NEWS

Salt & sugar taxes could cost shoppers up to £4.8 billion each year

Henry Dimbleby's National Food Strategy has proposed sugar and salt taxes on everyday staples that may see every household forking out an extra £172 per year to the taxman.

Dimbleby predicts the tax would cost households between £2.9 and £3.4 billion per year, but think tank estimates put this far higher. A comprehensive tax on salt and sugar consumed could mean a £4.8 billion tax bill.

The recommendation of a £3/kg tax on sugar and a £6/kg tax on salt in processed foods is expected to increase prices on everyday essentials. Foods affected by the tax could include store cupboard staples such as jam, ketchup and cereals, which could increase in price by almost a half. The tax could also see the price of chocolate bars increase by almost a quarter, multipacks of sweets by almost a third, and crumpets by almost a quarter.

The tax could be felt in restaurants and takeaways, increasing the cost of a dozen Krispy Kreme doughnuts by around 50p and a Domino’s pizza by more than 30p. This could be particularly difficult to tax in small restaurants, where quantifying the amount of salt and sugar used in every dish is burdensome.

Despite backing away from a potential additional tax on meat, the report demands a reduction in meat consumption, with the salt and sugar tax hitting products like bacon, corned beef and sausage rolls.

The TaxPayers’ Alliance, Adam Smith Institute, and Institute of Economic Affairs argue the proposals would target consumers, food manufacturers and the already struggling hospitality industry. It would be deeply regressive and see food items become either tasteless or reduced in portion sizes.

Examples of food impacted by the tax:

Breakfast staples like strawberry jam and frosted cornflakes could become around 46 and 33 per cent more expensive (£1.25 to £1.82 and £3.50 to £4.66) respectively.

Storecupboard sauces like ketchup and soy sauce could become around 23 and 43 per cent more expensive (£1.99 to £2.44 and £0.60 to £0.86) respectively.

Treats like Skittles and Twix bars could become around 32 and 25 per cent more expensive (£1.50 to £1.99 and £1.25 to £1.56) respectively.

Snacks like brownies and chocolate digestives could become around 21 and 18 per cent more expensive (£1.65 to £1.99 and £1.35 to £1.59) respectively.

Lunchtime choices like crumpets and jarred sandwich spread could become around 24 and 14 per cent more expensive (£0.25 to £0.31 and £1.70 to £1.93) respectively.

Family dinners like pizzas and pasta sauce could become around 15 and 6 per cent more expensive (£3.50 to £4.02 and £1.75 to £1.86) respectively.

Takeaways like Krispy Kreme doughnuts and Domino’s could become around 3 and 1.5 per cent more expensive (£15.75 to £16.22 and £20.99 to £21.32) respectively.

John O’Connell, Chief Executive of the TaxPayers’ Alliance, said:

"This is yet another case of middle-class meddling that will hit the poorest families hardest, as this madcap scheme will hike up costs of everyday essentials.

“Not only do the high priests of the nanny state think that ordinary folk can't look after themselves, they also can't resist dipping their hands into taxpayers' pockets.

“The government must reject outright any tax hikes and instead trust British families to make their own choices."

Dr Eamonn Butler, Director of the neoliberal think tank the Adam Smith Institute, says:

“We thought the nanny state had died during the pandemic, but the blob marches on thanks to a man whose privilege blinds him to the blight his proposed policies would inflict on a nation that does not want his prescription.

“Boris needs to stand up for the consumer interest and say that there is no benefit for ordinary families from increasing the cost of food while ruining its taste.

“Henry Dimbleby should have looked at how his own firm could bring down the cost of good quality food to the reach of ordinary Britons before he decided to play with everyone else's food.”

Christopher Snowdon, Head of Lifestyle Economics at free market think tank the Institute of Economic Affairs said:

“Once again, rich people want to clobber ordinary people with stealth taxes, this time on sugar and salt. By Mr Dimbleby’s own admission, this cash grab will cost consumers £3 billion, but independent analysis suggests it will cost even more.

At a time of rising inflation, after the deepest recession in 300 years, Mr Dimbleby really needs to read the room. He rightly says that a meat tax would be unpopular and regressive. If Boris Johnson is foolish enough to act on these recommendations, he will soon find the same is true of taxing basic nutrients.”

Aussies & Brits tell Govts: Get trade deal done

Two-thirds of Brits and Aussies back a Australia-United Kingdom free trade deal.

There is majority support for the deal across all UK regions, party voters, age cohorts, education levels, and Leave and Remain.

Brits believe Australia has high food safety and animal welfare and do not want to block a deal to protect British farmers from competition.

Brits want to buy more Australian wine, beef and lamb — and Tim Tams and Kangaroo meat. Aussies want more UK cars, British cheese, and Scottish whisky.

Brits want Australia to trade just as easily if not easier than the UK with the European Union.

A new poll from the free market think tank the Adam Smith Institute (ASI) and research and strategy firm at C|T Group RSR has found Brits and Australians want to expand trade and secure a comprehensive deal.

65% of Brits support a free trade deal with Australia, 5% are opposed; there is majority support across all key demographic groups across the United Kingdom, and across the political spectrum.

69% of Aussies support a free trade deal, 3% are opposed

Leading pollster and Head of Research at C|T Group RSR, Dr Michael Turner, found that Australia is the foremost priority to expand trade among Brits. This comes from a strong belief in Australia’s high standards, that a deal will benefit both sides as well as the close family and friendship connections between Brits and Aussies.

Two-thirds of Brits (66%) believe Australia has high standards of food safety and animal welfare, just 6% of people believe Australia has low standards

Australia is the top priority for more trade for Brits, with two-thirds (66%) of Brits saying the UK should trade more with Australia; followed by Canada (63%), New Zealand (61%), the United States (48%) and Japan (42%)

72% of Aussies want Australia to be trading more with the UK

74% of Brits believe both countries will benefit from a free trade deal

73% of Aussies believe that both sides will benefit

Brits back a tariff-free deal that allows consumers to access a wider range of goods, recognises nursing qualifications without retraining and allows more people to live and work across countries. Brits want to see more jobs created, British businesses become more internationally competitive, and reduce barriers to investment.

91% of Brits would feel comfortable being treated by an Australian nurse, 73% believe that nurse should not have to requalify before practicing in the UK

62% of Brits believe it should be easier to move between countries, 8% think it shouldn't be easier

There is also substantial interest among Brits in consuming more Australian goods, and among Aussies in consuming more British goods.

A majority of Brits say they would buy more Australian wine (57%), beef (52%) and lamb (50%) if it were stocked more frequently. There is also interest in purchasing Anzac biscuits (33%), Tim Tams (28%), Kangaroo meat (23%), vegemite (23%) and lamingtons (20%).

Australians are interested in purchasing more British goods if they were stocked more frequently and cheaply, including shortbread (59%), British cheese (53%), jam and marmalade (51%), Cornish pasty (47%), Scottish whisky (45%), Yorkshire tea (41%), gin (36%), Marmite (25%) and Irn Bru (22%).

68% of Aussies would consider purchasing a British-manufactured car

MYTHBUSTING: The efforts of a vocal pressure group to scupper the deal to protect British farmers has not resonated with the public. The British people back British farmers to compete globally. If the deal does go ahead, Brits want a short transition period and do not consider protecting farmers to be a reason worth blocking the deal.

63% would support a trade deal with Australia even if it means that increased competition would reduce profits for British farmers and some might go out of business; just 20% would prefer to block a deal to prevent British farmers having more competition

64% believe British farmers should compete on an equal basis with foreign imports of the same standards; 52% believe they should not be denied access to Australian farming goods produced at a lower price

68% of people think that the transition period on beef and lamb should be 2 years or less

If push came to shove, most Brits say that they would prefer to trade with Australia over the European Union, and more than four-fifths of voters feel that trade with Australia should be at least as easy as it is with the EU.

84% believe Australia should be able to trade with the UK more easily, or just as easily, than the EU

52% would opt for Australian beef as an alternative to British beef, just 24% would opt for EU beef

Australians prioritise diversifying trade away from China, and a clear majority say that Australia should increase links with like-minded countries like the UK.

54% of Australians would prioritize expanding trade with UK, compared to 4% that want to prioritise China and 31% who say both

77% of Aussies believe it is essential that Australia trades more freely with its closest allies

Michael Turner, report co-author, Head of Research (Director) at C|T Group RSR and a Fellow of the ASI, said:

“This research not only shows that Brits believe in the core benefits of free trade. From Tim Tams to Cornish pasties, Aussie beef to British cheese, the results show consumers in both countries have a healthy and reciprocal appetite to consume goods made in each other's countries.

“Contrary to the popular narrative of the inward-looking and protectionist Brexit voter, this research shows that the overwhelming majority of those who voted to Leave the EU in 2016, are in fact supportive of a more outwardly-focused and freely trading Britain post-Brexit.

“Four in five Brits agree that a successful domestic industry requires more global trade, not less. This UK-Australia trade deal should be, as the Aussies say: ‘no wuckas mate.’”

Matthew Lesh, report co-author and Head of Research at the Adam Smith Institute, said:

“The Australia-United Kingdom trade deal isn’t some distant elite project. It is deeply supported by Brits and Aussies.

“The British public have little interest in the pronouncements of self-interested lobbyists that want to restrict them from accessing Aussie produce. From Australian wine, beef and Tim Tams to Scottish whisky and UK cars, we want to eat and drink each other’s finest products. We want the ability to live and work in each other’s countries and to recognise our qualifications as equivalent.

“In an increasingly complex world, there’s a need for good mates not only to stick together but to become even closer. That’s what Australians and Brits want.

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne: matt@adamsmith.org | 07584778207.

The report ‘Ever closer mates: The deep support for an UK-Australia trade deal’ is available here.

Dr Michael Turner is Head of Research (Director) at at C|T Group RSR and a Fellow of the Adam Smith Institute. Matthew Lesh is the Head of Research at the Adam Smith Institute and an Adjunct Fellow at the Institute of Public Affairs (Australia)

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Rishi's rush to tax sells Britain short

In response to the Chancellor announcing a global minimum tax rate cartel of the G7 Nations, Deputy Director Matthew Kilcoyne says:

"Rishi has rushed out an announcement that the G7 has created a global tax cartel. The world's most powerful governments have clubbed together to shirk the responsibility of going for growth and chosen instead to maximise the taxman's take — and all at our expense.

“In doing so the UK Government has signed away the primacy of Parliament in setting taxes for the British people — and the rights of the Overseas Territories and Crown Dependencies to set their own fiscal policy. A quarter of a millennium ago our American cousins fought a revolution to reject Westminster’s taxation without representation. Half a decade ago Britons voted to take back control over all the rules of the economy. Nobody voted to hand power over our taxes to Washington’s demands.

“These proposals are not in the UK’s interest and Rishi has sold Britain short. Rishi Sunak’s flagship policies of Super Deductions and Free Ports are dead in the water. The Chancellor's own policies, scuppered by his own hubris."

To arrange an interview or further comment, please contact Matt on 07904099599

(happy) Tax Freedom Day 2021

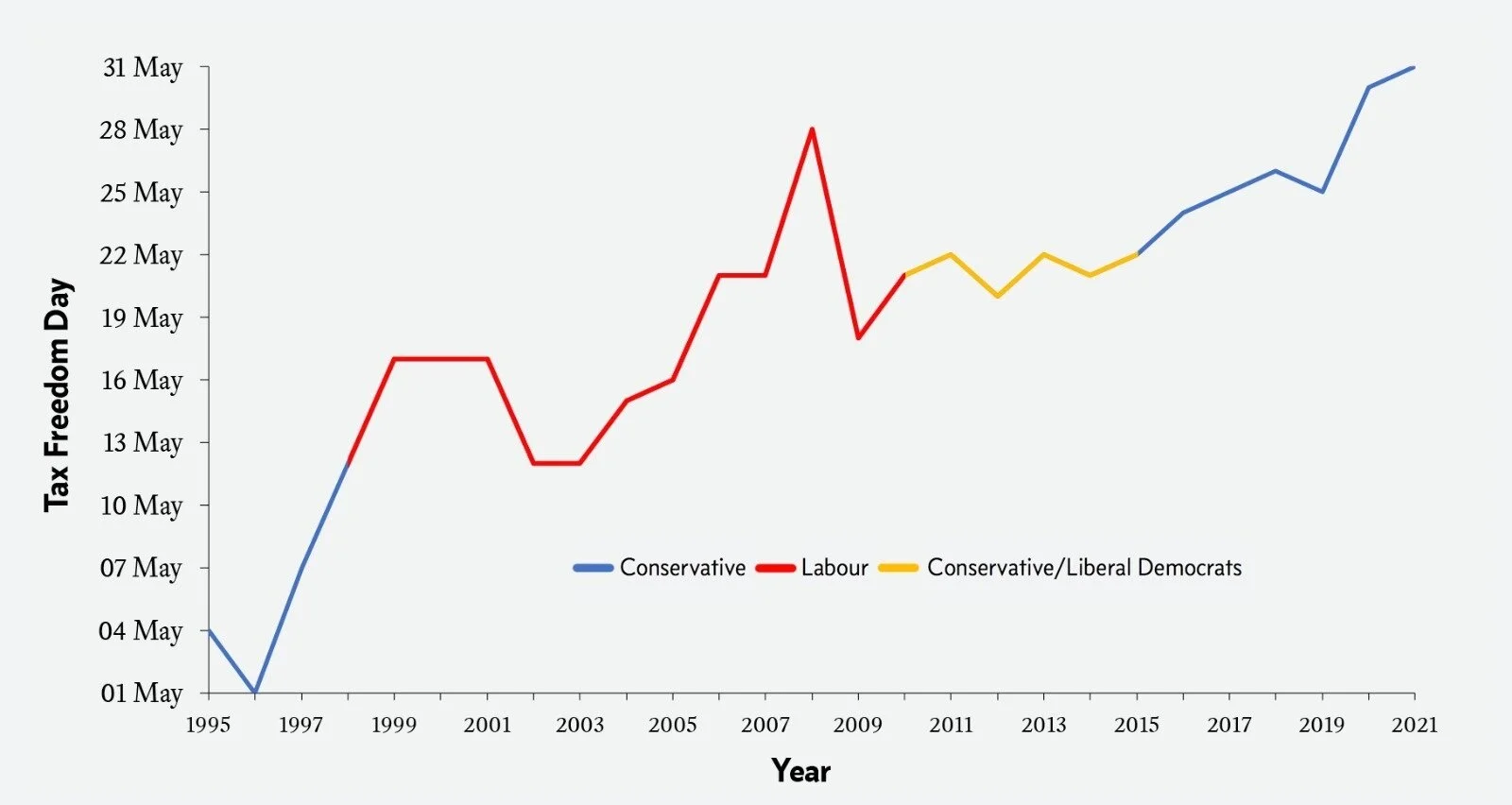

TAX BURDEN HIGHER THAN AT ANY TIME SINCE 1995

Taxpayers worked 150 days for the Boris and the taxman this year, today is the first day they start working for themselves

Tax Freedom Day falls on May 31st

Brits work 150 days of the year solely to pay taxes, pandemic spending and no plans to reign in political projects means taxes likely to rise in future years

Tax demands are at a record high, even prior to taking into account the full scale of the pandemic. MPs provide their comments on the need to reduce the burden on businesses, hard working families, and the need for the Conservative Party to return to conservative and free market principles

Tax Freedom Day is a measure of when Britons stop paying tax and start putting their earnings into their own pocket. This year the Adam Smith Institute has estimated that every penny the average person earned for working up to and including May 30th went to the taxman—from May 31st onwards they are finally earning for themselves.

British taxpayers have worked a gruelling 150 days for the taxpayers this year. Brits will fork out £730 billion to the Treasury this year, over two-fifths of every pound we earn. More of us are working for Boris than worked for the taxman in any year under New Labour, the Coalition or Theresa May’s governments. Britain’s tax burden is moving in the wrong direction.

Unfortunately for Britons, this Tax Freedom Day cannot yet fully take into account the tax costs of measures taken to tackle COVID19 — and the Government has been borrowing hundreds of billions more to finance the covid response. All borrowing is a form of taxation deferred and the hundreds of billions of pounds borrowed to tackle this viral threat will only begin to be borne in future years and as the government begins to unlock economic activity.

Tax Freedom Day is over a month and a half later in the UK than it is in Biden’s America, where workers started taking home their own pay from April 16th this year.

With talks of global minimum taxes on the businesses that allowed millions of us in the UK to work from home and still get fed, entertained and connected, the minimum governments could do is look again at the costs they impose on all of us. As the pandemic comes to an end we need a new approach that lets taxpayers keep more of their money, which grows our economy, creates jobs and boosts wages.

It’s easy to spend other people’s money. What we need now is a plan to reduce the burdens on working people, that lets them keep a little more of their hard-earned money.

Dr Eamonn Butler, Founder and Director of the Adam Smith Institute, said:

“Borrowing off the backs of others is easy, making sure the books are balanced is the hard part. We can all forgive the government reaching for easy credit in a crisis but the fact of the matter is that the cost of government has been on a rising path for years now. As politicians prepare to say that businesses and families need to prepare for global minimum taxes, the least they could do is to look again at the burdens they’re putting onto all of us to pay for their largesse.”

Tom Clougherty, head of tax at the Centre for Policy Studies, said:

"The latest Tax Freedom Day in decades should serve as a stark reminder that this isn't the time for tax increases. Instead, the Government needs to come up with a plan to overhaul the tax system – so that it can raise money as efficiently as possible, while also reducing the burden on people's earnings and investments. Without radical reform, we risk ending up in a vicious circle of tax hikes and weak economic growth."

Mark Littlewood, Director General of the Institute of Economic Affairs, said:

"That Tax Freedom Day falls so late in the year is a sign this government is failing to deliver on what is left of its free market rhetoric. We in fact live under a high-tax, high-spend government that is on track to create an overall level of taxation to rival Clement Atlee's socialist administration. We are approaching, if not at, our taxable limit and repairing the public finances post-COVID will require expenditure cuts, not further tax hikes."

Duncan Simpson, research director of the TaxPayers' Alliance, said:

"Tax Freedom Day couldn't come a moment too soon. Sadly it gets later and later every year, as struggling families are battered by endless hikes and taxes reaching the highest sustained level they've been for 70 years. Hard hit households need tax cuts now more than ever, to ease the burden and help them recover from the covid crisis.”

Rt Hon Sir Iain Duncan Smith, Member of Parliament for Chingford and Woodford Green, said:

“I congratulate the Adam Smith Institute for their brilliant work in bringing together calculations of the whole tax burden so that we understand better just how much tax we pay to Government. We can see from their analysis that the tax burden has risen over the years. Since I first came into Parliament, we are now working for the Government for a whole extra month before we are working for ourselves. This indicates the scale of Tax rises through both Labour and Conservative Governments. The chart the Adam Smith Institute have produced makes it very clear and easy to understand that the tax burden has risen steadily over the years and for that I congratulate the Adam Smith Institute. I hope that the Government will look carefully at this and understand that no matter the debates at general elections - the truth is that tax has risen.”

James Gray, Member of Parliament for North Wiltshire, said:

“Like my fellow Glaswegian, Adam Smith, I am a strong supporter of less government, greater individual freedom, lower 'safety nets' provided by society and as a result of that a lower need for National or local taxation. Freedom Day should, in my view, be as close to Ne'erday as it is possible to be.”

Tim Loughton, Member of Parliament for East Worthing & Shoreham, said:

“Tax Freedom day is a stark reminder just how heavily individuals are taxed and it is always alarming when this date gets progressively later in the year. Good Conservative governments acknowledge that people are incentivised by lower and fairer tax rates and this usually results in a higher tax take to the Exchequer overall in any case, so notwithstanding the current strains on our finances caused by the pandemic I hope we return to good Conservative government principles as soon as possible.”

Alex Stafford, Member of Parliament for Rother Valley, said:

"As the days get shorter and shorter, so Tax Freedom Day gets further and further away from the start of the year. True freedom is allowing us to keep more of our own money in our pockets - so that we, rather than the Government, can choose where it goes. With the economic impact of Covid being felt, now more than ever, do we need true control over our own finances."

David Simmonds, Member of Parliament for Ruislip, Northwood and Pinner, said:

"Everyone in politics needs to be thinking about how hard someone has had to work to earn the money that government is spending, and ask, if they were in my position, would they agree that this spend represents value for money?"

Greg Smith, Member of Parliament for Buckingham, said:

“High taxes are a barrier to growth, a disincentive to invest and calamitous for family finances. With tax freedom day coming later and later, it is imperative to cut taxes and go for growth.”

Stephen McPartland, Member of Parliament for Stevenage, said:

“The only way to level up the country is to let people keep more money in their own pockets to spend in their local communities. The farcical behaviour of local and national government on fantasy projects and schemes, which sound good in a press release but in reality act as barriers to employment and investment locally, must stop.”

Sir Desmond Swayne, Member of Parliament for New Forest West:

“Individuals make better decisions about what is best for them and their families. The more we are allowed to do so, the better we will be for it. The more we have to work just to pay for government and it's priorities, so proceeding, our initiative and enterprise is diminished.”

Andrew Lewer, Member of Parliament for Northampton South, said:

"The trend for Tax Freedom Day to get ever later in the year was well established before the trauma of Covid-19 hit us. We have had a Conservative-led Government since 2010 and so we are well overdue for this trend to be reversed. I hope that those in leading positions in Government will be mindful that increased tax RATES often do not mean increased tax TAKES."

Christopher Chope, Member of Parliament for Christchurch, said:

“The ASI analysis is a timely wake up call to Conservatives of the need to take back control from the State .Taxation is the enemy of personal liberty because it transfers choice and responsibility for spending decisions from families and individuals to wasteful bureaucrats.”

Steve Baker, Member of Parliament for Wycombe, said:

“It doesn’t just feel like it, tax freedom day does arrive later every year under Conservative Governments. This cannot go on. In order for us all to be prosperous, eventually Conservatives must stand up for the formula we have always believed in - that means lower taxes.”

Bob Blackman, Member of Parliament for Harrow East, said:

“Over the past year, significant revisions to the net national income stats have pushed Tax Freedom Day back by around a week In 2020, we worked 150 days just to pay our tax bill.

“From May 30th onwards, we’re working for ourselves. Tax Freedom Day is now later than at any time since 1995. High taxes discourage work, investment, and economic growth. We must encourage everyone to take TaxAction by making the most of their tax reliefs. Assuming that people stick to those things approved by HMRC then there are several legitimate schemes an individual can take advantage of to reduce their tax bill.”

John Baron, Member of Parliament for Basildon and Billericay, said:

“Although taxes support our vital public services, it’s nevertheless good news that we are all now ‘working for ourselves'. The Government should work hard to keep taxes low – and must remember the lessons of the Laffer Curve.

Robert Goodwill, Member of Parliament for Scarborough and Whitby, said:

"Tax Freedom Day is a brilliant way of bringing home to ordinary people just how burdened we are with tax. The pandemic has resulted in unprecedented peace time levels of public expenditure, but we do need to bring this under control and ensure that in future Tax Freedom Day can be earlier in the year and not later!"

Geoffrey Clifton Brown, Member of Parliament for the Cotswolds, said:

“As Deputy Chair of the Public Accounts Committee, I am extremely conscious that every pound spent by Government eventually must be raised in taxation. It is probably inevitable that some taxes will have to rise to pay for the enormous expenditure throughout the pandemic. But the long-term aim of Government should always be to keep taxation as low as possible, conducive to providing a reasonable level of public services. The individual or the family always know how to spend their own money more wisely than the Government.”

Henry Smith, Member of Parliament for Crawley, said:

"The fact that almost half a year elapses before we are in essence free of paying tax, is a sober reminder of the state's financial burdens on us. A lower tax economy produces growth, which in turn creates a greater common wealth - we do well to remember this, especially given the serious demands on us as individuals and as a nation at this time."

Alun Cairns, Member of Parliament for Vale of Glamorgan, said:

“It’s hard to believe that we work 150 days just to pay our taxes. This brings into focus the principle of effort and reward for the benefit of all in society. I pay tribute to the Adam Smith Institute for maintaining focus on this important acid test of fiscal discipline. We all recognise public spending commitments but Tax Freedom Day underlines that we all pay, in the end.”

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne, matt@adamsmith.org | 07904099599

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Government to repeal the Porn Laws

The Government's Online Safety Bill (Clause 131) will quietly abolish the much-dreaded Porn Laws.

The Adam Smith Institute’s Head of Research Matthew Lesh responded to the news:

"The repeal of the Porn Laws is excellent news for our privacy and online freedoms. This will mean Brits won't have to buy a state-sponsored porn pass or provide their credit card, passport or driver’s licence every time they visit a porn site.

"But we shouldn't celebrate too quickly. This is a pyrrhic victory. The Online Safety Bill will mandate age verification to access the adult versions of Twitter, Facebook and YouTube. Until you present a drivers' licence or passport, the sites will be forced to only display child-appropriate content.

“Just like repeatedly approving cookies, constantly verifying your age will add huge inconvenience to surfing the internet. It would also mean forcing Big Tech to gather even more private data about individuals, risking our privacy and online security.”

Learn more about the Adam Smith Institute’s efforts to Repeal the Porn Laws.

For further comment or to arrange an interview, please contact Matt Kilcoyne via 07904099599 or email matt@adamsmith.org

Online Safety Bill: Frightening and historic attack on freedom of expression

In response to the Government’s publication of the Online Safety Bill, the Adam Smith Institute’s Head of Research Matthew Lesh said:

“The Online Safety Bill is an incoherent train wreck. The inclusion of ‘lawful but still harmful’ speech represents a frightening and historic attack on freedom of expression. The Government should not have the power to instruct private firms to remove legal speech in a free society.

“The scope of these proposals is practically limitless, encompassing everything from ‘trolling’ to ‘fraud’ and ‘misinformation’. It will threaten privacy by age-restricting the entire internet: requiring websites to gather drivers’ licenses and passports to ensure services are age-appropriate. The vagueness of the legislation means there will be nothing to stop Ofcom and a future government including any additional measures in future.

"The costs to businesses will be huge, with the Government's impact assessment indicating that the proposals will cost £2.1 billion, with an extraordinary £1.7 billion expected to be spent on content moderation. These costs will be crippling for start-ups and scale-ups, cementing the power of Big Tech.

“The bill needs a serious rethink. There needs to be a mandate on Ofcom that prevents the issuing of guidance that infringes on legal speech, open to arbitrary interpretation under the current proposals. There also needs to be a much greater focus on the perpetrators of unlawful behaviour. The proposals will not see a single extra penny dedicated to law enforcement or prosecuting serious online crimes.

For further comment or to arrange an interview, please contact Matt Kilcoyne via 07904099599 or email matt@adamsmith.org

"Nutty nanny statism": Government plans to ban 'junk food' advertising online and after 9.00pm

In response to the Government maintaining plans to ban so-called ‘junk food’ from online advertising and before 9.00pm on television, the Adam Smith Institute’s Head of Research Matthew Lesh said:

“The ad ban plan is nutty nanny statism. It will do nothing to reduce obesity while savagely striking at struggling hospitality businesses and hurting the public.

“The measures will apply to a shockingly large array of foods. It will be illegal to advertise online British favourites like fish and chips, scotch eggs or even a Full English breakfast; takeaways would be unable to post images of their food online; descriptive words like ‘delicious’ will be banned. Thousands of restaurants, which have been kept alive thanks to online delivery, will no longer be able to advertise online to find new customers, hitting small businesses the hardest.“The ban will even make it harder for the public to discover new restaurants and food delivery services, taking joy out of our lives.

“It’s all pain for no gain. By the Government’s own calculations banning online advertising will reduce children’s calorie consumption by just 2.8 calories per day—having no impact on obesity.”

Click here to learn more about the ASI’s research on the Mad Ad Ban Plan.

For further comment or to arrange an interview, please contact Matt Kilcoyne via 07904099599 or email matt@adamsmith.org

UK Gov will miss Brexit chance to make 2030 smoke free

Despite decades of public policy aimed at reducing smoking, there remain 7 million smokers in the UK (14.1% of adults, down from 14.7% in 2018)

According to ONS data the average annual decline in the smoking rate from 2011 to 2019 was 0.76 percentage points.

The UK’s public health consensus in favour of e-cigarettes as a smoking alternative has played a significant role in accelerating the decline in smoking rates over the past decade

But for the first time since e-cigarettes were introduced to Great Britain their use has declined from 7.1% to 6.3% of the adult population.

The Cochrane review found that for every 100 people using nicotine e-cigarettes to stop smoking, 10 might successfully stop compared to just 6/100 using nicotine replacement therapy or 4/100 with no support or behavioural support only.

Even with the current rate of decline, the Government’s ‘2030 smoke-free’ goal will be missed.

Brexit and the new Tobacco Control Plan “provide once-in-a-generation opportunity to create and implement evidence-based policy” says Rt Hon David Jones MP

Any missed Brexit opportunities to reduce restrictions on sale and advertising of alternative products risk lives lost to smoking related illnesses.

In the UK, around 78,000 people die every year as a consequence of smoking with and many more live with the misery of debilitating smoking-related diseases. While the number of smokers has fallen in recent years the Government is not on track to meet its target of being ‘smoke-free by 2030’, which means having an adult smoking prevalence of 5% or less.

Even under optimistic assumptions, the Government will miss its target by a whole percentage point on current trends. This is the warning today by the free market think tank the Adam Smith Institute in a new report. Previous forecasts have predicted an even higher degree of failure, with Cancer Research UK suggesting that England would hit the target 7 years behind schedule while Scotland was only predicted to reach the target in the latter half of the century.

The neoliberal think tank argues that decades of policies designed to reduce smoking prevalence are at risk have only started to bear fruit after a squeeze on incomes against inelastic consumption of nicotine via higher taxes was also met with options to switch away from cigarettes to less harmful alternatives such as e-cigarettes.

It is the poorest that will suffer, they argue and are joined in that opinion by the Rt. Hon. David Jones MP who argues that “poorer communities across the country are being left behind, and the problem, currently, is only getting worse.”

The free market think tank says that the government has so far failed to make the best use of Brexit to reduce the barriers to products like e-cigarettes that are proven to reduce the harms of smoking.

Over the past decade the success of our harm reduction approach has seen an average annual decline in the smoking rate from 2011 to 2019 of 0.76 percentage points.

More worryingly the recent spate of people quitting cigarettes during the pandemic is likely to be short-lived and a result of young people having reduced time to spend with friends and at events, falling disposable incomes and job insecurity, and COVID-related health worries — all of which are both intended to be reversed by the government and society at the end of the pandemic. The free market think tank says that even in the best case scenario where these COVID-induced quits are long-term — a questionable assumption since young people tend to relapse at higher rates — they represent a one-off event rather than shift in the overall trend.

E-cigarettes’ reputation as an effective way to stop smoking is borne out by the evidence. In October 2020, a Cochrane medical science research review of 50 completed studies summarised that “for every 100 people using nicotine e-cigarettes to stop smoking, 10 might successfully stop, compared with only six of 100 people using nicotine-replacement therapy or nicotine-free e-cigarettes, or four of 100 people having no support or behavioural support only.” A wide consensus of UK public health bodies and NGOs also maintain that they are significantly less harmful to health than tobacco cigarettes.

The Adam Smith Institute argues that the recent plateauing of e-cigarette use by smokers since 2016 — hovering at just under two-thirds of all adult smokers and despite the fact that almost all (94%) of smokers having heard of of e-cigarettes — means nearly one-third of UK smokers have still never used the UK’s most popular (and arguably most effective) quit method.

When Britain left the European Union powers and advertising rules over nicotine products like cigarettes, cigars, vaping, and heated tobacco returned to the Westminster level from Brussels. With that came a chance to reform things like warnings to be product rather than sector specific, advertising alternative products within cigarette packets, and nicotine levels in certain products that are both safe and more likely to act as a direct replacement for long-term smokers. With no movement shown in the 13 months since, and despite a cardio-vascular disease pandemic, the think tank warns that the opportunities of Brexit are being squandered.

However, the Government can signal their intent to continue the liberal approach to regulation, product development and access at the Framework Convention on Tobacco Control’s COP9 later this year — the UK’s first time unbound by the EU’s common position.

If the Government is to achieve its target of a sub 5% smoking rate by 2030, it will best do so by continuing and expanding a liberal and consumer-welfare focused approach to access of alternatives to smoking, as well as seizing the opportunities that Brexit presents.

Report author and ASI Head of Programmes Daniel Pryor, says:

“For a decade, the UK has been a world leader in using tobacco harm reduction to encourage smoking cessation. But until now, EU restrictions limited how far we could pursue this path. If the Government doesn't take advantage of Brexit to change its approach to vaping and other low-risk smoking alternatives, they'll miss the Smokefree 2030 target and squander a golden opportunity to help British smokers make the switch.

“We need to make these changes now. Many smokers aren’t switching to safer alternatives like vaping because of widespread misperceptions about relative risk or because they are simply unaware that other options exist. Others are put off by outdated product rules and even outright bans on things like snus that our newfound Brexit freedom gives us the opportunity to revise.

“Global Britain should also leverage its newly independent position to push for the World Health Organisation to adopt a more sensible approach to reduced-risk products at COP9 later this year: especially in light of our decision to increase their UK taxpayer funding. If we don’t make these changes now, what was the point of Brexit?”

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne: matt@adamsmith.org | 07904 099599.

The report ‘The Golden Opportunity: How Global Britain can lead on tobacco harm reduction and save millions of lives’ is available here.

Daniel Pryor is Head of Programmes at the Adam Smith Institute. The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

1000 Statutory Instruments Last Year Wrapped Britain in Red Tape

Red tape costs businesses £100 billion a year, a substantial portion of which is spent simply searching for the law.

There were 1,000 new regulations or ‘statutory instruments’ in 2020, as Covid-19 and Brexit led to the proliferation of new rules

329 were Covid 19-related with an average of 8 per week after 6 March 2020

Post-Covid and post-Brexit prosperity depends on reducing, simplifying, and that starts with properly cataloguing the law with reference to relevant cases.

Citizens and companies should be able to search for laws pertaining to an issue and see relevant case law and statutory instruments updates on legislation.gov.uk with all new rules added via accessible website, data feed (XML, JSON), and PDF formats.

The rule of law and Britain’s economic prosperity is being undermined by excessive legislating and regulating, a new report from the free market think tank the Adam Smith Institute claims.

The quantity of law has grown unchecked and often even unspecified, making it impossible for citizens and businesses to discover the rules let alone follow them. The growing red tape burder undermines the rule of law and the United Kingdom's economic prosperity. This is the dire warning by report author Robin Ellison — a Visiting Professor in Pensions Law and Economics at The Business School, City, University of London.

Worse still, the Institute says that the United Kingdom lacks a depository of all laws and regulations. Judges and lawyers, let alone citizens and businesses, often complain about the difficulty ascertaining the state of the law. The inability to identify the law has led to unfair application including common sentencing mistakes.

Citizens must comply with an ever expanding array of legislation, regulations known as ‘statutory instruments’ (of which there were over 1,000 in 2020), imported European Union legislation, and tens of thousands of pages of materials issued by dozens of regulatory agencies.

In 2017 the National Audit Office estimated the cost of regulation in the UK to be around £100bn. Searching for what are the applicable rules in any given situation will be a material part of the total regulatory burden. This includes the cost of compliance officers, legal advisers, subscriptions to services such as WestLaw, LexisNexis and Halsbury, and compliance support organisations.

The extent of legislation and regulation creates substantial economic costs, including pushing up prices for consumers, reducing wages for workers and creating disproportionate burdens on small businesses.

The Institute is calling for all types of law, including legislation, regulation, and departmental guidance to be reduced, simplified and catalogued. They are also calling for new rules such as one-in-three-out, targets for reductions in restrictive clauses (known as RegData) and extensive sunsetting rules.

To reduce the cost burden of red tape as far as possible, the Institute argues that Ministers should be required to assess all possible consequences of laws coming in, with rules required to have externally validated cost calculations. This would represent an upfront cost to Whitehall’s operations, but hopefully avoid passing on unintended costs to the private and public sectors implementing the rules in full.

The free market think tank also says that Britain has lessons to learn from her fellow English language parliamentary democracies Australia and New Zealand. Publication of laws in the antipodean states are accompanied by explanatory memoranda, parliamentary debates and other documents designed to help the user understand the purpose and thinking behind the laws in place, as well as the politics of the Chamber during decisions. While debates prior to broadcast or written records of debate are not easily added to laws, new laws could see the addition of relevant information added from the Parliament’s extensive modern record keeping to ensure citizens are well informed well past the date of a law’s Royal Assent.

Report author Robin Ellison, a Visiting Professor at City, University of London, says:

“It has become unfair to expect citizens to understand the law. There is so much of it and it’s constantly changing — and, adding insult to injury, there isn’t even a reliable depository of the rules we expect citizens to follow. This severely undermines the rule of law and hamstrings businesses with huge red tape costs.

“Brexit offers a unique opportunity to simplify and improve our legal system, whilst saving money and improving access to legal information. There is a desperate need to both clarify what is the law, and reduce its complexity and length.”

Head of Research at the Adam Smith Institute Matthew Lesh, said:

“Covid has highlighted the dire consequences of lawmaking that is rushed, incoherent and easily misunderstood. We expect every citizen to follow the law, but make that practically impossible by its length, complexity and lack of depository. When even judges and lawyers struggle to identify the law you know there’s a problem.

“The constant proliferation of new laws, regulations and guidance is creating extraordinary burdens on citizens and businesses. For Britain to recover from Covid and succeed after Brexit there is a desperate need to cut the red tape that is strangling British businesses and make the law easily understandable by all citizens.”

Notes to editors:

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

The report Ignorantia legis: How the growing red tape burden undermines the rule of law and economic prosperity will go live on the Adam Smith Institute website at 10pm (UK time) on Thursday 8th April 2021.The report can be accessed via the link here.

Robin Ellison is a Visiting Professor in Pensions Law and Economics at The Business School, City, University of London, a consultant with Pinsent Masons, and author of numerous books on pensions law and on regulation.

How Coronavirus impacted law-making:

In total there have been 329 Coronavirus-related Statutory Instruments laid before the UK Parliament in 2020. There have been an average of eight per week since 6 March. Covid 19-related statutory instruments represented about a third of all SIs during 2020, using powers from 109 Acts of Parliament including the Saint Helena Act 1833, the British Settlements Act 1887 and the Colonial Probates Act 1892. Two hundred and twenty six were made under the ‘negative procedure’, so that they became law unless a motion against them was carried, which in any event requires the Government to grant time for such a motion to be debated. One hundred and forty five of the instruments breached the 21-day rule and came into force less than 21 days after they were laid, and 42 came into force even before they were laid.

Some of them were prepared so quickly that they had to be corrected within days. The Statutory Sick Pay (General) Regulations 1982 were amended twice within four days. On 2-3 September 2020 the ‘protected areas’ covered by the Health Protection (Coronavirus Restrictions) (Blackburn with Darwen and Bradford) Regulations 2020 were amended twice in 12 hours. The Health Protection (Coronavirus, Wearing of Face Coverings in a Relevant Place) (England) Regulations 2020 were amended by three different SIs made in two days on 22-23 September 2020.

Super duper deduction by dishy Rishi

In response to the Budget 2021, Deputy Director of the Adam Smith Institute Matt Kilcoyne spoke about some of the biggest changes announced.

On the headline grabbing super deduction, a policy the ASI has championed, and other rates reliefs:

"Rishi Sunak's super deduction will induce investment into Britain’s factories and help businesses bounce back and Britain’s economy boom as we leave the pandemic behind. We'd estimated at 100% full expensing would be worth over £2,214 per worker, going beyond that is a bold move to help the private sector build the recovery. It will benefit most those areas that have been left behind in recent decades. It is the most serious attempt to rebalance the economy a Chancellor has made and it is truly welcome.

"Rates relief and employment support will be welcome while the ability to operate and raise revenue remains suppressed even as we leave lockdown. But the success of vaccines means the economy will reopen and activity will return; the government cannot continue propping up our economy indefinitely. Moving forward, the strategy should be to get the state out of the way, by lowering taxes to encourage investment and cut red tape that hurts entrepreneurs."

But on the silliness of the Mortgage Guarantee:

"The Chancellor was right to say that the state should not be borrowing to pay for everyday public spending. But it’s hard to square that circle with a new commitment to guarantee mortgages of first time buyers. This is a Fannie Mae and Freddie Mac guarantee to boost the demand side — without a credible plan to boost supply of new homes in the places people want to live we’ll just end up with another housing bubble and the risk of boom and bust.

"Keir Starmer was right to remind the Conservative Party that the proper basis on which to make tax decisions is economics not the political cycle."

Media contact:

emily@adamsmith.org

Media phone: 07584778207

Archive

- May 2024

- April 2024

- March 2024

- February 2024

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- January 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- September 2013

- August 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

- March 2008

- February 2008

- November 2007

- October 2007

- September 2007

- May 2007

- April 2007