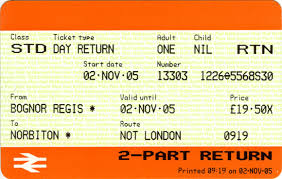

This train fare question isn't difficult you know

The Guardian rather jumps the shark here:

The Guardian view on rail fares: unfair Travelling by train produces benefits for everyone – less air pollution, lower greenhouse gas emissions, fewer traffic jams. Passengers should not have to pay two-thirds of the cost

Actually, a small engined car with four people in it has lower emissions, lower pollution, than four people traveling by train. So it simply isn't true that everyone benefits from more train travel.

There are indeed some truths there though. It simply would not be possible to fill and empty London each day purely by private transport: some amount of commuting public transport is going to be necessary. And there's no reason why those who benefit from that should not pay for it: as they largely do through the subsidy of London Transport paid for by Londoners.

But on the larger question of who should pay for the railways of course it should be those who use the railways that pay for it. Some City fund manager who commutes in from 50 miles outside London should not have his lifestyle choice subsidised by the rest of us. We should not be taxing the man who cycles to work at minimum wage in order to pay for wealthier people top travel longer distances.

The Guardian is, once again, forgetting that there is no magic money tree. If rail users do not pay for the railways then there is no unowned cash that can be diverted to doing so. Either the rest of us put our hands in our pockets or we don't. And why should the poor pay taxes so the middles classes can live in the greenbelt?