QE cannot both boost asset prices and wreck pensions

Quantitative easing is complex and difficult to understand—economists aren't even sure exactly if and how it works. It would be unreasonable to expect non-economists to fully grok its workings even if journalistic explanations were clear and overall true. Since economics journalist's explanations have been largely lacking (including, I expect, my own, when I was an econ journo), it would be very difficult for others, further removed from economics, to 'get it'. Still, this piece on Bank of England staff pensions from Richard Dyson, the Telegraph's personal finance editor, has a number of problems which I can't help but try and correct. Dyson argues that (a) the Bank of England's pension scheme is 'eye-catchingly-generous'; (b) final salary pension schemes have died in the private sector substantially because of the BoE's quantitative easing (QE) programme; (c) QE has harmed pensioners; and (d) the Bank's policy of investing in pension pots in bonds is too low-risk and earns insufficient returns. All are substantially false.

Firstly, the Bank of England's 'generous' pensions are (as Dyson notes at the end) to compensate for lower regular and bonus pay than the jobs that very smart and qualified BoE staff could get elsewhere. Dyson might be right that this, overall, is larger in the public sector, indeed there is a literature suggesting that the total pay + benefits for public sector workers of a given skill and experience level is higher than for private sector workers. But the simple fact of a relatively large fraction of that coming out in pensions doesn't tell us anything on that point—and I would wager that the Bank is run much more like a profit-maximising private organisation than most arms of the state.

Secondly, as we see in Dyson's graph, private sector final salary/defined benefit pension schemes have been declining since a peak in the mid sixties, with about half of the drop coming in the 70s and about half in the 90s. Practically nothing has happened to them since the introduction of QE.

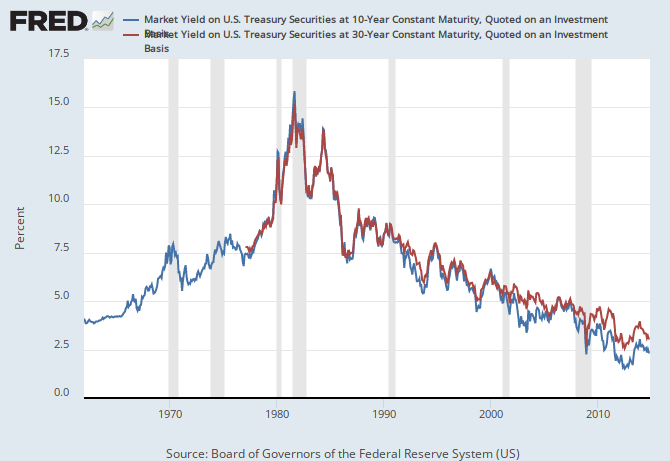

Which brings us onto thirdly: QE boosts asset prices. QE raises the value of stock markets and bonds and pretty much all securities that people hold in their pensions. QE makes pensioners better off, like it makes pretty much everyone better off. Yes, you've heard that QE leads to lower interest rates. I'm not sure that's true. Remember we are at the bottom of a 30-year slide in real risk-free interest rates, and it seems much less clear that QE is a big factor.

Finally and fourthly, is the Bank too careful with its money? I don't actually have an answer here but I'd suggest that Dyson (and Ros Altmann, who he quotes on this) are a tad too confident. If the Bank invested in riskier equities or emerging markets or whatever, then sure it would be likely to earn a higher return, but would the Bank's critics really give it any slack if these investments went bad, as they'd be more likely to do? I don't really know how the BoE should invest its pension fund, but it seems to me that they are going to be damned if they do and damned if they don't.

So I think we should leave off the Bank and its pension scheme, whatever issues we might have with its macroeconomic management. It pays high pensions to attract talent. It didn't cause the decline in private sector final salary pensions (I think government is probably to blame for that). It's not to blame for high interest rates and it has helped those with pension investments. And we probably don't have the right info to choose its investment portfolio for it.