My word, you mean competition actually works?

Well, would you look at that! Apparently competition works to the benefit of consumers! Who could have possibly predicted that outcome?

Shop prices fell at the steepest rate for at least eight years last month as the popularity of discount stores among the middle classes helped to drive down the cost of clothing and consumer goods.

The overall price of items at the till fell by 1.8 per cent compared with June last year, with the price of clothes down by 13.7 per cent year-on-year.

The figures, compiled by the British Retail Consortium/Nielsen shop price index, show the fastest drop in prices since the trade association began compiling data in 2006.

It was also the 14th month in a row in which shop prices fell, easing the pressure on households where wage-earners have suffered pay freezes.

Yes, of course, the capitalists are straining every sinew to increase the profits that they make from our need for basic necessities such as food and drink. But in doing so they find themselves competing with other capitalists who would also like to like that pelf from our pockets. That competition then limiting the amount any one shop can charge and finally leading to falling prices for consumers.

Of course, a number of people have pointed this out before, starting with Adam Smith, Bastiat had things to say on the point and even Karl Marx got it. Monopoly capitalism is to be avoided for it is without that competition, for it is that market choice that makes such a system work to the benefit of consumers.

This is all obvious to us, the initiates, of course. But we need to continue to make a song and dance about it. Yes, there really are things that governments must do that cannot be done by other actors. Yes, there really are times that said government must intervene in the economy. But for the most part that intervention necessary is simply to ensure that competition is possible.

It's not necessary to ensure that competition is happening, only that it can. For a monopolist in possession of a contestable monopoly is unable to exploit that monopoly for fear of competition arising to contest it. It's not even necessary to have a level or even playing field, only to have an open one.

Worth noting the next time someone starts to complain about the monopoly of the supermarkets (as they do every few years, prompting yet another enquiry). Precisely because competition is forcing prices down we've obviously not got an exploitable monopoly here.

So just what is slow economic growth then?

This is slightly worrying:

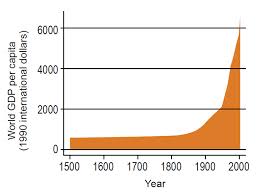

Just how difficult this has become was shown last week when the OECD released its predictions for the world economy until 2060. These are that growth will slow to around two-thirds its current rate; that inequality will increase massively; and that there is a big risk that climate change will make things worse. Despite all this, says the OECD, the world will be four times richer, more productive, more globalised and more highly educated. If you are struggling to rationalise the two halves of that prediction then don't worry – so are some of the best-qualified economists on earth.

World growth will slow to 2.7%, says the Paris-based thinktank, because the catch-up effects boosting growth in the developing world – population growth, education, urbanisation – will peter out. Even before that happens, near-stagnation in advanced economies means a long-term global average over the next 50 years of just 3% growth, which is low. The growth of high-skilled jobs and the automation of medium-skilled jobs means, on the central projection, that inequality will rise by 30%.

Not the predictions themselves, which come from this OECD report, but the interpretation that is put upon them. For it appears that Paul Mason, supposedly one of those employed to explain the world to us, is incapable of actually reading a report.

On the inequality point he's missed the crucial qualifier: "in-country" inequality. The report is actually telling us that the currently poor countries are going to catch up with the currently rich ones and that when they do, when they join us at the technological frontier, then their growth will be lower than it is during the current catch up phase.

That is, the prediction is that the vast gulfs of inequality between those living on a $1 a day and ourselves will be closed: yet Mason is concerning himself with that trivial 30% rise in inequality amongst ourselves, the already rich. It's absurd to be worrying that in-country gini will rise from, say, 0.30 to 0.39 while not celebrating the collapse of the global gini from 0.80 to 0.40 (made up numbers just for illustration). At least it's absurd if inequality is one of those things that you want to worry about.

There's another misunderstanding there, one which anyone who has actually read Piketty should understand for he explains it very well. Gross GDP growth, the size of the entire economy, is driven by two different things. One is the expansion of the population that is producing that GDP. The other is the efficiency with which each person is contributing to that GDP. The report is stating that the entire globe is just about to finish going through the demographic transition, as the UN and everyone else assumes it is. Thus population growth will not be contributing to growth after some few decades of the future.

3% (or 2.7%) growth without the demographic effect is not low or slow growth: this is fast growth. The economy doubles every 25 years or so but over the same number of people meaning that per capita GDP doubles every 25 years. This is not an historically slow level of per capita GDP growth. This is actually rather fast.

It's not the specific predictions that worry at all: it's that someone supposedly employed to explain such matters to us doesn't seem to understand the points being made. How did we end up in this situation?

One of the upsides of having a global elite is that at least they know what's going on. We, the deluded masses, may have to wait for decades to find out who the paedophiles in high places are; and which banks are criminal, or bust. But the elite are supposed to know in real time – and on that basis to make accurate predictions.

Well, yes, quite.

Voxplainer on Scott Sumner & market monetarism

I have to admit that I usually dislike Vox. The twitter parody account Vaux News gets it kinda right in my opinion—they manage to turn anything into a centre-left talking point—and from the very beginning traded on their supposedly neutral image to write unbelievably loaded "explainer" articles in many areas. They have also written complete nonsense. But they have some really smart and talented authors, and one of those is Timothy B. Lee, who has just written an explainer of all things market monetarism, Prof. Scott Sumner, and nominal GDP targeting. Blog readers may remember that only a few weeks ago Scott gave a barnstorming Adam Smith Lecture (see it on youtube here). Readers may also know that I am rather obsessed with this particular issue myself.*

So I'm extremely happy to say that the article is great. Some excerpts:

Market monetarism builds on monetarism, a school of thought that emerged in the 20th century. Its most famous advocate was Nobel prize winner Milton Friedman. Market monetarists and classic monetarists agree that monetary policy is extremely powerful. Friedman famously argued that excessively tight monetary policy caused the Great Depression. Sumner makes the same argument about the Great Recession. Market monetarists have borrowed many monetarist ideas and see themselves as heirs to the monetarist tradition.

But Sumner placed a much greater emphasis than Friedman on the importance of market expectations — the "market" part of market monetarism. Friedman thought central banks should expand the money supply at a pre-determined rate and do little else. In contrast, Sumner and other market monetarists argue that the Fed should set a target for long-term growth of national output and commit to do whatever it takes to keep the economy on that trajectory. In Sumner's view, what a central bank says about its future actions is just as important as what it does.

And:

In 2011, the concept of nominal GDP targeting attracted a wave of influential endorsements:

Michael Woodford, a widely respected monetary economist who wrote a leading monetary economics textbook, endorsed NGDP targeting at a monetary policy conference in September.

The next month, Christina Romer wrote a New York Times op-ed calling for the Fed to "begin targeting the path of nominal gross domestic product." Romer is widely respected in the economics profession and chaired President Obama's Council of Economic Advisors during the first two years of his administration.

Also in October, Jan Hatzius, the chief economist of Goldman Sachs, endorsed NGDP targeting. He wrote that the effectiveness of the policy "depends critically on the credibility of the Fed's commitment" — a key part of Sumner's argument.

But read the whole thing, as they say.

*[1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16]

Lost and loster

“So you’re telling me there’s a chance!” That is Jim Carrey’s reaction, in Dumb and Dumber, when the lady he fancies tells him his chances are like one out of a million. (The 33-second clip is here.) You’ve got to admire such optimism. May we classical liberals find it when we ponder the chances of seeing a turn toward classical liberalism.

The prospects are enhanced by understanding the situation. But currently we are still stuck in the ruts that were worn into our culture from 1880. A hard look at the period 1880-1940 might inspire, not a comedy, but a tragedy: Sad and Sadder.

But there’s still a chance, so chin up. At the end of Dumb and Dumber, Carrey does not get the girl, but he and his friend carry on in good cheer.

Our movie would be called Lost and Loster. “Lost” not as in “lost cause,” but as in “lost children.” Our civilization has gone astray and is now bewildered as to place and direction. That is the theme of the new website, Lost Language, Lost Liberalism, nicknamed 4L.

With governmentalization on autopilot, with the center-left dominating much of the media, schooling, academia, and other cultural institutions, with the entrenchment of government as big, suffocating player, it is no surprise that many people who fancy themselves “liberal” are doing some soul searching. Edmund Fawcett’s 2014 book Liberalism: The Life of an Idea demonstrates such soul searching, if not soul finding.

What makes a liberal? To answer that question, it is good to learn about how the term “liberal” first arose as a political term. Here, think Adam Smith (as I explain here). Then, we also need to understand how from 1880 the meaning shifted—the theme of Lost Language, Lost Liberalism – 4L.

4L shows that English-language discourse underwent a watershed change during the period 1880-1940. 4L studies the changes in the meaning of words, and suggests that these changes played an important role in the decline of classical liberalism. Ten central words are treated: liberal(ism), liberty, freedom, justice, property, contract, equality, equity, law, and rights.

Compendia of quotations show the debate over the meaning of each word. The site also features other forms of evidence, including ngrams and copious testimony about generational shifts.

I am honored that the Adam Smith Institute has chosen to partner on the project; the Press Release from ASI can be found here.

The chances of recovering Adam Smith liberalism depend on understanding the course of the past 250 years. The 1880-1940 act is especially sad and casts a long shadow. But there is still hope that we’ll find our way to the true path of liberalism.

Did you know that the public health campaigners are complete loons?

Well, if you didn't know that the public health campaigners are complete loons then perhaps this will help to persuade you. The European Union is taking the next step in reforming the entirely absurd sugar regime, making it marginally less awful. The public health wallahs are shouting that this might make sugar cheaper, to the point where everyone will explode from eating too much of it. No, really:

Controversial agricultural reforms by the European Union could cause sugar levels in food and drink to rise, experts have warned.

Campaigners said it was “perverse” that the EU was planning to lift sugar production quotas at a time when health authorities are advising people to reduce their consumption of the ingredient.

Under the current system production of sugar within the EU is restricted to 13.3 million tonnes a year. However the quota is due to be scrapped in 2017 as part of a series of reforms to the Common Agricultural Policy.

The move is expected to make sugar cheaper for food and drink manufacturers, prompting fears it will encourage them to use rising levels of the ingredient. Dr Aseem Malhotra, science director of Action on Sugar, a campaign group, said it would be “disastrous” for public health.

Oh dear.

They've really not understood what's going on here at all.

In the nightmare world of EU agricultural policies the abolition of quota does not mean that prices are going to fall. For what actually happens is that if you grow sugar beet then there's two prices which you can sell that deformed mangelwurzel to the processor at. One, a guaranteed one, much higher than a free market price, is only available if you have quota to go with your sugar beet. The other price is very much lower than a free market price and almost no one ever tries to grow beet without quota as a result.

The important point about the abolition of quota is not that it abolishes quota. It is that if there is no quota then beet with or without quota cannot gain that guaranteed price. Thus the price on offer to Europe's sugar beet growers is going to fall: all other things being equal we'll thus have less beet being grown. And thus less sugar being taken into storage and then subsidised by the EU when it is later dumped on the food manufacturers.

The abolition of quota will lead to less sugar being produced. And the public health campaigners are arguing against the abolition of quota to stop less sugar being produced.

Go figure.

On the idea of the three day weekend

The idea of reducing the working week raises its head again. This time it's the idea that we should have a three day weekend:

Professor John Ashton, president of the UK Faculty of Public Health, caused a stir this week by advocating a four-day working week. This would improve our mental and physical health, reduce stress and we would all "enjoy ourselves more".One reason to bring in a four-day week is that we work the longest hours in Europe.

Sadly this is not true, we do not work the longest hours in Europe. We might work quite long hours at paid, market, work this is true. But in return we do rather less unpaid, household, labour. The net effect of this is that we have more leisure hours than much of Europe does.

And there's a good reason why this is so too: the division and specialisation of labour.By doing market work we are able to do that dividing and specialisation which, as Adam Smith pointed out, allows there to be greater productivity. Household labour can generally only be divided between the two adults in a household: obviously less efficient than being able to divide and specialise with the 7 billion in the global economy.

By organising ourselves so that we do more market work and then purchase in more of that household labour (in the form of drip dry shirts, washing machines, vacuum cleaners, microwaves, prepared food and so on) we are thus able to have a higher standard of living while also enjoying more leisure.

We have also been doing more of this as the decades pass. Leisure hours continue to rise as household labour hours drop away.

But let's imagine that we really do want to increase the days spent in leisure as a matter of public policy rather than as a matter of personal choice. The obvious solution is to nationalise the power industry again, put the unions in charge of it and then get Heath back into No 10. We all had four day weekends back then and that worked out really well, didn't it?

How not to read a report, brought to you by Geoffrey Lean

A lovely example of how to propagandise rather than actually report from our Geoffrey Lean over at the Telegraph. Things are terrible and only going to get worse, of course:

Ours is the first generation than can largely take plentiful, cheap food for granted. Now, report after report is suggesting it may also be the last.Two days ago, a Ministry of Defence study of “global strategic trends” raised the spectre of global demand outstripping supply over the next 30 years. And two days earlier, a Commons committee warned that Britain’s own food security is imperilled.

Prices have been rising twice as fast as general inflation and appear to be accelerating. The MoD report suggests that they could eventually settle at twice their present level.

That's not, quite, what the report actually says. What it does say is this:

By 2045, food production is predicted to have increased by nearly 70%, to feed a larger and more demanding population13 – and it is possible that demand could outstrip supply. Some types of consumption are likely to grow particularly strongly. As affluence grows in the developing world, the demand for more protein-rich diets is also likely to increase. China, for example, has seen meat consumption increase by 63% between 1985 and 2009, and this trend seems likely to continue.14 Pollution and soil erosion are likely to adversely affect agricultural land – some estimates assess that, globally, as much as 25% of agricultural land is already degraded.15 Climate change will almost certainly have adverse effects on some agriculture, but may open up new areas for cultivation, with positive impacts on particular crops in certain regions. On balance, even though the quality of some areas is likely to have been degraded by 2045, the global arable land area is projected to remain relatively constant (estimates range from a 10% decrease to a 25% increase),16 with some potential increases in crop productivity in the high latitudes, and decreases across the tropical regions.17 Furthermore, warming, acidification and overfishing also threaten to reduce the amount of food that can be harvested from the oceans. Estimates of future food prices are highly varied and may be more volatile, although most projections indicate a general increase.18 Analysis by the International Food Policy Research Institute suggests that average prices of many staple grains could rise by 30% even in the most optimistic scenario.19 Disruption, and possibly congestion, of global trade routes may lead to sharp increases in food prices – particularly in those countries dependent on food imports. When the effects of climate change are taken into account, the price increase above present levels could be as much as 100%.

And when we go and look at that source report we find something very interesting.

If climate change is bad and population growth is high then the price of maize "might" rise by 100% in real terms (ie, after the effects of general inflation). Note, not "food" but "maize". The price, even in this worst scenario, of wheat might move by 30%.

However, note also one of the drivers of that food price rise: that people are getting richer and thus are able to have (ie, there is effective demand for) a richer and more varied diet. And whether food is "cheap" or not rather depends upon both the price of food and also the incomes of those trying to purchase said food. And even in that worst case scenario the incomes of the poor of the world (obviously, the people we're actually concerned about here, the change in the price of maize is going to make near no difference at all to rich world people like ourselves. Tuppence on a pack of cornflakes is too trivial to worry about for us.) rise faster than the price even of maize over the 2000 to 2050 time period being studied.

That is, yes, food rises in price but it also becomes cheaper, more affordable.

It makes sense that the MoD found this, that the original report found this, for it is also the same result Oxfam has found. Precisely because it is not a "shortage" of food, nor climate change, that is the major driver of future food price increases. Rather, it's that the poor will be getting rich and be gaining access to that petit bourgeois pleasure of three squares a day, some of them even with a little meat in them.

This is a problem, if you want to describe it as a problem, of the great success of the neoliberal, globalised, world economic order. Finally, for the first time since the invention of agriculture, the poor are able to eat well. This pushes up food prices, sure, but only and exactly because food is becoming more affordable for all.

We find it very difficult indeed to describe this as something we ought to worry about. More an occasion to get out the bunting and the flags really, time perhaps for Breughel-like scenes of the yeomanry feasting and drinking as we celebrate the good fortune of billions of our fellows.

Another bonkers regulation from the EU again

It appears that the European Union is about to foist upon us yet another near insane regulation:

It appears that the European Union is about to foist upon us yet another near insane regulation:

Worse still, after a decade and more of needlessly increasing the cost of waste disposal, to the detriment of other public services, the European Commission has today produced a new legislative proposal which takes us into altogether new territory.

According to its press release, it plans to set a new target for recycling, requiring 70 percent of all municipal waste and 80 percent of packaging waste to be recycled by 2030, and totally to ban the landfill of recyclable waste by 2025, aiming "to virtually eliminate landfill" by 2030. At most, it will accept an irreducible minimum of five percent of waste, that cannot be recycled.

The institution seems to be in the grip of the misapprehension that more recycling is, in and of itself, a good thing. This is incorrect.

Some recycling is obviously and clearly a good thing: you can tell this because you make a profit by doing it. Melting down old cars to make new ones, collecting copper scrap, smelting old gold fillings to make new ones (yes, it does indeed happen) make profits. This is an indication that the activity itself has added value: we are all richer as a result of this having been done.

There are also things that it would be insane to try to recycle. It's technically feasible, if you expend enough energy, to turn concrete back into cement. But it would be absurd to do so: better to bake some more cement.

Then there's a third class: things that are not profitable to recycle themselves but which we would like to for other reasons. It's not profitable to recycle most radioactive material but we'd also rather not have it lying around the countryside. Thus recycling it, even at a direct loss, might be a good idea for those more general reasons.

It's important to have these three types in mind. In terms of household and general waste, recycling the metals in them does make sense financially and so they come under that first type. And it's possible to argue that all of the other waste should be recycled for that second reason. We're running out of landfill for example, or we're running out of "resources" with which to make new stuff. But neither of those things is actually true. We've no shortage of suitable holes in the ground only of ones that anyone will licence. And there is no general shortage of "resources" at all. And, given that magic of markets thing, those that are in short supply are already in that first type of things worth recycling as their price is high.

We thus end up, as a result of the zealotry of some in the political system, with regulations like these new ones. Using incorrect type 3 arguments to force us into type 2 recycling, the type that makes us all poorer.

An unpublished letter to the LRB on high frequency trading

Lanchester, John. "Scalpers Inc." Review of Flash Boys: Cracking the Money Code, by Michael Lewis. London Review of Books 36 no. 11 (2014): 7-9, http://www.lrb.co.uk/v36/n11/john-lanchester/scalpers-inc Dear Sir,

It is striking for John Lanchester to claim that those who believe high-frequency trading is a net benefit to finance (and by extension, society) "offer no data to support" their views. Aside from the fact that he presents such views in the line of climate-change deniers, rather than a perfectly respectable mainstream view in financial economics, it doesn't really seem like he has gone out looking for any data himself!

In fact there is a wide literature on the costs and benefits of HFT, much of it very recent. While Lanchester (apparently following Lewis) dismisses the claim that HFT provides liquidity as essentially apologia, a 2014 paper in The Financial Review finds that "HFT continuously provides liquidity in most situations" and "resolves temporal imbalances in order flow by providing liquidity where the public supply is insufficient, and provide a valuable service during periods of market uncertainty". [1]

And looking more broadly, a widely-cited 2013 review paper, which looks at studies that isolate and analyse the impacts of adding more HFT to markets, found that "virtually every time a market structure change results in more HFT, liquidity and market quality have improved because liquidity suppliers are better able to adjust their quotes in response to new information." [2]

There is nary a mention of price discovery in Lanchester's piece—yet economists consider this basically the whole point of markets. And many high quality studies, including a 2013 European Central Bank paper [3], find that "HFTs facilitate price efficiency by trading in the direction of permanent price changes and in the opposite direction of transitory pricing errors, both on average and on the highest volatility days".

Of course, we should all know that HFT narrows spreads. For example, a 2013 paper found that the introduction of an algorithmic-trade-limiting regulation in Canada in April 2012 drove the bid-ask spread up by 9%. [4] This, the authors say, mainly harms retail investors.

The evidence is out there, and easy to find—but not always easy to fit into the narrative of a financial thriller.

Ben Southwood London

[1] http://student.bus.olemiss.edu/files/VanNessR/Financial%20Review/Issues/May%202014%20special%20issue/Jarnecic/HFT-LSE-liquidity-provision-2014-01-09-final.docx [2] http://pages.stern.nyu.edu/~jhasbrou/Teaching/2014%20Winter%20Markets/Readings/HFT0324.pdf [3] http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1602.pdf [4] http://qed.econ.queensu.ca/pub/faculty/milne/322/IIROC_FeeChange_submission_KM_AP3.pdf

Sometimes it's the little things that matter in tax systems

A little story that helps to explain why the Greek economy is in the depths that it is:

But as happens so often in Greece, the bureaucrats had other plans. In a country where you are viewed favorably when you spend money but are considered a criminal when you make it, starting a business is a nightmare. The demands are outrageous, and include a requirement that the business pay taxes in advance equal to 50 percent of estimated profit in the first two years. And the taxes are collected even if the business suffers a loss.

I recall something similar from time in California: you must put up a bond for the amount of sales tax that you will be collecting in the future. Plus a fee for the privilege of opening a business in that great state.

This just isn't a sensible manner in which to be running a tax system. Yes, of course, tax must be collected for there are things that we really do need government to do (even if not as many as they attempt to do). And it's probably a good idea to have certain measures in the tax law to make sure that people don't dodge said righteously due taxes. But to add to the capital requirements for starting a business in this manner is simply ludicrous. It's a difficult enough, and expensive enough, enterprise at the best of times. Rather better, therefore, to leave the possibility of avoidance there in the process of leaving some room for a business to even start.

Our own dear HMRC seems to have cottoned on to this point: it's no secret at all that many new firms bolster working capital by delaying PAYE tax payments to the Treasury. It's not exactly desirable in the scheme of things but when looked at in the round better that such companies survive their growth pangs than that HMG gets its money on the nail.