What’s the best idea in politics that nobody’s ever heard of? I think it’s what’s called “full expensing”, a tweak to the corporation tax rules that could eliminate a lot of the damage that tax does. It’s obscure in Britain, but new evidence is beginning to show that it might just be the single best tax reform the government could do to raise productivity and growth.

Basically, “full expensing” means letting businesses deduct the cost of any investment they do from their corporation tax bills straight away. At the moment, for ongoing expenses like pens and paper, you can do that already. But for longer-term expenses, like investments in a new building or in new machinery, you can only deduct a small fraction of the cost of investment each year over the accounting lifespan of that investment.

The problem is that this means that, in fact, businesses don’t actually get back the full cost of the investment. £100 today is worth more than £100 in ten years because of inflation and the things (like other investment) you could have done with the money in the mean time. The longer the write-off time, the less of the cost of the investment you can write off.

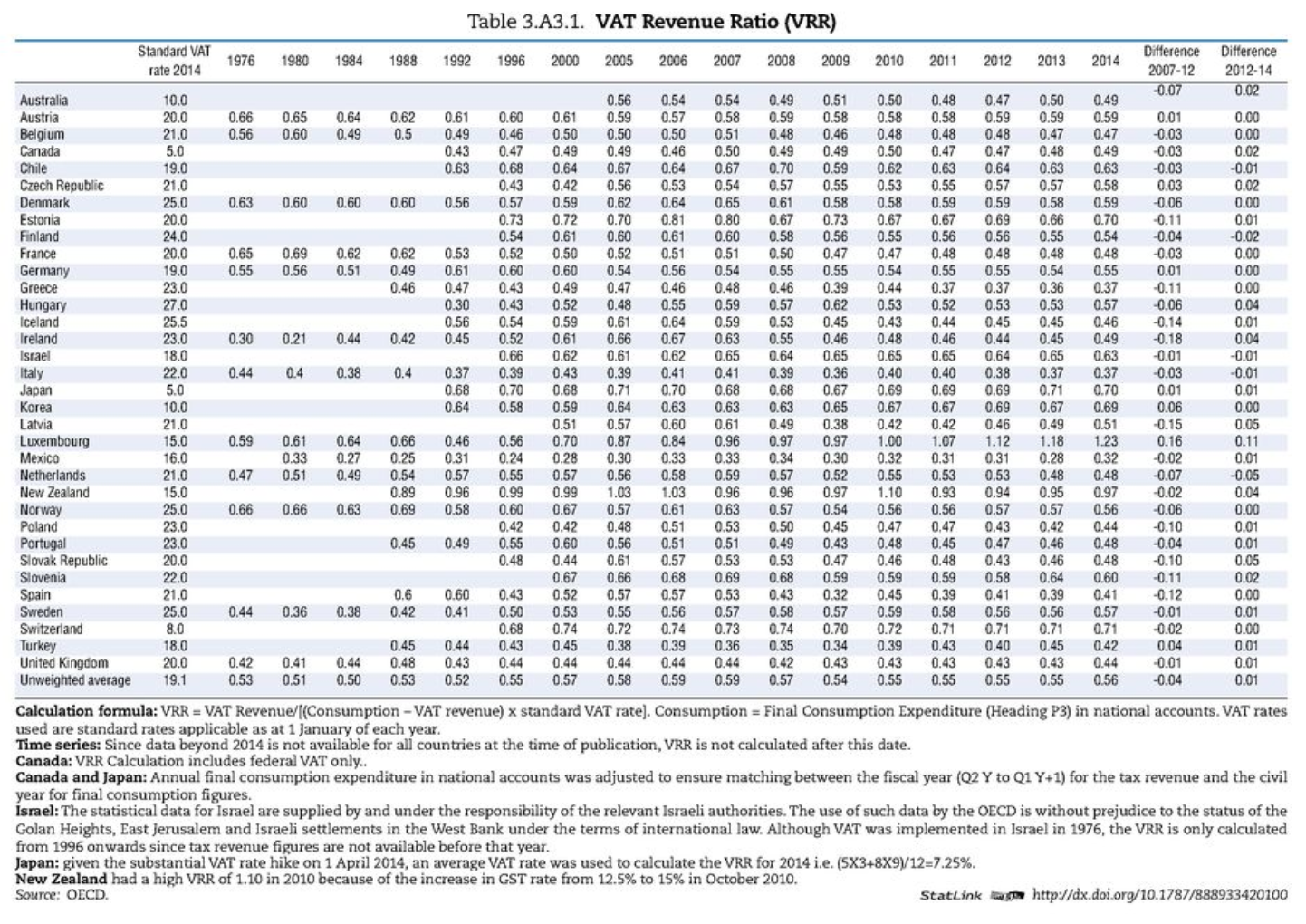

As the Tax Foundation’s excellent Kyle Pomerleau explains here, between 2008 and 2013 the UK reduced the value of deductions for machinery and property – from 87.5 percent to 84 percent for machinery, and from 59.2 percent to zero for industrial buildings. As Kyle says, “This means that corporations cannot write off the cost of investing in buildings over time at all!” (Kyle points out that this blunted the economic effects of the reductions in the headline corporation tax rate under the coalition.)

You may be able to see why this matters quite a lot. If we allowed businesses to deduct their investments from their tax bills immediately, we’d effectively be allowing them to deduct the full cost of those investments.

Now for the evidence. If our theory tells us what might happen, what does our evidence tell us what actually did happen? Two new papers, one from the US and one from the UK, suggest that full expensing could have very big positive economic effects.

The first, from Eric Ohrn, looks at states that adopted an full expensing policy temporarily in 2002 and 2008. It uses what’s called a ‘difference-in-differences’ technique which controls for the fact that states did not adopt these policies randomly – states starting from a lower level may have been more likely to adopt this sort of policy, for example.

Ohrn’s results are staggeringly large. Full expensing increased investment by 17.5% and grew wages by 2.5%. Five years after the full expensing window had been available, states that adopted it had 7.7% higher employment levels than comparable states that did not adopt it, and 10.5% higher production output (which means lower prices too, though not necessarily concentrated in that state).

This is such a large result that it sounds unbelievable. But it’s consistent with a paper from last year that looked at UK evidence too, from the introduction of a policy that allowed small- and medium-sized firms to write off more of their investments in plant and machinery early on – not full expensing, but closer than before (40% in the first year instead of 25%). A change in what allowed a firm to count as an SME gives the paper a quasi-experimental event, where they can look at firms that did not qualify one year and did the next, and compare them to firms whose status did not change.

Access to more generous capital allowances increased investment by 11% (2.1%–2.6% percentage points). That’s roughly consistent with the other paper (where the policy was more generous), and still shows a large effect. Both seem to suggest a high elasticity of investment, where every extra pound raised causes much less investment to take place.

Finally, Estonia's system of full expensing has helped to give it the most competitive tax system in the developed world, even though its headline rate of 20% is higher than many other's, including the UK's. In the four years after introducing full expensing in 2000, along with other reforms to its corporation tax, investment growth was 39 percentage points higher there than in its Baltic neighbours.

Full expensing sounds technical and obscure, and is unlikely to win votes on the doorstep. It is not the sort of policy to win headlines. But its effects seem like they could be very large, and could deliver the sort of jobs and wages boost that would be popular. For a government that seems desperate to boost investment, especially investment in machinery-intensive sectors like manufacturing, it could be one of the few policy silver bullets it has left.