We Can’t Just Print More Money

Some truth-telling from the Member for Great Yarmouth:

‘By a continuous process of inflation… governments can confiscate secretly and unobserved an important part of the wealth of their citizens.’

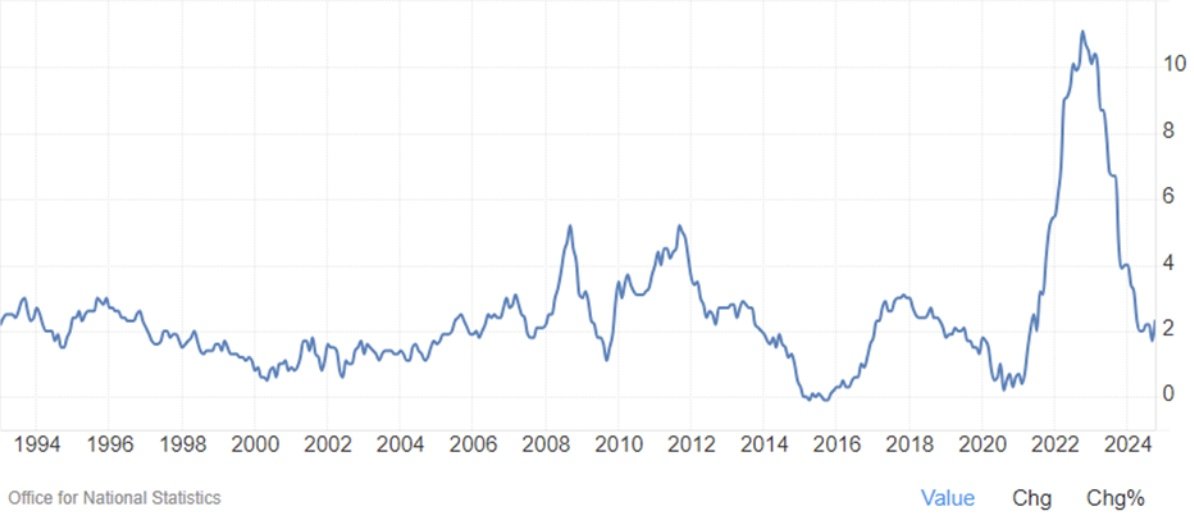

The reminder is unwelcome. £450 billion of money-printing during the Pandemic helped inflation reach 11.2% in October 2022, a rate which remained stubbornly high until April 2024. The inflationary surge wiped out 16 years of prior earnings growth and partly cost the Conservative Party 251 seats in the July election.

While governments can be hired and fired by the electorate (regardless of their genuine culpability), the Bank of England is above such tedious concerns as ‘accountability.’ Nonetheless, their power to afflict economic damage – in the form of mass-scale coordinated currency debasement – is very real indeed.

Ever since the end of the US Dollar’s convertibility to gold in 1971, the world has transitioned to a system of fiat currencies based entirely on trust. This has made the responsibility of central banks to maintain confidence in their currency more important than ever. Without a belief in the underlying economic and political institutions that guarantee the value of money, modern currency ceases to be a viable option. It follows that central banks exercise some caution when playing fiddle with the money supply.

In 2001, the Bank of Japan chose to do away with such caution, using Quantitative Easing formally for the first time. With the economy stuck in a rut of deflation and low growth, it was the ideal conditions for this monetary innovation to work. The central bank’s injection of ¥35.5 trillion of new funds promised to boost the availability of credit, spark a consumption boom and in turn revive Japan’s stagnant economy.

But this plan ignored what had been precisely the cause of Japan’s ‘lost decade’ in the 1990s, to which the anxious central bankers were responding. A Keynesian approach to monetary policy between 1986 and 1990, which saw the money stock grow at a rate of 10.5% per year, had created a bubble economy with inflated asset prices. When it burst in 1991, deflation was the necessary mechanism through which the economy was rebalancing – allowing wages and production input costs to fall in an overheated economy. So, given that deflation was a process correcting for prior-Keynesianism, the solution was not more Keynesianism. Ultimately QE stymied the natural self-correcting mechanism of the economy, while leaving the country’s underlying problems completely the same. As China’s economy of over a billion people opened up, there was naturally going to be downward pressure on Japanese wages. Meanwhile, preventing the population from ageing and shrinking is sadly beyond the remit of monetary policy. Growth continued to be anaemic and the economy has remained a byword for stagnation in decades since, only recently showing signs of change.

After the 2008 financial crisis, Britain, along with America and the Eurozone, imported this exercise in monetary expansion to hasten its recovery, gradually pumping £435 billion into the financial system. We soon found that neither artificially low interest rates nor the purchase of corporate bonds will revive investment levels when ‘animal spirits’ are in the doldrums. But that didn’t stop inflation shooting above the target range.

Keen eyed observers will notice how rounds of QE in 2009 and 2020 are met shortly after with sharp spikes in inflation. What makes this more jarring is that prior to these interventions, inflation was largely under control, routinely hitting within the targeted range of 2%+-1%. While correlation n’est pas toujours suggester causation, there’s some pretty unassailable logic at play here.

Namely that QE creates new money, but not new wealth. More money circulates the economy, but with no increase in goods and services produced, inflation is the inevitable result. This is the hidden tax Mr Lowe goes onto describe in his speech. The vector which erodes the value of savings, creates harmful uncertainty for business, devalues the currency and increases imported costs of production.

As Mr Lowe rightly points out: ‘Taxes should be transparent, justifiable and simple. The cost of government should be covered by taxes alone.’

QE is just another stealth raid by the government imposed when it can’t live within its means. The irony is that the increase in inflation caused by QE, often prompts the central bank to raise interest rates (hence skyrocketing mortgage bills we’re still experiencing now), which slows economic recovery, as demand for borrowing falls and with it, investment. How puzzling that the UK economy is now going through ‘stagflation’, and debt interest payments have shot up to a 16-year high as sticky inflation prevents interest rate cuts.

So Mr Lowe’s recently introduced bill to ban QE without the express consent of Parliament is a welcome development. The measure should not be a get-out-of-jail-free card for our institutions, when they fail to meaningfully address our underlying growth barriers.