New report by analyst, former journalist and rail expert Adrian Quine for the Adam Smith Institute calls for the introduction of much greater competition in our railways.

- Privatisation of British Rail led to greater number of services and record passenger numbers, but DfT over-specification and monopolistic franchises are costing consumers dearly

- Open Access operators compete directly with incumbent franchises

- Fares on Open Access are cost less per mile with higher customer satisfaction; fares on Virgin’s East Coast franchise where it faces direct competition are 24% cheaper than on its West Coast franchise where it doesn’t

- Open Access (OA) operators are held back by the excessive strictness of the “Not Primarily Abstractive” test, which is designed to prevent OA operators cherry picking the most profitable routes.

- Just 1% of passenger miles are travelled on OA operators despite OA operators topping passenger satisfaction polls.

- Lack of competition has seen the cost of unregulated ‘anytime’ fares rise by as much as 250% on many routes since the last year of British Rail in 1995, while RPI has risen only 86%

- UK should learn from airline competition and scrap the one-size-fits-all model of franchising to give passengers real choice on long distance routes

A new paper by the free-market Adam Smith Institute is calling for a ‘complete rethink’ of how the country’s passenger rail services are structured. Rather than re-running tired debates between nationalisation and privatisation, the think tank advocates injecting more competition into the current franchise model by making it easier for Open Access (OA) Operators to compete on long-distance routes.

Short term political thinking and civil service micromanagement of the industry is unsustainable, argues report author Adrian Quine. Competition between rail providers on key long distance rail routes will deliver lower fares, reduced running costs, improved customer service, and a greater focus on technology and innovation to ensure a better deal for the passenger & taxpayer.

This new report follows on from the Public Accounts Committee’s (PAC) damning account of the Department for Transport’s management of the Southern rail franchise Govia and the East Coast mainline, which it called a “debacle” and “totally unacceptable”.

20 years on from privatisation, its full promise is yet to be fulfilled. Despite record numbers of passengers and high levels of investment, there is a lack of competition in the market and government is increasingly over-specifying franchise conditions. As consumers are well aware, this has meant uncompetitive delivery of bare bones services and high ticket prices despite the Competition and Markets Authority’s 2015 report ‘Competition in Passenger Rail Services in Great Britain’ calling for greater competition.

Since the last year of British Rail in 1995 the cost of an ‘anytime fare’ has risen by 250% on many routes, while RPI has risen only 86% in that time.

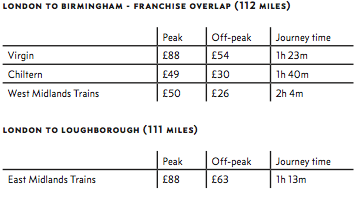

Fares are dragged down where competition does exist. Virgin’s fare on the West Coast is 32% more than it charges on the East Coast where it faces competition. Between London and Crewe a peak train is £131 for a journey of 158 miles, while the 156 miles between London and Doncaster where there is Open Access competition costs £99 (The two open access operators are even cheaper: £58 with Hull Trains and £52 with Grand Central).

Open Access operators regularly top passenger satisfaction leagues, with Grand Central and Hull Trains taking the top two spots.

Where franchises overlap, unintended competition delivers cheaper and more frequent services. Peterborough is the starting point for GoVia Thameslink Railway (GTR) running a half hourly stopping service to London and onwards to the South Coast. Slower and with more stops, but lower in price than Virgin’s direct service, the GTR route has seen a 70% increase in commuter numbers in just 14 years.

But Open Access competition is rare in the UK with just 1% of passenger miles conducted by OA operators, despite the current Railway Act allowing for such competition. This slow take-up is down to the ‘Not Primarily Abstractive’ test.

At present operators are required by government to ensure that for every pound of abstracted revenue 30% of new revenue has to be generated. In practice this means virtually no competition on long-distance inter-city lines. This is part of the reason the UK is the only European country that runs its commercial inter-city operations on such a model despite the reduction in costs a move to Open Access would deliver to passengers.

Unlike commuter trains, long-distance inter-city services are “closer in style to the airline business” with most routes used by one-off business or leisure passengers who buy their tickets in advance, the report argues. But, while passengers choosing to fly have access to choice between budget operators like Ryanair and premium services like British Airways, rail passengers lack a similar range of options.

And that competition delivers dividends for passengers. Report author Adrian Quine finds that where competition does exist between airlines on intra-UK flights fares were nearly half as much as where there is a sole operator.

The lack of innovation in rail stems in small part from the level of micromanagement by the Department of Transport, which has left private companies hamstrung by what they can provide. The DfT can dictate timetables, frequency of trains, stopping patterns and even minor details such as whether a train has a catering trolley or not.

The paper argues that the level of detail the DfT can stipulate and the power of unions on services with just a single provider often leads to unexpected consequences, such as the recent scandal where half of the carriages on some inter-city services were closed on trains run by Great Western Railway.

With such high levels of government oversight and control over the railways, what we have is now nationalisation in all but name. But Adrian Quine argues that ‘advocates of nationalisation really need look no further than the current costly’ running of the publicly-owned National Rail to understand why renationalisation would not work.

Opening up inter-city services to competition would drastically improve services, drive down operating costs, reduce fares, boost innovation, and give passengers real choice. By steering people away from road and air onto rail, the paper argues, we will see additional revenue from rail and reduce the burden on the taxpayer.

Competition in the Long Distance inter-city rail market has the potential to bring about the most radical and progressive realignment of our rail system since privatisation and create a true rail renaissance.

Adrian Quine, author of the paper and rail consultant, said:

“The UK rail industry structure is wasteful, bureaucratic and largely not fit for purpose. This paper highlights many of the core issues at stake yet provides radical, achievable solutions that are in the best interests of users, the taxpayer and the wider economy”.

Sam Dumitriu, Head of Research at the Adam Smith Institute, said:

“Renationalising the railways wouldn’t solve today’s problems. We need more, not less, competition on the UK’s railways. Allowing more Open Access operators to compete directly on long-distance rail routes would boost productivity, improve customer service, and deliver cheaper fares”

About the author:

Adrian Quine is an analyst and entrepreneur with a specialist interest in transport and infrastructure. He is a former investigative journalist and broadcaster and has worked for many leading publications including: the BBC, Discovery Channel, National Geographic and the Times. He also writes regular opinion pieces on rail as a columnist for The Telegraph.

Adrian has worked as a consultant on various projects including rail and aviation. He has specialist knowledge in public transport and infrastructure.

Adrian has a particular interest in rail competition and was one of the original founders of ‘Alliance Rail Holdings Ltd’ – he devised the name around a proposed ‘Open Access’ service between the Scottish and Welsh capitals from Edinburgh to Cardiff via the West Coast Mainline and Shrewsbury.

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne, Head of Communications, matt@adamsmith.org | 07584 778207.

The report ‘A Third Way for Britain’s Railways’ can be accessed here.