The long history of school choice division

Most people, acting rationally, would prefer to choose the school their child goes to as opposed to having their child forcibly assigned to a school. So opposition to school choice seems no less strange wherever it comes from. Nonetheless understanding the reasons is enlightening. The divide of opinion on school vouchers in the States, for example, is portrayed as being between the left and the right. Or Republicans against Democrats and whites against minorities. But it is not as simple as this and not really the case. A new paper (pdf) by Shuls and Wolf studies the empirical reality regarding the political and racial divide over vouchers and explains its history in the U.S to offer conclusions about the logic of political support of and opposition to school choice. It also explains, for the unacquainted, what we mean when we talk about private school choice.

These two charts demonstrate the rise and prevalence of Private School Choice Programs in the States today:

The interesting finding is that while support for vouchers does tend to be higher among Republicans, support at the policymaking level is found both among ideological Democrats of the social-justice-promoting kind like Senator Corey Booker, and Republicans like Senator Rand Paul who support free markets. Those opposed tend to be moderate and mostly rural Republicans and establishment Democrats.

Teachers’ unions contribute more money than any other interested party to election candidates in the U.S. Of their campaign contributions, 88-99% of national-level, and 80-90% of state-level, contributions have gone to Democrats. The priority policy issue for the main teaching unions – the National Education Association and (NEA) and the American Federation of Teachers (AFT) – is to stop the spread of private school choice. Therefore one reason why so many Democrats may actually be opposed to school choice is that they would be doing so in spite of their single largest funder.

On the contrary, one has to ask why elected politicians in the U.S would support private school choice given teaching unions’ opposition. Research conducted for the Friedman Foundation for Educational Choice found 40% of parents polled would prefer to send their child to a private school and 10% of respondents would rather a public charter school. Private school vouchers were supported by 63% of respondents.

As DiPerna reports, “The demographic groups having the highest positive margins and most likely to favor school vouchers are school parents (+42 points), Southerners (+36 points), Republicans (+42 points), young voters (+44 points), low-income earners (+47 points), African Americans (+50 points), and Latinos (+47 points)” (DiPerna 2014, p. 14).

Reports from parents are far-off actual enrolment figures. The National Center for Educational Statistics tells us 9% of K-12 students attend private schools and 4% attend charter schools. So the Friedman Foundation poll suggests that opposition from the unions is pitted against popular opinion, especially in areas with more young people and ethnic minorities.

Inspired by the Prisoner's Dilemma, the School Choice Dilemma explains some of this by illustrating the compelling reasons for the opposition and support found in various political factions. Imagine two groups of students, one "advantaged" and one "disadvantaged"; one has enjoyed educational trips, access to materials and so on and the other hasn't. When both are given the opportunity to either accept their assigned school or to choose it themselves, they will be impacted in different ways.

If they both accept the assigned school, then there will be a mix of advantaged and disadvantaged students, which benefits (B) the disadvantaged from integrating with a brighter peer group; but may actually harm (H) the advantaged. Compared to this, the diagram shows that both will have an incentive to 'defect' and move to a situation where only they get S—the benefit of school choice. Advantaged students can already do this by buying houses near good schools or going to private schools—but the disadvantaged achieve this through targeted vouchers.

The conclusion is that we will probably continue to see rational politicians from both sides oppose school choice as the establishment in both parties have strong political incentives for protecting the status quo. Meanwhile social-justice politicians see school choice as a means to improving educational outcomes for disadvantaged students, and free-market individuals see school choice as a fundamental way to make education more efficient.

Quite right, we should abolish stamp duty on shares

As ever when there's a budget in the offing we've people making suggestions about what should be in said budget. Some of these suggestions are even sensible, as is this one arguing that we should abolish stamp duty on shares:

“Abolishing the tax would lead to an immediate 7.7pc, or £133bn, increase in the value of listed companies on the LSE’s main market on the day of abolition,” he wrote. “It would incentivise saving for the future, removing a £402m a year burden from UK pension schemes and reduce the tax liability by up to £18,000 from the average UK family’s savings.”

A previous academic look into the subject is here.

The important thing to understand is the incidence of this tax. Certainly, it's the people buying and selling shares that appear to pay the tax itself. But after everything has flowed through the economy who is it that actually bears the economic cost of its existence? One answer is as above, pension funds. The end result is that pensions are lower than they would be in the absence of this tax. And, given that we tax privilege pensions in the first place it seems most odd to have another tax which then reduces them.

The other group who lose out is the workers in the country in general. As is noted above share prices would rise in the absence of the tax. This is equal and equivalent to making capital cheaper for companies. Cheaper capital will mean more capital being employed. And it's the addition of capital to labour that increases productivity, the average productivity of labour being what determines the average wages in the economy. Thus more expensive capital lowers average wages.

A tax which both lowers pensions and also wages in general doesn't seem to have a lot going for it. So, yes, we agree, abolish stamp duty on shares.

The problem with identities in economics

Obviously, George Osborne's plan to make budget deficits illegal is just a piece of politicking. For it's only "illegal in certain circumstances" and being in a recession is a special circumstance. So, actually, it's really just a restatement of the Keynesian orthodoxy, that there should (can be if you prefer) be fiscal stimulus in a recession and there should also be fiscal austerity in the boom so as to reduce the white hot heat of that technological revolution. Shrug. But it's got all the right people het up as this letter to The Guardian tells us:

Economies rely on the principle of sectoral balancing, which states that sectors of the economy borrow and lend from and to each other, and their surpluses and debts must arithmetically balance out in monetary terms, because every credit has a corresponding debit. In other words, if one sector of the economy lends to another, it must be in debt by the same amount as the borrower is in credit. The economy is always in balance as a result, if just not at the right place. The government’s budget position is not independent of the rest of the economy, and if it chooses to try to inflexibly run surpluses, and therefore no longer borrow, the knock-on effect to the rest of the economy will be significant. Households, consumers and businesses may have to borrow more overall, and the risk of a personal debt crisis to rival 2008 could be very real indeed.

This is true, in one model, because that's how we set that one model up. Indeed, it's how we define that model. But we must not confuse the model with the economy, nor the map with the territory. For there's no particular reason why there has to be inter-sectoral lending or borrowing at all. There can, obviously, be intra-sectoral such. Some companies are cash rich at present. Some households are at that stage of life where they have significant savings and or assets. Some companies desire borrowing, as do some households. There's no reason at all why there must be lending or borrowing across those sectoral boundaries, nor why government should be taking any part in any that does happen. It's simply a construct of our model that we think it must. And, again, models are not reality.

Our economists are getting rather carried away by the constraints of the models they're using. But then, a group letter to The Guardian signed by Andrew Simms, Richard Murphy and Howard Reed. We knew it was going to be wrong, didn't we?

There's a lot of ruin in a nation

But ruin is not something in infinite supply in any nation:

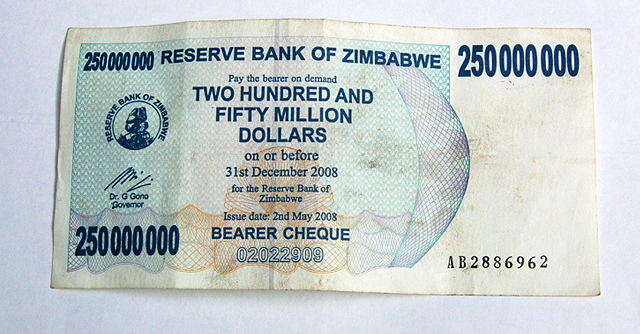

From Monday, customers who held Zimbabwean dollar accounts before March 2009 can approach their banks to convert their balance into US dollars, the governor of the Reserve Bank of Zimbabwe, John Mangudya, said in a statement.

Zimbabweans have until September to turn in their old banknotes, which some people sell as souvenirs to tourists.

Bank accounts with balances of up to 175 quadrillion Zimbabwean dollars will be paid $5. Those with balances above 175 quadrillion dollars will be paid at an exchange rate of $1 for 35 quadrillion Zimbabwean dollars.

The highest – and last – banknote to be printed by the bank in 2008 was 100tn Zimbabwean dollars. It was not enough to ride a public bus to work for a week.

The bank said customers who still had stashes of old Zimbabwean notes could walk into any bank and get $1 for every 250tn they hold. That means a holder of a 100tn banknote will get 40 cents.

At some point simply running the printing presses does run into real problems. Our favourite little story from this whole disastrous episode comes from the final end days of the printed currency. Normally, currency printing is a very profitable occupation. Bit of paper, the price of some ink, and a banknote that is worth whatever the government says it is is created. Right at the end there it's said that the final decision to stop printing was taken because....no one would accept a bank note of any denomination at all, or any number of them, in return for supplying the ink with which to print the banknotes.

There have been hyperinflations before and it's a near certainty that it will happen again, somewhere. But this is the only example we know of where seigniorage was ridden all the way down to the bottom, to the bitter end.

The public wealth of nations

In 2013's Cash in the Attic ASI fellow Nigel Hawkins detailed £600bn of assets the government owned, but had never subjected to a market test. The paper recommended selling 10% of the assets off to begin with, in order to subject them to the market test and see if they were being best used, as well as giving the government money to reduce the national debt A new book, The Public Wealth of Nations, written by Dag Detter and Stefan Fölster, argues a lot of the same points—although with a much broader scope and deeper focus. The book's blurb runs:

When you look around the world it's almost as if Thatcher/Reagan economic revolution never happened. The largest pool of wealth in the world – a global total that is twice the world's total pension savings, and ten times the total of all the sovereign wealth funds on the planet – is still comprised of commercial assets that are held in public ownership.

And yet, while this is the largest pool of assets in the world, is also one of the murkiest – what goes on inside them is often not even properly known by the governments who own them. In most countries this vast portfolio is both a fiscal and political burden on society. If professionally managed it could generate an annual yield of 2.7 trillion dollars, more than current global spending on infrastructure: transport, power, water and communications.

Is there any reason why hospitals should own their buildings rather than rent them with long-term contracts? Outside of some historically-significant places couldn't the same be said for most public property. And how do we know whether an army barracks is well-placed if the army doesn't compete with other users over it?

The authors recapitulate their argument in a Citigroup note (pdf), with an introduction by Willem Buiter, going over their case for turning over government property to a properly-managed sovereign wealth fund.

As ever, the ASI is ahead of the curve!

Backing the 1%

I spoke last Thursday in the Cambridge Union on the motion, "This House Believes We Need the Richest 1%." I spoke in favour, giving 6 reasons for my support.

1. The richest 1% feature many people who have provided things to improve our lives.

These include Google, Amazon, Facebook, Paypal, YouTube, etc. We use them regularly and have propelled their developers into the top 1%. They made life easier, more interesting & more rewarding by providing services of value to others. Even the much-derided bankers have made capital work more effectively and made it more available.

2. The richest 1% act as an example to others.

People look at the careers of Elon Musk, Bill Gates, Steve Jobs, & Mark Zuckerberg, and are themselves inspired to develop goods and services that will similarly be of use and value to others.

3. The top 1% pay taxes.

In the UK the 1% pay nearly 30% of all income tax. The top 3,000 UK earners pay more between them than the bottom 9 million. Their taxes support schools, hospitals and essential public services.

4. They give to charitable causes.

They are the mainstay of many medical & cultural charities. They fund art galleries, museums & symphony orchestras. They are helping to conquer disease and suffering. The Bill and Melinda Gates Foundation is funding the eventual conquest of malaria, a disease that kills an estimated 2m people annually, including 500,000 children. Warren Buffet has issued the Giving Pledge, for rich people who pledge to give or leave half their fortunes to charity. Hundreds, including Bill Gates, have signed it.

5. The top 1% are early adopters.

They can afford to buy the new gadgets and try out the new processes. The ones that fall short of expectations drop by the wayside, but successful ones go into mass production, fall in price and become generally available. It was the 1% who bought the first large flat screen plasma and LCD TVs that are now commonplace and within reach of most people.

6. The top 1% include those who accelerate the pace of technological advance by putting their money behind adventurous developments.

Paul Allen made his fortune with Microsoft, and put $25m to back SpaceShipOne, winner of the X-Prize for the first private vehicle to carry people into space. Elon Musk made his fortune from Paypal, and used it to fund Tesla because he believes that electric cars can enable a cleaner world. He funded SpaceX, which sends Dragon capsules to the Space Station and is testing ways of landing and refueling its boosters. He does this to speed up accessible spaceflight.

With more time I could have added more reasons, such as the fact that the 1% help create most of the new jobs that replace ones automated or outsourced. I concluded by saying that the 1% help make the world a better, more colourful and more interesting place, and that the goods and services they make available enrich our lives.

Not the way to reform business rates

This is a cheeky little attempt here by the CBI:

The antiquated business rates system is a major barrier to investment and must be reformed, the Confederation of Business Industry (CBI) has urged. The CBI has recommended that smaller properties should be exempt from business rates, revaluations should be more frequent, and future increases should be limited as a result of a switch of the inflation benchmark which they track. The recommendations were made in a response by the industry body to a review of business rates announced by George Osborne, the Chancellor, in last year’s Autumn Statement. The industry body has recommended properties valued below £12,000 should be exempt from rates. The CBI has also called on the Government to reform its “decades-old” business rates model and shift towards raising the tax in line with the consumer price index (CPI), as opposed to the retail price index (RPI). Unlike CPI, RPI includes housing costs, which considerably inflates the rate and has largely fallen out of favour as an economic measure. Such a move could save UK companies £1.5bn, the CBI has said, and would ensure business rates do not outpace the official measure of inflation.

That's really not the point at all. Business rates are the closest thing to land value taxation that we have. As such they're pretty close to being the perfect tax (for we're always going to have government and thus do have to raise tax money somehow). And the point is that land (or at least land with the permission to build a commercial outlet upon) is the scarce thing. We thus want to tax that thing at its current market value. It is this which leads to the use of that scarce thing more efficiently.

It shouldn't actually be linked to an inflation measure at all: it should be linked solely to that underlying land value. But if it is going to be linked to an inflation measurement then it has to be to the one that includes that underlying land value, not the one that excludes it.

There is the other point of course. Which is that they're only arguing for this at a time when CPI is lower than RPI. As and when that reverses they'll be calling for a reversal. As has happened with things like cost of living increases in pensions. When wage growth is higher than inflation the government tends to link the increases to inflation. When wage growth is below inflation then the switch occurs to linking to wage growth.

So, of course, we could say that the CBI is just trying on what the politicians do routinely. To which the response is, come on CBI, you're not politicians and they are. Meaning that you're better than that.

UK loss on RBS sale: so what

Bygones are bygones. Or as economists call them, 'sunk costs'. If you invest in something that doesn't pay off, you can kiss your sunk costs goodbye. Just sell for what you can get. Today we are being told that UK taxpayers are going to take a £7bn loss when the government sells its stake in the the mega-bank RBS. Add fees and costs, and it might be £14bn. So what?

When the UK's Labour Chancellor Alastair Darling spent £45bn of our money bailing out RBS – and another £63bn on Lloyd's, Bradford & Bingley, Northern Rock and the rest – he wasn't going through the Financial Times with a highlighter to pick good investments to enrich taxpayers. He was trying to rescue Britain's financial services sector during the financial crash.

For a sector that brings in £66bn a year in taxation, that was a pretty good deal. Yes, you can argue that if he had done nothing, the market would have sorted it out. Or that the government should have simply lent the banks more money. But at the time it was all pretty hair-raising. Banks exist on trust, because if all their customers pull out at the same time the banks don't (usually) have enough cash on hand to repay their deposits. They have lent out that cash to help grow businesses, jobs and prosperity. So when 20,000 queued up to take their savings out of Northern Rock, and the RBS said its cash machines were going to run out of cash in 48 hours, it wasn't unreasonable to do something.

Actually, when you look at that £108bn went, taxpayers are already in pocket. Slices of Lloyd's have already been sold off, and Northern Rock is looking like a really good business again. It depends on your predictions of what the remaining bits are worth, but taxpayers could already be £14bn up on the deal. That's no surprise: the same happened in Sweden when its banking sector was bailed out years ago.

So what of RBS? Bygones are bygones. The bank grew bloated in the boom years, and has had to spend hundreds of millions restructuring. And being involved in just about sort of financial business known to humanity, it has picked up more regulatory penalties than most. So it is trading well below the 502p share price that Alastair Darling bought it at.

But that money was spent, not on buying a bank as an investment, but on buying a bank to save it from utter collapse. Money spent, job done. Bygones are bygones, let's move on.

Should we wait until things improve, so that taxpayers get all their money back? No. After all, as they keep telling us, shares can go down as well as up.

The world is not running out of resources after all, says new ASI monograph

The depletion of mineral reserves poses no serious threat to society, a new monograph published today by the Adam Smith Institute has concluded. “The No Breakfast Fallacy: Why the Club of Rome was wrong about us running out of resources” argues that outcries over resource availability from environmentalist groups are based on a misinterpretation of numbers and a misunderstanding of what mineral resources actually are.

The monograph, written by Adam Smith Institute Senior Fellow and rare earths expert Tim Worstall, says that groups that have warned about the world running out of rare mineral resources, such as The Club of Rome, have been using the wrong sets of data, mistaking the exhaustion of mineral reserves for the exhaustion of mineral resources.

Mineral reserves, the monograph explains, are simply the minerals that have been prepared for use for the next few decades; they are minerals that can be mined with current technology at current prices. Some reserves are going to run out in the near future, but this is a normal process. Every generation runs out of mineral reserves.

Mineral resources, however, refer to a concentration of minerals of a certain quality and quantity that have shown reasonable prospects for eventual economic extraction. These are much larger than mineral reserves.

Organic farming, for example, may be a useful idea, the monograph asserts, but the idea that it is a necessity because we’re about to run out of inorganic fertilisers is based on a falsehood. The reserves for minerals used in fertilizers may exhaust in the next few hundred years, but the exhaustion of resources is not estimated to occur for 1,400 years for phosphate and 7,300 years for potassium.

The report concludes that efforts to conserve and/or recycle mineral resources are wasteful and often end up being net harms to society, by diverting economic activity from more productive uses.

Senior Fellow at the Adam Smith Institute and author of the report, Tim Worstall, said:

We have a basic problem in our discussion of resource availability. Which is that most of the people in that discussion are grievously misinformed about what a resource is and how much of any of them we might have. It really is true that Paul Ehrlich, Jeremy Grantham, the Club of Rome, Limits to Growth and the rest are looking at the wrong numbers when they consider how much of any mineral or metal there is that we might be able to use.

This is not some arcane economic point. It is not some mystery explained only to the illuminati. Quite simply, most people assume that mineral reserves are what we have left that we can use. This is not so: mineral reserves are only what we have prepared for us to use in the next few decades. As such, it's really no surprise at all that mineral reserves are generally recorded as being going to last for the next few years.

This book explains this simply enough that even a member of the Green Party should be able to grasp the point. We are no more going to run out of usable minerals because we consume mineral reserves than we are to run out of breakfast because we eat the bacon in the fridge.

To read the full press release, click here.