No, really, this time is different. Honest

The phrase you never do want to hear in a financial market is “This time is different”. For that is the belief which, when it becomes general, means the crash is about to happen in 3…2…1…

Rachel Reeves’ tax-and-spend gamble is driving Britain towards a 1970s-style debt crisis and bailout from the International Monetary Fund, leading economists have warned.

Well, no, we don’t think so. Partly because only some are musing on it but rather more because we’re not trying to defend a fixed exchange rate at present. So things really are different. True, we could still get caught in stagflation, we could have no growth, inflation, ever rising public debt and a wildly incontinent government in a fiscal sense. You know, to the extent that we don’t already. But that’s not going to trigger a 1976-style crash because we’ve simply not got that trigger, that FX rate which must be defended.

But there’s also that other standard market point. Crashes don’t happen when there are still differences of view in the market. It’s when everyone has given up on disagreeing and now starts talking about “the new normal” that we’re in 3…2…1… territory.

So, an interview with an economist who very obviously does not understand the nature of money, the ability of a central bank to create it at will, and the fact that IMF bailouts can never be required in a country like the UK unless its politicians wish to ask for them to symbolise their own economic incompetence, has been spun by a journalist who leans to the far-right to suggest we are about to go cap-in-hand to Washington when quite clearly nothing could be further from the truth because there is quite literally no eventuality where the UK might ever need to do so.

That is, when Richard Murphy has managed to convince everyone that a crash is simply impossible - Modern Monetary Theory says so, you know - that’s when to get really worried.

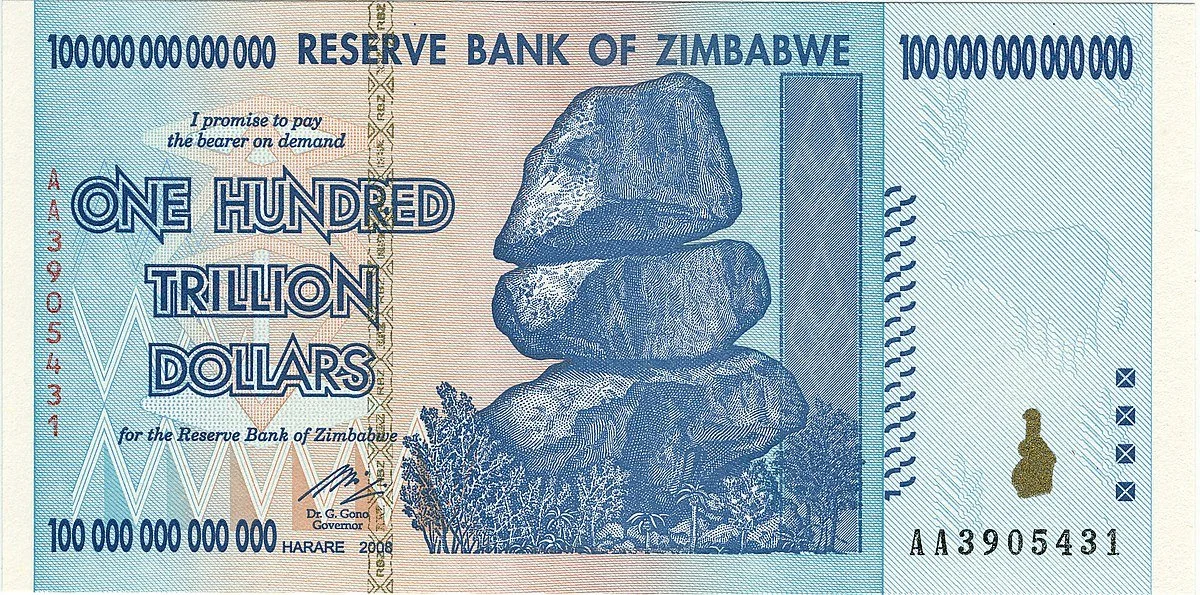

As to exactly why - Murphy is correct that a government that prints its own money can never run out of money. But, as everyone also now agrees, money is simply debt etc. And the value of a debt is in the eye of those it is owed to. Which means that government can keep printing money but that money can end up being worth nothing. It has happened:

Governments are cash constrained and our really big problem is going to start just as everyone starts to believe they’re not.

Tim Worstall