New Tracker Reveals Government Can Spend But Can’t Grow

New analysis reveals the government is largely meeting its spending goals but falling behind on its economic targets.

Unlike in the private sector, where leaders have clear metrics of success, holding politicians to account is a difficult task.

To tackle this, the Adam Smith Institute has created an Accountability Tracker to measure this government, and future governments, against their commitments.

The tracker uses the Key Performance Indicators (KPI) format to assess whether the government is fulfilling its aims.

The tracker shows that the government is off-track on its key economic pledges.

Monthly growth has averaged just 0.09% since July 2024, well below the goal of 2.5% annual growth by 2029.

Inflation, which the government pledged to stabilise at 2%, has also risen, with inflation reaching 3.4% in May and 3.6% in May.

While the economic outlook is bleak, the government is meeting its spending targets.

It is on track on its pledges to add 2 million new NHS appointments, hire more mental health staff and is likely to raise defense spending to 2.5% of GDP by 2027.

The fact that the government has largely met its spending commitments while failing to deliver on the economy is worrying, suggesting more borrowing and tax rises may be on the horizon.

New analysis from the Adam Smith Institute (ASI), a leading economics think tank, reveals that the Government is falling short on many of its flagship economic pledges.

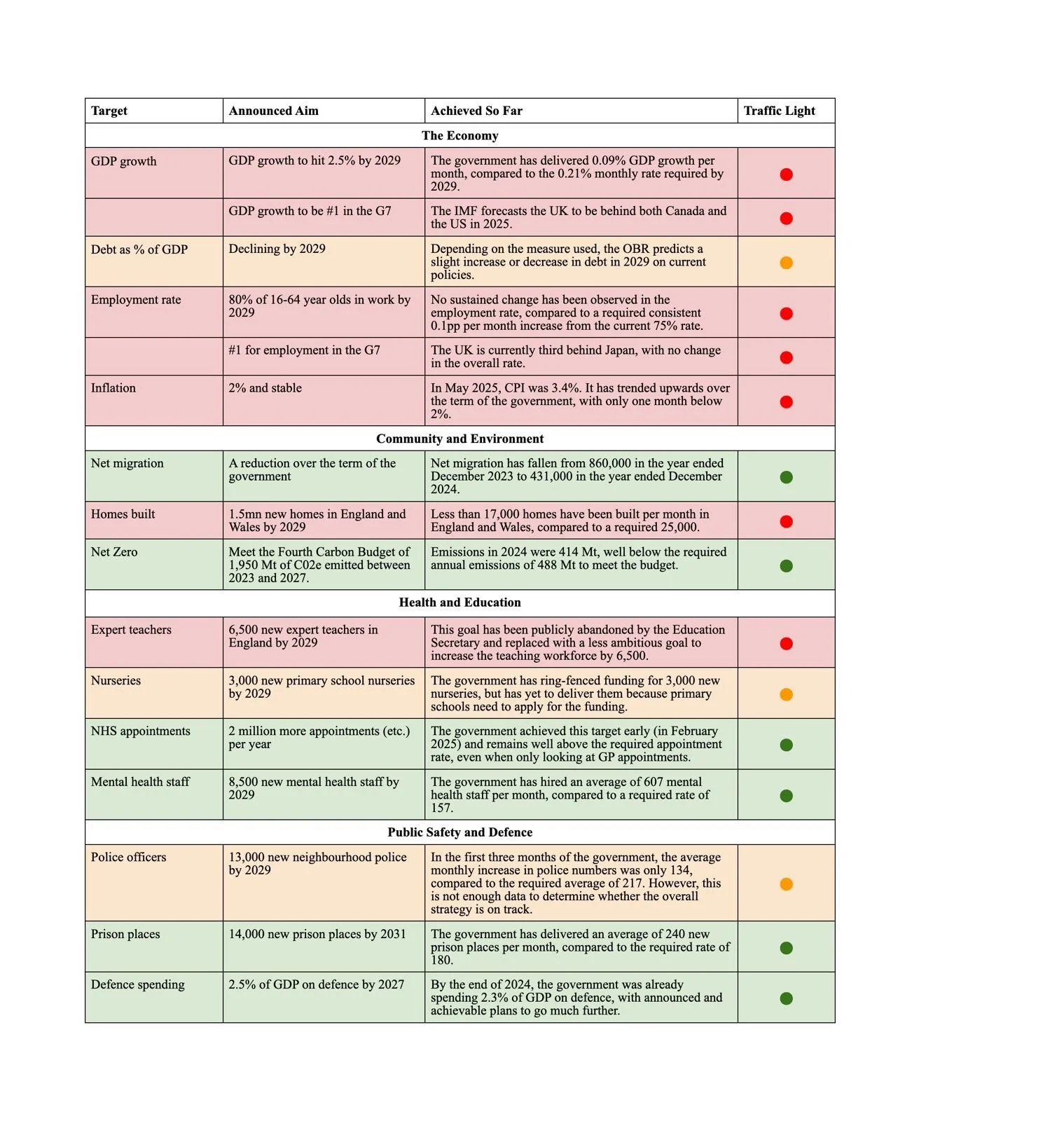

The Institute’s new Accountability Tracker monitors progress against the Government’s own stated goals, consolidating them into a single framework. Designed to bring private sector-style accountability to public policy, the Tracker provides a clear, data-driven picture of government delivery. It uses the KPI framework, or Key Performance Indicators, to objectively measure whether the government is delivering on its pledges.

Overall, the government has missed 7 of its targets, is mixed on 3 of its targets and has delivered on 6 of its targets. However, the results reveal a striking gap between progress on spending commitments and performance on core economic goals.

Upon taking office, the Government committed to prioritising economic growth. Yet the Tracker shows it is underperforming on several core economic indicators, including growth, inflation, employment, and housebuilding.

To reach its goal of 2.5% average annual GDP growth by 2029, economic growth needs to rapidly speed up. Since July 2024, monthly growth has been only 0.09% - compared to the 0.21% needed to achieve the government's 2.5% target. Inflation, which the government pledged to stabilise at 2%, has also risen, with last month's inflation reaching 3.4% and with only one month recording inflation below 2%. The employment rate, meanwhile, remains stuck at 75% - far from the target of 80% by the end of the decade.

Housebuilding is also falling behind. Between July 2024 and March 2025, just 142,800 homes were completed - an average of 15,900 per month. To meet the target of building 1.5 million homes by 2029, construction needs to significantly ramp up.

However, progress has been stronger in other areas, particularly related to spending. The Government has already exceeded its pledge to deliver 2 million additional NHS appointments and mental health staffing is increasing ahead of schedule. Defence spending is also increasing and likely to meet the 2.5% target.

This imbalance, failing on pro-growth reforms while largely delivering on big spending pledges, raises concerns about the UK’s public finances. It suggests tax rises and more borrowing could be imminent. Sustained spending without growth risks locking in a high-tax, high-debt model that holds back innovation. If the government doesn’t change course, the gap between its ambitious spending and the sluggish economy funding it will only grow, threatening the UK’s long-term financial stability.

Charles White-Thomson, Senior Fellow of the Adam Smith Institute and author of the Accountability Tracker, said:

“This new Accountability Tracker provides an excellent resource to hold this government - and future governments - to account.

If we want to improve the performance of our politicians, they need to be subject to the same level of scrutiny the private sector demands. That means objectively assessing whether they have actually delivered on their commitments.

The data shows a worrying imbalance. While the government is largely delivering on its spending commitments, it is failing to grow the economy as planned, missing its targets on growth, inflation and employment.

This spells trouble. Without stronger economic performance, the government will not be able to fund its ambitious spending commitments, risking higher taxes and more borrowing. If ministers don't improve, the UK risks sinking further into a spiral of stagnation and decline.”

-ENDS-

Notes to editors:

For details on the methodology, or to arrange an interview, please contact sebastian@adamsmith.org / +44 7584778207

Charles White-Thomson is a Senior Fellow at the Adam Smith Institute and former CEO of Saxo UK. He led on the creation of the Accountability Tracker.

The Accountability Tracker is not intended to evaluate the merits of each policy pledge but instead offers a neutral, transparent tool for assessing whether these promises are being met. The ASI will update the Tracker regularly as new data becomes available, providing an independent benchmark for evaluating policy delivery.

The Adam Smith Institute is one of the world’s leading think tanks. It is ranked first in the world among independent think tanks and as the best domestic and international economic policy think tank in the UK by the University of Pennsylvania. Independent, non-profit and non-partisan, the Institute is at the forefront of making the case for free markets and a free society, through education, research, publishing, and media outreach.