The zeigeit is gearing up for an increase in the taxation of the self-employed and it's worth noting the mistake at the heart of the basic claim. Which is that those who are employed through personal service companies pay less tax. This is both true and not true and the form of the truth makes a difference to what is being suggested:

More than 100,000 self-employed workers who are paid through companies could be hit by a new tax crackdown by the Government.

The Treasury has launched a consultation which aims to target people who are paid through a personal service company (PSC) instead of being on their employer’s payroll.

“This is unfair: two people doing the same job, in the same way, can end up paying very different levels of tax, depending on how they are engaged," its consultation document said.

The usual claim is that people only pay the corporation tax on the incomes they draw from such companies, not income tax which would generally be a greater amount. That is not actually how it works. Taxes on dividend incomes and those on employment ones are roughly the same, by design, once we piece all the bits of the system together. For high dividend incomes then pay more income tax again, over and above that corporation tax already paid. The total bite out of the income is, as we say, roughly the same.

Sure, maybe there's some bits to do at the margin but it's not a major difference.

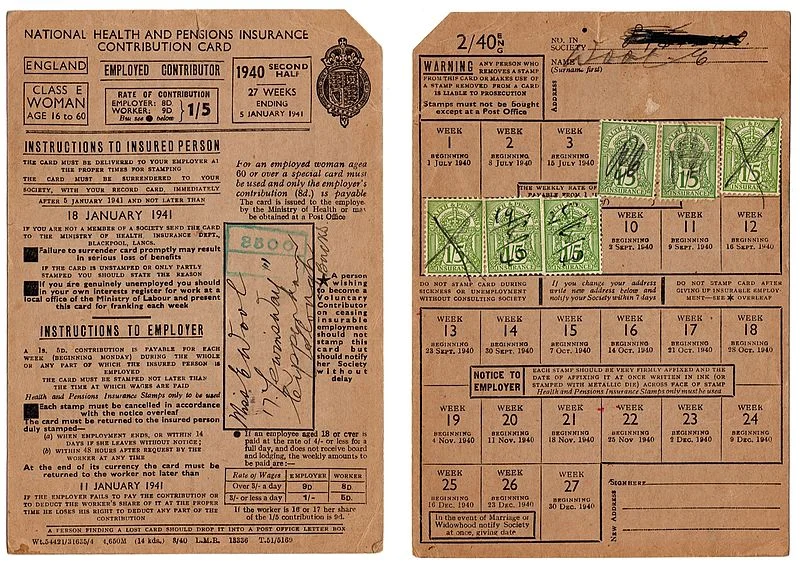

Where there is a significant difference is with national insurance. Dividend income doesn't pay either - employers' or employees' - and that will be a saving. Given that there's a cap then a minimal rate above it of 2% on the employee's side, it's the employers' of 13.8% which is "dodged."

It's also true that when counting the revenue NI really is just another tax. The national insurance fund has been a fiction for generations now, the money just all goes into the general revenue pot.

However, from the point of view of the individual it isn't just another tax. For, with the payment of NI comes certain forms of social insurance. If you don't pay it you don't get certain things. We also have different classes of NI, each of which give access to different parts of the social insurance system. You'll not get unemployment pay if you're paying a light stamp for example.

Reform of the system might well be due - we've argued for many a year to simply abolish NI altogether and just have the one taxation system upon incomes. But it is still necessary to point out that much of this about personal service companies isn't really about tax dodging, it's about not purchasing state proffered services. Which does rather change the conversation, doesn't it?