It's entirely possible to take a number of different views on the merits or not of the plain packaging proposal for cigarettes. An entirely unwarranted intrusion into commercial freedom by the usual prodnoses perhaps, a vital public health policy as some profess to believe. That we tend toward the former view while the prodnoses the latter isn't the point at issue here though. The interesting question is why is there such pressure for the law to be passed immediately?

The government is under fire from politicians on all sides amid fears that legislation forcing tobacco companies to sell cigarettes in plain packs will not be introduced before the general election.MPs from all three main parties, including the Tory chair of the health select committee, have warned time is running out to introduce a law that would see cigarettes sold in unbranded packs, a measure experts claim would deter young people from smoking. .... In a letter to the health minister Jane Ellison, the Tory chair of the health select committee, Sarah Wollaston, warns “unless the government makes a final decision soon, time will run out for a debate and vote before the election”.

A failure to implement the legislation to introduce what Wollaston describes as “one of the most important public health reforms of the last 20 years” would, she argues, “be an unnecessary and serious setback for public health policy, if the clearly expressed will of parliament were now to be frustrated”.

A failure to introduce the measure would cause tension in the coalition. Lib Dem health minister Norman Lamb said: “This is a landmark public health issue. I want the government to act while we have time before the election. From a Lib Dem perspective, we want this legislation to go through and that’s what we will fight for.”

In April, Ellison confirmed the government’s intention to “proceed as swiftly as possible” on plain packaging, noting evidence that it would “very likely have a positive impact on public health”.In a letter to Ellison, Labour’s shadow health minister, Luciana Berger, called for guarantees that the legislation would get enough parliamentary time to become law. Berger said that if the measure was not voted on before the election “it would be seen as a major victory for the tobacco industry”.

Why the rush? After all, whoever actually wins the next election there will still be a Parliament, one that can and will pass any number of laws.

The answer is contained in this from Chris Snowdon:

Two years on, we now have enough data on tobacco sales and smoking prevalence to say with confidence that plain packaging has had no positive impact.

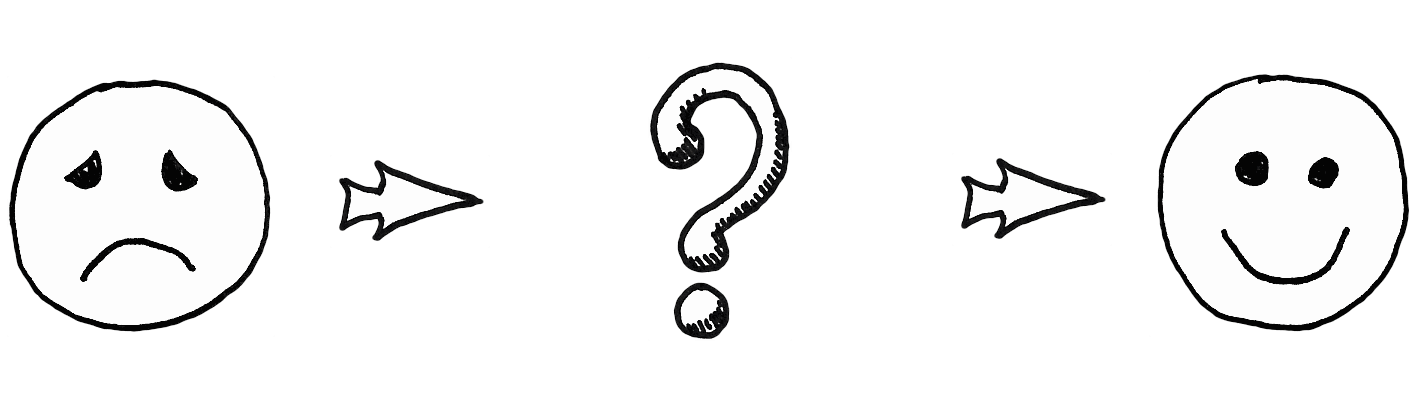

The reason they're leaping up and down and screaming now, Now! NOW! is that the evidence of the effectiveness of the idea is now coming in. And it simply doesn't work: it does not do what it is claimed it should do. Regardless of what you think about the desirability of curtailing commercial freedom in the cause of reducing smoking rates, plain packaging simply doesn't reduce smoking rates. But there's people emotionally and politically invested in the idea so they insist that this must be imposed before anyone has a chance to actually consider this evidence.

Aren't we all just so ecstatically happy at the way we are governed?