Hard-headed misunderstandings

Today I was on BBC World talking about obesity. My opposite number Tam Fry pointed out that the obese cost the rest of us while they are alive through their use of the NHS and other state services. I pointed out that they don't totalled up over the lifetime because the obese die earlier and take much less out in pensions and end-of-life care.

In saying this I was trying to make the point that this doesn't mean we shouldn't care about obesity, or that it's (heaven forbid!) a good thing because they cost the rest of us less. Are people so obsessed with the government's balance sheet that pointing out the obese cost the government less by dying earlier seems equivalent to saying I want them to die earlier?

My point was that most of the costs of obesity are to the individual, not to society. There is no harm principle argument here that we should intervene into their lives because they are hurting others. The case for intervening into the lives of the obese would be to make them better off, because say, obesity shortens their lives, makes them more likely to get diabetes, or makes them less happy.

Now I don't think there's never a case for paternalistic intervention (we can all think of crazy thought experiments) but I do think we should be very careful before we decide we can run someone's life for them. That's because usually the government gets things wrong when it tries to plan on other people's behalves.

Most people would not like to live in a society where people are not at least in some cases free to take the steps that lead to obesity—even if overall they'd prefer there were fewer obese people. Most people would find it rather chilling to have a society where the diets and exercise regimes of the obese were centrally managed and rigidly enforced.

By contrast, the Mexican 'squats for bus tickets' scheme, though very likely to be ineffectual, is probably not such a bad idea.

Economic Nonsense: 7. New technology destroys jobs

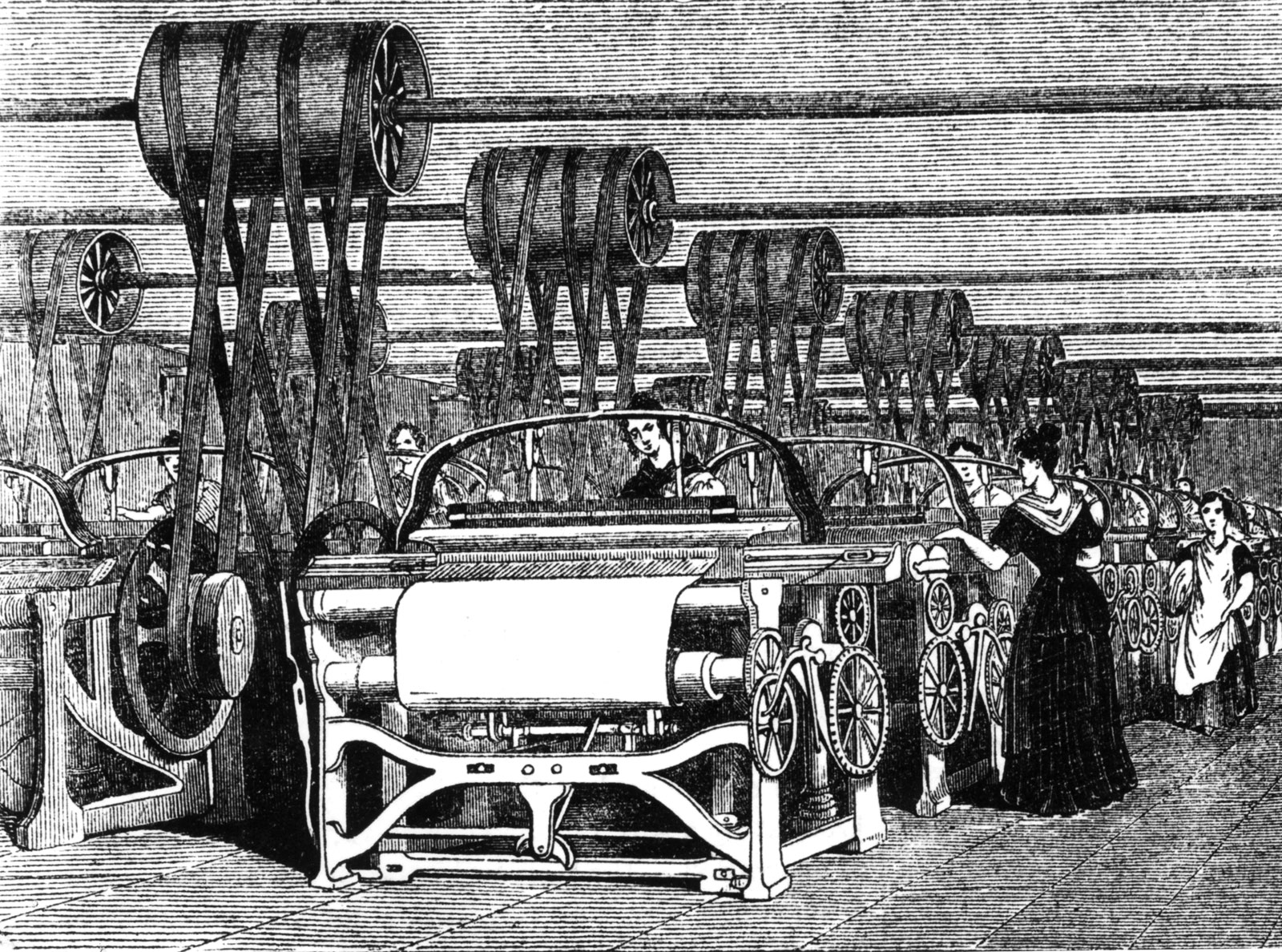

This is partly true, but in a misleading way. New technology has often displaced people from their traditional occupations, but in doing so it has created the wealth that has enabled vastly more jobs to be created than were lost. Agricultural technology meant far fewer jobs for farm workers, but it also meant cheaper, more abundant food that left people able to afford things sustained by newer jobs. A similar effect occurred with early textile technology. Spinners and weavers were displaced, but cheaper, mass-produced textiles enabled people to afford other things that led to other jobs. This is how economic progress is made. People develop new products and new processes that people prefer over what they were doing before. Jobs are lost and more are created as part of that churn.

Voices are often raised against the change, especially by those affected, with calls for restrictions to be imposed on new technology in the name of protecting jobs. Sometimes it has led to violence. The Luddites smashed machinery, while the Saboteurs were named from throwing their wooden shoes (sabots) into the machines to wreck them. This was done in a vain attempt to halt the march of progress.

New technology can bring hardship upon those affected by it, and some of those displaced can find it hard to secure alternative employment. Governments, rather than attempting to stop new technology, sometimes try to ameliorate some of its effects by funding schemes that help retrain and if necessary relocate those most affected by it.

Sometimes people will ask where the new jobs will come from if technology displaces traditional ones. The question cannot be answered because the future is inherently unpredictable. New technology makes things cheaper, and that leaves people richer, with more money to spend on other things. We don't know what those other things will be, but we do know that they will involve new types of jobs. New technology, in making manufactured good cheaper, has left people with more to spend on services industries, and there are more jobs in total than there were. This is how new technology works. It destroys some jobs and creates more.

Logical Fallacies: 10. It's worth it if it saves lives

https://www.youtube.com/watch?v=tBuYHSLpbyw

Madsen Pirie's series of logical fallacies continues with a look at the idea that 'it's worth it if it saves lives'.

You can pre-order the new edition of Dr. Madsen Pirie's How to Win Every Argument here

Economic Nonsense: 6. The rich are growing richer, the poor poorer and the gap is widening

Sometimes this is asserted on a world scale, and sometimes claimed to be true within individual countries. Not only is this nonsense; it is also false. The rich have indeed grown richer, and the poor have also grown richer. It matters more to poor people. Extra wealth to the rich might mean more luxuries; to the poor it can mean the difference between starvation and survival. The last few decades have witnessed the greatest advance in living standards for the world's poor than ever before in human history. More than a billion people have been lifted above subsistence. The poor have not become poorer, they have become richer to a spectacular degree. India and Chine have made astonishing advances, but it has not been confined to them; other countries have seen their poor become wealthier, and it is still happening.

Within rich countries the poor have become richer. The yardstick that matters is the one that tells us how much they can buy. In terms of the hours of work needed to buy goods, they are much better off than they were decades ago. In some cases what used to take weeks of work to buy now takes less than a day.

Those who make this false claim are concerned with equality rather than wealth. If the poor gain wealth, but the rich gain more, then under their perverse way of regarding things, they regard the poor as having become poorer. If achieving twice the spending power is called "becoming poorer," then words have lost their meaning.

On a world scale decades ago there were a handful of rich countries with the rest dirt poor. Since then many poorer countries have climbed the ladder to wealth, and others are doing so. Globalization and the spread of market economics have brought an explosion of wealth that has been widespread and beneficial, and promises to continue being so.

Peer effects: they exist but they're not very big

One reason parents try and get their kids into 'good' schools is that they have better teachers, facilities and so on. Another is that the other students are also high achievers and this is believed to feed into their own children's achievement—via less disruptiveness, an environment more conducive to scholarly activity, and so on. A paper newly published in the Oxford Bulletin of Economics and Statistics tests the size of these effects on achievement by looking at the random component of sorting that occurs when most British children transition from primary to secondary school at age 11.

"Peer Effects: Evidence from Secondary School Transition in England" (up-to-date gated version, full working paper pdf), by Stephen Gibbons and Shqiponja Telhaj, finds that although having brighter peers raises someone's grades a bit, the effect size is very small.

Our general finding is that school-level peer effects exist, but they are small in magnitude: a one standard deviation increase in the mean ks2 primary school scores of secondary schoolmates is associated with a 0.03 standard deviation increase in student achievement in secondary school ks3 achievement.

These peer effects originate in characteristics of secondary school peers that were already evident in their achievements at age 7, and family background issues such as low income and English being second language, rather than academic progression during the later years of primary schooling preceding secondary school entry.

This finding suggests a rather limited role for peer effects in amplifying the effects of educational interventions (e.g. social multiplier effects as in Glaeser Sacerdote and Scheinkman 2003), unless these interventions occur very early on in life. Our results show only limited heterogeneity across student demographic types.

But the paper does go on to say that because school has very little impact on student outcomes, we should probably see this as a relatively large effect in that context. And that peer groups might matter for lots of other things besides achievement ("physical safety, emotional security, familiarity, life-time friendship networks, or simply exclusivity") so parents aren't necessarily crazy to aim for 'better' peers for their kids.

Make Britain safer: bring back pistols

We live in peaceful times – at least compared to the past thousand-ish years. Crime, especially personal violence, has been reduced significantly since the 13th century (though not always continuously). The drop looks something like this:

What explains the drastic decline in violent crime, specifically between 1500 and 1900? Why has crime spiked up (moderately) from 1900 – 2010? The widely preferred explanation for the fall in crime – particularly homicide – is referred to as the “civilizing process”, which claims that criminal breaking points can be attributed to the growth of centralised power (i.e. state power), which created more structure and stability in regional areas.

The conventional wisdom…attributes the decline in personal violence to the “civilizing process” first suggested by Elias (1939) who hypothesized that the primary cause was the transformation of Europe from a large number of fiefdoms in the Middle Ages to a small number of large, centralized nation states under a single monarch. The centralised state instituted and enforced a monopoly on violence, known as the king’s peace.

To this day, the ‘civilizing process’ remains the longest-running, widely accepted theory and continues to shape crime and policing policy. But, despite its acceptance, there are some very notable flaws in the theory, including the fact that much of the evidence shapes up to disprove the thesis:

Belgium and the Netherlands were at the forefront of the decline, yet they lacked strong centralized governments. When Sweden joined the trend, it wasn’t on the heels of an expansion in state power either. Conversely, the Italian states were in the rearguard of the decline in violence, yet their governments wielded an enormous bureaucracy and police force...

...the civilizing process theory is not consistent with the rise in violence between 1200 and 1500, it does not explain the sudden and precipitous decline and reversal of trend that occurred in the 16th and 17th centuries, and it is not consistent with the 1793 reversal of trend.

A new paper from Carlisle E. Moody published last month provides an alternative theory last century’s decline in violence. The paper, “Firearms and the Decline of Violence in Europe: 1200-2010”, finds that the sudden historical drops in crime are consistent with the “invention and proliferation of compact, concealable, ready-to-use firearms” which “caused potential assailants to recalculate the probability of a successful assault and seek alternatives to violence.”

And unlike the civilizing process theory, Moody's firearms theory remains consistent with the evidence and breaks in violence. As concealed weapons became more available historically, crime rate dropped radically. (Bolded mine.)

Homicide was increasing before the invention of concealable firearms and decreasing after. While there may be many other theories, the sudden and spectacular decline in violence around 1505 and again around 1610-1621 is consistent with the theory that the invention and proliferation of concealable firearms was responsible, at least in part, for the decline in homicide. The landscape of personal violence was suddenly and permanently altered by the introduction of a new technology. The handgun was the ultimate equalizer. The physically strong could no longer feel confident of domination over the weak.

Some of these arguments may sound familiar; they're the ones those crazies over the States tend to go on about - guns 'equalize' the playing field regardless of physical strength and 'psyche out' violent perpetrators who might be more willing to attack their victims if they knew they were unarmed.

But according to the report, those crazies have some strong points. The report cites several studies which found that the possibility that a victim might be armed deters criminals from acting:

Even in the United States today, criminals are reluctant to encounter armed victims. In 1981 Wright and Rossi interviewed 1874 incarcerated felons in ten states. Eighty-one percent agreed with the statement, “A smart criminal always tries to find out if his potential victim is armed.” Thirty-four percent report being, “scared off, shot at, wounded or captured by an armed victim. (Wright and Rossi 1986, pp. 132-155) Using the same data, Kleck found that, among criminals who had committed violent crimes or burglaries, 42 percent had been deterred during an attack by an armed victim and 56 percent agreed that, “most criminals are more worried about meeting an armed victim than they are about running into the police.”(Kleck 1997, p. 180)

Perhaps, then, we might admit (based on evidence, consistency and lack of other credible theories) that firearms reduced violence historically; but in the modern era, guns cause more violence than they deter. But that's not the case either:

The government in England has been placing increasingly stringent controls on guns especially handguns, since 1920, reducing both the actual and the effective supply of firearms. (Malcolm 2002) The homicide rate in England in 1920 was 0.84 and the assault rate was 2.39. In 1999, the corresponding rates were 1.44 and 419.29. Thus both the homicide and assault rates increased as the effective supply of handguns declined.

That's a 17,544% increase in England's assault crime over the past 100 years. In truth, there is no explicit correlation between gun control laws and murder rates between countries (Switzerland and Israel “have rates of homicide that are low despite rates of home firearm ownership that are at least as high as those in the United States.”) It is the case that handguns used in crimes in the UK have doubled since they were banned in 1997. Guns can't account fully for the drop in crime throughout the 20th century, nor can they account fully for the rise in violent crime over the past 100 years, but there is no doubt that accessibility to firearms has worked as a successful deterrence against criminals in progressive societies and that bans have ensured that any handguns in England are only falling into criminal hands.

Should we proliferate handguns around England tomorrow? Probably not. (Obviously we should begin with firearm training sessions - safety first!) But liberalizing gun laws should not be off the table. Historically, they've earned it.

Today's crazed loon idea

So, we know very well that the government is spending very much more than it is raking in in taxes. There should be some solution to this at some point. At least we hope there will be. But perhaps not this solution:

What might be fairer would be to treat capital gains in houses just like any other financial asset and tax it at 28pc.Given the turnover of the UK housing market and the gains built into it, it isn’t fanciful to think that, in a good year, the Government could raise £20bn to £30bn a year alone from this source.

For those inflamed by the inequities of the North-South divide, they will be pleased to know that the bulk of anything raised in this way would hit the south east of England hardest.

How wonderful: increase the taxation of the most successful part of the economy. And it's worth pointing out that the SE already pays much more tax: because the higher salaries earned there are taxed under national income tax rates, not regional ones. but then this is just mad:

As far as pension funds go, a simple 1pc levy on the value of schemes would be easy to administer and collect. This would raise an additional £20bn each year and given that pension fund contributions are subject to income tax relief, it doesn’t seem unreasonable to pay some of those investment gains back to the nation.

We specifically grant income tax relief because we want people to save for their old age. So now we're going to charge a wealth levy on people who save for their old age? Even knowing that wealth taxes have much larger deadweight costs than income taxes (or consumption ones)? Meaning that if you think pensions savings are undertaxed then it would be more economically efficient to simply reduce the income tax benefits of doing so rather than instituting a wealth tax.

Of course what's really interesting about the proposals is that no one at all believes that government could ever just curt back its spending to the amount of tax revenue that it has available. Sadly.

What we need to do is obvious

This piece could equally well be titled "Interesting things we learn in The Guardian". For we find out that Britain has the longest tax code in the world:

The question is: why does the UK have the longest tax code in the world? The Hong Kong tax code, widely held by tax lawyers to be the most admirably efficient in the world, is 276 pages long. The British tax code, rapidly beginning to look like the most disingenuous in the world, is currently in excess of 17,000 pages. It has more than trebled in size since 1997.

And what was it that happened in 1997? Ah, yes, Gordon Brown.

We also find out something else very interesting:

A couple of tax lawyers eventually told me that a 276-page tax code could generate the same if not more revenue in the UK....

So, umm, given that a 276 page code would both reduce the amount wasted on dodging around the systemn and also provide the same or more revenue (in itself the primary purpose of a tax system), why don't we have a nice bonfire and get ourselves a 276 page tax system? One that might actually be comprehensible to some mere mortal? We can't really see any argument against it.

And if we were to take the Hong Kong example seriously we might want to take two more things from them. One being that there's no with holding in their system. In order to pay your taxes you've actually got to go and pay your taxes, there's no salami slicing of that wedge from each and every paycheque. This physical act of having to hand over the money obviously puts a certain pressure downwards on tax rates as people actually see how much government is costing them. And while we'd never actually reach the second defining feature of the Hong Kong system, their low rates, we would obviously get closer if that pressure were to exist.

On our little list of things not to worry about

OK, so this is only a letter to The Guardian but it still betrays a certain mindset that we find ourselves being very confused by:

He talks about the future of businesses based on a new Companies Act, but it’s not clear how this would address the problems presented by 40% of shares in major UK companies (including utilities) being foreign owned.

We're confused because we simply cannot see why this might be a problem. The foreign capitalists are sending their lovely foreign capital into our country. This means that there is, other things being equal, more capital in this country than there would be without that lovely foreign capital. Given that it is capital added to labour that increases the productivity of labour, the average productivity of labour is what will determine the average income in the country, this means that foreigners sending their lovely capital to our rainy little island means that wages are higher here in the rain than they otherwise would be.

And we think this is a good idea.

As to why there is this concern our best bet is that old problem of the British left. All too many socialists are also quite ghastly nationalists. A combination we had rather too much of in Europe in the last century so hopefully not something that's going to become popular again.

The BBC and the Election

It will be interesting to see how the Conservatives bear up under the relentlessly hostile BBC campaign coverage. It is not that the BBC openly praises Labour and its policies. What the BBC does do is to follow the Labour agenda of the stories they wish to focus upon. One week it is continuous coverage for several days of alleged failings and deficiencies in the NHS, perceived as a Labour issue. The next it highlights for several days allegations of "tax dodging" – a phrase they use to conceal the distinction between paying tax in accordance with the law, and criminal dishonesty in concealing earnings. Tax avoidance means organizing your affairs to lower your tax exposure in ways that the law allows and sometimes encourages. Tax evasion means not paying the tax you are required by law to pay. The words "tax dodging" and "tax dodgers" are used to conceal that distinction. Multi-millionaire Margaret Hodge wants people to pay what she thinks they ought to pay, rather than what the law requires them to pay. The BBC has given massive coverage to another area seen as a Labour issue.

The BBC also pursues a relentless anti-business campaign, highlighting what it sees as abuses by businesses, even where these, too, are within the law. Energy companies are castigated for not passing on falling wholesale prices, with never a mention of the time lag between energy companies buying wholesale and the delivery of that energy to customers. Stories focus not on the role of companies in creating jobs and wealth, but on their alleged abuse of their market position. Again, since the Conservatives are perceived to be more pro-business than Labour, the BBC is following the Labour agenda.

It is unlikely that the BBC is taking orders to highlight Labour issues every day, and much more likely that the BBC programme planners and presenters think like Labour does, and regard these issues as the important ones. There could just be some self-interest, too, with BBC planners thinking that a Labour government would probably give the BBC a more advantageous licence fee renewal deal than would a Conservative one. It will be interesting to see how effective their campaign is.