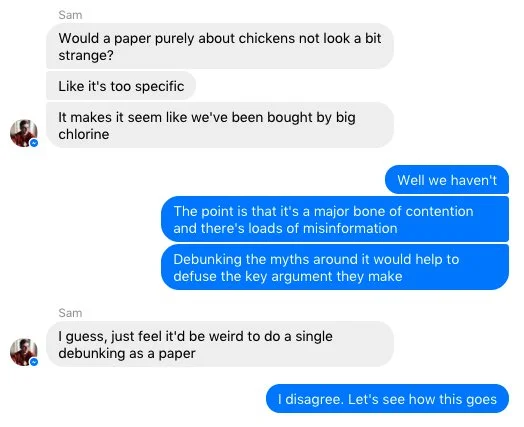

The most common response we got to our Monday ASI paper on chlorine chicken is that our view was driven by a monetary interest. It wasn't: we don't accept any funding for specific projects—everything comes out of general funds—and as far as I know none of our general donors stand to benefit from such a move either. The actual inspiration for the paper came in a facebook chat in January between ASI staff, screenshotted below. But the interesting question is: would it matter if we did get our funding that way?

There is a popular view, perhaps derived from a Marxist-materialist worldview, or more mundanely from a economicsy self interest perspective, that opinions are just outgrowths of economics. Everyone cynically supports the perspectives that stand to contribute to their narrow, mostly financial, self interest. The rich like property and the poor like redistribution. Sometimes, in a more vulgar version of the theory, the holder will argue that self interest is for thee, but not for me, and all views except theirs are a sort of false consciousness.

It's certainly one model of the world. But as Sam says very well here: political error is driven by complexity, not greed. In fact, most of the evidence on public choice suggests that people are pretty altruistic and "sociotropic" in their political behaviour. People are ignorant, and that causes great problems. But by and large they are not corrupt or atavistic. I think that jumping to motivational games suggests people are unwilling, or unable, to try and understand the question at hand, and thus need some sort of crutch to explain beliefs, rather than being open to the possibility of honest disagreement.

Look: even if I were in favour of this trade deal step due to Big Chicken or Big Chlorine payouts, how could that affect my work? Scientists working in lab studies declare conflicts of interest because their work is partly dependent on their probity. The recent massive scandals around p-hacking, publication bias, and even straight scientific fraud underline why this is important.

But when I write something I'm not asking anyone to trust me as an authority, and I use publicly available data and evidence created by people completely unrelated to me. This is by definition transparent, doesn't pose problems in the way Monsanto-funded pesticide research might. Does getting payment from corporate lobbies or interested parties make me more convincing? Does it find me better data or cleaner logic? It's hard to see how it could possibly affect the situation in any way.

Interest groups fund people who support their interests. If they didn't fund them, they'd still support those interests, but with less money. If John Stuart Mill were alive today then tobacco firms, brewers, distilleries, and Coca Cola would probably give him cash. But he would be defending the Harm Principle either way. True Believers have a comparative advantage over shills in advocacy.

The only possible reason someone could ask for my motivations is that they can't be bothered to tackle the argument. Perhaps they are even looking for reasons to dismiss evidence that conflicts with their existing worldview (we are all prone to this, because it hurts to admit you are wrong). But neither do their motivations tell me that their conclusions are wrong, just as the fact the IFS gets their funds mostly from governments doesn't tell me they're wrong, and the fact that CLASS is funded by unions doesn't tell me that they're wrong.

It's simple minded to jump to money as an explanation for all evils. Sometimes people are just wrong, because social, political, and economic questions are often hard to answer.